Portal Ct Gov MediaDepartment of Revenue Services Form CT 941X DRS Use ONLY 2021

Understanding the CT 941X Form

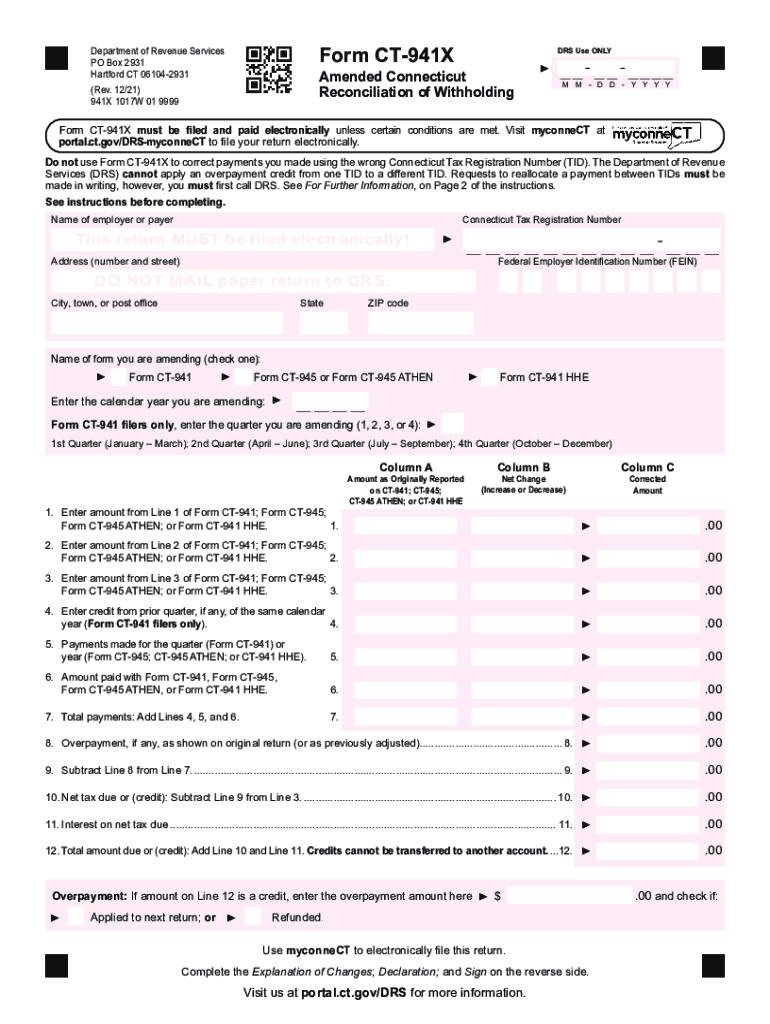

The CT 941X form is used for amending previously filed Connecticut quarterly withholding tax returns. This form allows businesses to correct errors related to withheld income tax, ensuring compliance with state regulations. It is essential for employers to accurately report and adjust their withholding amounts to avoid penalties and maintain good standing with the Connecticut Department of Revenue Services.

Steps to Complete the CT 941X Form

Completing the CT 941X form involves several key steps:

- Gather all relevant information from the original CT 941 form, including the period of the return and the amounts previously reported.

- Clearly indicate the corrections needed in the designated sections of the CT 941X form.

- Ensure that all calculations are accurate to avoid further amendments.

- Review the completed form for any additional information that may be required, such as supporting documentation.

- Sign and date the form to validate the submission.

Legal Use of the CT 941X Form

The CT 941X form is legally recognized for amending tax returns in Connecticut. It must be filed in accordance with state tax laws to ensure that any adjustments to withholding amounts are officially documented. Employers should retain copies of the amended returns for their records, as they may be needed for future reference or audits.

Filing Deadlines for the CT 941X Form

It is crucial to file the CT 941X form within the appropriate time frame to avoid penalties. Generally, the form should be submitted as soon as an error is discovered, but it must be filed by the due date of the original return to ensure compliance. Keeping track of deadlines helps businesses maintain accurate records and avoid unnecessary fines.

