Form CT DRS CT 941X Fill Online, Printable, Fillable 2024-2026

What is the Form CT DRS CT 941X?

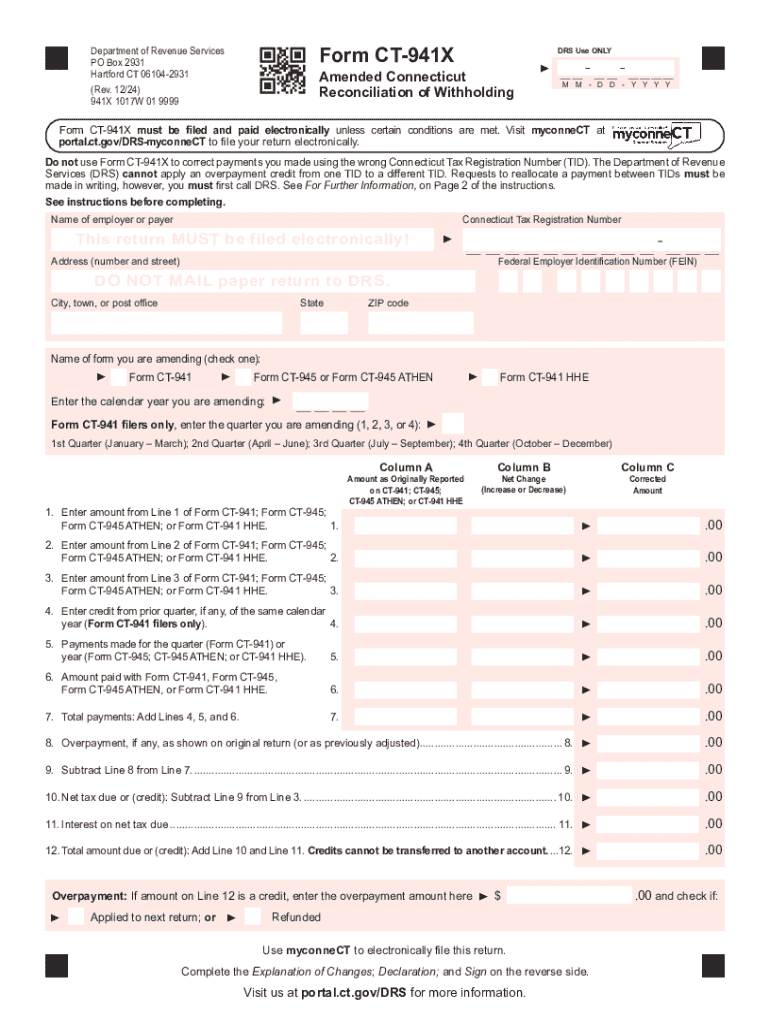

The Form CT DRS CT 941X is a critical document used by businesses in Connecticut to amend previously filed Connecticut quarterly withholding tax returns. This form allows employers to correct errors in their reported wages, tax withheld, or any other information that may have been inaccurately submitted. It is essential for ensuring compliance with state tax regulations and accurately reflecting a business's tax liabilities.

Steps to Complete the Form CT DRS CT 941X

Completing the Form CT DRS CT 941X involves several key steps:

- Gather necessary information, including the original CT-941 form, employee wage details, and any supporting documents related to the errors.

- Clearly indicate the tax period for which you are amending the return.

- Fill in the corrected amounts for wages and taxes withheld, ensuring accuracy to avoid further discrepancies.

- Provide an explanation of the changes made in the designated section to clarify the reasons for the amendment.

- Review the completed form for any errors before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT DRS CT 941X. Generally, amendments should be filed as soon as discrepancies are identified. The state of Connecticut typically allows for amendments to be filed within three years from the original due date of the return. Adhering to these timelines helps avoid penalties and ensures compliance with state tax laws.

Required Documents

When preparing to file the Form CT DRS CT 941X, certain documents are necessary to support your amendment. These include:

- The original CT-941 form that is being amended.

- Documentation that verifies the corrected amounts, such as payroll records or tax payment receipts.

- Any correspondence with the Connecticut Department of Revenue Services related to the original filing.

Legal Use of the Form CT DRS CT 941X

The Form CT DRS CT 941X is legally recognized for making amendments to previously filed tax returns in Connecticut. Proper use of this form is essential for maintaining compliance with state tax laws. Filing an amendment can protect businesses from potential audits and penalties that may arise from incorrect filings. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of the amendments being made.

Form Submission Methods

The Form CT DRS CT 941X can be submitted through various methods to accommodate different preferences:

- Online submission via the Connecticut Department of Revenue Services website, which may streamline the process.

- Mailing the completed form to the appropriate address provided by the state.

- In-person submission at designated state offices, if necessary.

Create this form in 5 minutes or less

Find and fill out the correct form ct drs ct 941x fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the form ct drs ct 941x fill online printable fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Connecticut calendar feature in airSlate SignNow?

The Connecticut calendar feature in airSlate SignNow allows users to schedule and manage document signing events efficiently. This feature integrates seamlessly with your existing calendar, ensuring that you never miss a deadline. With the Connecticut calendar, you can easily track when documents need to be signed and by whom.

-

How does airSlate SignNow's pricing work for Connecticut calendar users?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those utilizing the Connecticut calendar feature. You can choose from monthly or annual subscriptions, with options that scale based on your document signing needs. This ensures that you only pay for what you use while benefiting from the Connecticut calendar's capabilities.

-

What are the key benefits of using the Connecticut calendar with airSlate SignNow?

Using the Connecticut calendar with airSlate SignNow enhances your document management process by providing clear visibility into signing timelines. It helps streamline workflows, reduces delays, and improves overall efficiency. Additionally, the Connecticut calendar feature ensures that all stakeholders are aligned on deadlines, making collaboration smoother.

-

Can I integrate the Connecticut calendar with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications, including popular calendar tools. This means you can sync your Connecticut calendar with platforms like Google Calendar or Outlook, ensuring that all your scheduling needs are met in one place. This integration enhances productivity and keeps your document signing process organized.

-

Is the Connecticut calendar feature user-friendly?

Absolutely! The Connecticut calendar feature in airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for anyone to navigate and manage their document signing schedules without any technical expertise. This ensures that you can focus on your business rather than getting bogged down by complicated processes.

-

What types of documents can I manage with the Connecticut calendar?

With the Connecticut calendar feature in airSlate SignNow, you can manage a wide range of documents, including contracts, agreements, and forms. This versatility allows businesses to handle various signing needs efficiently. Whether it's a simple document or a complex agreement, the Connecticut calendar helps you keep track of all signing activities.

-

How does airSlate SignNow ensure the security of documents scheduled through the Connecticut calendar?

airSlate SignNow prioritizes the security of your documents, including those scheduled through the Connecticut calendar. The platform employs advanced encryption and security protocols to protect sensitive information. This ensures that your documents remain confidential and secure throughout the signing process.

Get more for Form CT DRS CT 941X Fill Online, Printable, Fillable

- Case 13 01346 form

- Nursing staff assignment sheets form

- Tr 321 form

- Form 15c consent motion to change ontario court services

- Transport document for lithium batteries form

- Harris teeter educational leave form

- Qaf no authorization required form medicaid clear health alliance

- Property lossdamage claim form garrun group

Find out other Form CT DRS CT 941X Fill Online, Printable, Fillable

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online