AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL Form

Understanding the Auditor Considerations Regarding Significant Unusual

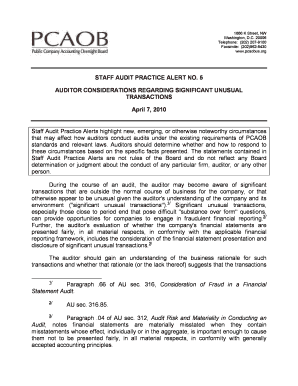

The Auditor Considerations Regarding Significant Unusual refers to the guidelines that auditors must follow when assessing unusual transactions or events during an audit. These considerations help ensure that auditors maintain a high level of scrutiny and professional skepticism, particularly when they encounter transactions that deviate from the norm. This process is crucial for identifying potential misstatements or fraud that could impact the financial statements of an organization.

Auditors must evaluate the nature of the unusual transactions, their significance, and the context in which they occur. This includes understanding the rationale behind these transactions and assessing whether they align with the entity's overall financial reporting objectives.

Steps to Complete the Auditor Considerations Regarding Significant Unusual

Completing the Auditor Considerations involves several key steps that auditors should follow to ensure thorough evaluation:

- Identify unusual transactions: Review financial records to pinpoint transactions that stand out due to their size, complexity, or timing.

- Assess significance: Determine the impact of these transactions on the overall financial statements and whether they warrant further investigation.

- Gather context: Collect information about the circumstances surrounding the transactions, including management's rationale and any relevant documentation.

- Evaluate risks: Analyze the risks associated with these transactions, including the potential for misstatement or fraud.

- Document findings: Maintain detailed records of the evaluation process, including conclusions and any additional procedures performed.

Legal Use of the Auditor Considerations Regarding Significant Unusual

Auditors must adhere to legal and regulatory requirements when applying the Auditor Considerations Regarding Significant Unusual. This includes compliance with standards set forth by the American Institute of Certified Public Accountants (AICPA) and the Public Company Accounting Oversight Board (PCAOB). These standards provide a framework for how auditors should approach unusual transactions, emphasizing the importance of transparency and accountability in financial reporting.

Failure to comply with these legal standards can result in significant penalties for both the auditor and the organization being audited, including reputational damage and financial repercussions.

Key Elements of the Auditor Considerations Regarding Significant Unusual

Several key elements are essential for auditors to consider when addressing significant unusual transactions:

- Nature of the transaction: Understand what makes the transaction unusual and how it differs from typical transactions.

- Timing: Evaluate when the transaction occurred and whether its timing raises any red flags.

- Documentation: Ensure that adequate documentation supports the transaction, including contracts, invoices, and correspondence.

- Management's explanations: Review management's rationale for the transaction and assess its reasonableness.

- Impact on financial statements: Analyze how the transaction affects the overall financial position and performance of the entity.

Examples of Using the Auditor Considerations Regarding Significant Unusual

Auditors can encounter various scenarios that illustrate the application of the Auditor Considerations Regarding Significant Unusual. For instance:

- A company may report a sudden increase in revenue due to a one-time sale of assets, prompting auditors to investigate the transaction's legitimacy.

- Unusual fluctuations in expense accounts, such as a significant increase in legal fees, may require auditors to delve deeper into the reasons behind these changes.

- Transactions involving related parties can also be flagged as unusual, necessitating a thorough examination of the terms and conditions involved.

Quick guide on how to complete auditor considerations regarding significant unusual

Complete AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL seamlessly on any gadget

Digital document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any wait. Manage AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL on any device with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL with ease

- Locate AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark essential sections of your files or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes a few seconds and bears the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the auditor considerations regarding significant unusual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key auditor considerations regarding signNow unusual transactions?

AUDITOR CONSIDERATIONS REGARDING signNow UNUSUAL transactions include evaluating the rationale behind these transactions, assessing their impact on financial statements, and ensuring compliance with applicable accounting standards. It's essential for auditors to document their findings and provide recommendations to mitigate risks.

-

How can airSlate SignNow help with auditor considerations regarding signNow unusual transactions?

airSlate SignNow simplifies the documentation process, making it easier for businesses to prepare and maintain records related to signNow unusual transactions. By streamlining eSignature workflows, our solution enhances transparency and allows for quicker access to important documentation for auditors.

-

What features does airSlate SignNow offer for accounting and auditing purposes?

airSlate SignNow provides features such as customizable templates, audit trails, and secure cloud storage that directly address AUDITOR CONSIDERATIONS REGARDING signNow UNUSUAL transactions. These features ensure that all signatures and modifications are tracked and easily accessible for audits.

-

Is airSlate SignNow cost-effective for small businesses regarding auditor requirements?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With features tailored for compliance and secure document handling, it respects AUDITOR CONSIDERATIONS REGARDING signNow UNUSUAL needs without breaking the bank.

-

What integration options are available with airSlate SignNow?

airSlate SignNow integrates seamlessly with various accounting and financial software platforms, which aids in addressing AUDITOR CONSIDERATIONS REGARDING signNow UNUSUAL transactions. These integrations simplify data exchanges and enhance the overall efficiency of record-keeping processes.

-

How does airSlate SignNow enhance compliance in auditing?

With robust security features and compliance checks, airSlate SignNow helps businesses maintain adherence to accounting standards. This directly supports AUDITOR CONSIDERATIONS REGARDING signNow UNUSUAL transactions by providing a reliable platform for secure document handling.

-

Can airSlate SignNow facilitate real-time collaboration during audits?

Absolutely! airSlate SignNow allows multiple users to collaborate on documents in real-time, making it easier to review and update records related to signNow unusual transactions. This feature aligns with AUDITOR CONSIDERATIONS REGARDING signNow UNUSUAL by fostering clear communication and transparency among stakeholders.

Get more for AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL

- Wa odometer disclosure form

- Washington bill of sale for watercraft or boat form

- Washington as is form

- West virginia bill of sale in connection with sale of business by individual or corporate seller form

- California jurat acknowledgment form

- California acknowledgment for a certificate for proof of execution form

- Florida acknowledgment for certifying to a non recordable document form

- Hawaii acknowledgment for individuals form

Find out other AUDITOR CONSIDERATIONS REGARDING SIGNIFICANT UNUSUAL

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template