Form Submission Methods for the CT 941X

The CT 941X form can be submitted in several ways:

- Online through the Connecticut Department of Revenue Services portal, which offers a secure method for filing.

- By mail, sending the completed form to the appropriate address provided by the state.

- In-person at designated state offices, allowing for immediate confirmation of receipt.

Common Penalties for Non-Compliance

Failure to file the CT 941X form correctly or on time can result in penalties. These may include fines based on the amount of tax owed or additional interest charges. It is important for employers to understand these consequences to avoid financial repercussions and ensure compliance with state tax laws.

Quick guide on how to complete portalctgov mediadepartment of revenue services form ct 941x drs use only

Easily Prepare Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as it allows you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

Effortlessly Edit and Electronically Sign Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY

- Obtain Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you'd like to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov mediadepartment of revenue services form ct 941x drs use only

Create this form in 5 minutes!

How to create an eSignature for the portalctgov mediadepartment of revenue services form ct 941x drs use only

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct reconciliation and why is it important for businesses?

CT reconciliation is the process of verifying and reconciling transactional records in your accounting systems. It is crucial for businesses to ensure accuracy in financial reporting, minimize errors, and maintain compliance. With airSlate SignNow, you can streamline your ct reconciliation process by easily organizing and securely signing your financial documents.

-

How does airSlate SignNow support ct reconciliation?

airSlate SignNow supports ct reconciliation by providing an intuitive platform for sending, signing, and managing documents digitally. This reduces the likelihood of paper errors and ensures all transactions are documented correctly. Our solution not only saves time but also allows for quick access and modification of important financial documents needed for reconciliation.

-

What pricing options are available for airSlate SignNow users interested in ct reconciliation?

airSlate SignNow offers a variety of pricing plans to accommodate different business sizes and needs. From individual plans to enterprise-level solutions, each option includes features that facilitate ct reconciliation. You can choose a plan that fits your budget while benefiting from seamless document management and e-signature capabilities.

-

Can I integrate airSlate SignNow with other accounting software for ct reconciliation?

Yes, airSlate SignNow integrates with various accounting software programs to enhance your ct reconciliation process. This integration allows for smooth data transfer and document management across platforms, reducing duplicate work. By connecting your accounting systems with airSlate SignNow, you can streamline your entire reconciliation process.

-

What features does airSlate SignNow offer that aid in the ct reconciliation process?

airSlate SignNow provides several features designed to assist with ct reconciliation, such as document templates, secure electronic signatures, and audit trails. These features ensure that all financial documents are consistent and verifiable. Additionally, the easy-to-use interface allows teams to collaborate effectively and track changes throughout the reconciliation process.

-

What benefits can businesses expect from using airSlate SignNow for ct reconciliation?

By using airSlate SignNow for ct reconciliation, businesses can expect increased efficiency, improved accuracy, and cost savings. The digital solution reduces the time spent on manual paperwork and allows for quicker access to necessary documents. This can ultimately lead to faster financial decision-making and better overall management of financial records.

-

Is there a mobile app available for airSlate SignNow to assist with ct reconciliation?

Yes, airSlate SignNow offers a mobile app that allows users to manage and complete ct reconciliation on the go. This app enables you to send, sign, and track your documents from anywhere, ensuring that you stay connected to your financial processes. With the convenience of mobile access, you can streamline your reconciliation tasks even when you're away from the office.

Get more for Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY

- Write the sentences below using going to form

- Aed monthly inspection forms

- Pdf filler com southern california edison form

- Costco employee agreement form

- Application cum declaration as to physical fitness see rule5 2 form

- Ndw r 130771 form

- Hsbc pre authorized payment form

- Cleaning job application form

Find out other Portal ct gov MediaDepartment Of Revenue Services Form CT 941X DRS Use ONLY

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure