Form 8907 Nonconventional Source Fuel Credit

What is the Form 8907 Nonconventional Source Fuel Credit

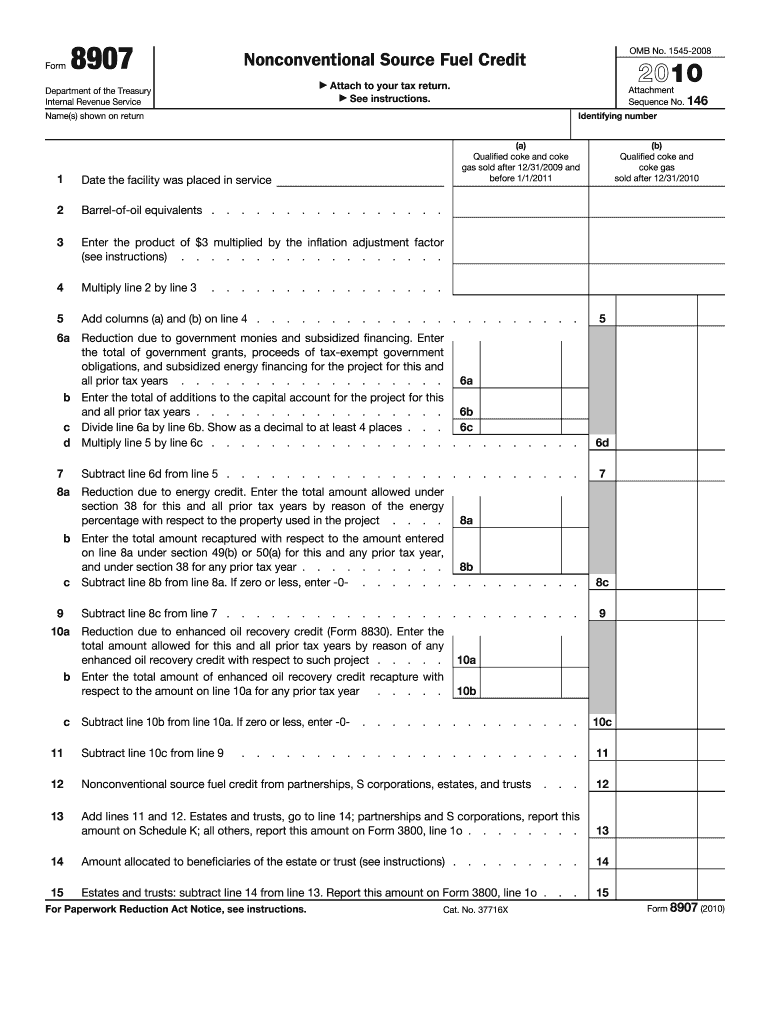

The Form 8907 Nonconventional Source Fuel Credit is a tax form used by businesses and individuals to claim a credit for the production of nonconventional source fuels. These fuels include biomass, geothermal energy, and other alternative energy sources that are not derived from conventional fossil fuels. The credit is designed to encourage the production and use of renewable energy, thereby reducing dependence on traditional energy sources and promoting environmental sustainability.

How to use the Form 8907 Nonconventional Source Fuel Credit

To use the Form 8907, taxpayers must first determine their eligibility based on the type of nonconventional fuel produced. The form requires detailed information about the production process, the amount of fuel produced, and the specific type of nonconventional fuel. Once completed, the form is submitted with the taxpayer's annual tax return, allowing them to claim the credit against their tax liability.

Steps to complete the Form 8907 Nonconventional Source Fuel Credit

Completing the Form 8907 involves several key steps:

- Gather necessary documentation, including records of fuel production and any related expenses.

- Identify the type of nonconventional fuel produced and ensure it meets IRS eligibility requirements.

- Fill out the form accurately, providing all required information, including production quantities and relevant calculations.

- Review the completed form for accuracy before submission.

- File the form along with your federal tax return by the appropriate deadline.

Eligibility Criteria

To qualify for the Nonconventional Source Fuel Credit, taxpayers must meet specific eligibility criteria set by the IRS. This includes producing fuel from eligible nonconventional sources and adhering to defined production processes. Additionally, the taxpayer must be able to substantiate their claims with adequate documentation, such as production records and receipts for expenses related to fuel production.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form 8907. Typically, the form must be submitted along with the taxpayer's annual return, which is due on April fifteenth for most individuals and corporations. However, extensions may be available, and it is crucial to check for any updates from the IRS regarding specific deadlines for the current tax year.

Required Documents

When completing the Form 8907, several documents are required to support the claims made on the form. These documents include:

- Records of fuel production, including quantities and types of nonconventional fuels produced.

- Receipts and invoices for expenses incurred during the production process.

- Any additional documentation that demonstrates compliance with IRS eligibility requirements.

Quick guide on how to complete form 8907 nonconventional source fuel credit

Complete [SKS] effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly option to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to initiate.

- Use the tools we provide to finalize your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8907 nonconventional source fuel credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8907 Nonconventional Source Fuel Credit?

The Form 8907 Nonconventional Source Fuel Credit allows businesses to claim tax credits for the production and use of nonconventional source fuels. This credit can signNowly reduce your tax liability, making it crucial for eligible companies. Understanding how to utilize this form effectively can enhance financial savings.

-

How can airSlate SignNow assist with Form 8907 Nonconventional Source Fuel Credit?

airSlate SignNow offers an efficient way to prepare and eSign the necessary documents related to the Form 8907 Nonconventional Source Fuel Credit. With its user-friendly interface, users can easily manage paperwork, ensuring compliance and timely submissions. Leveraging this tool helps streamline the process for better efficiency.

-

What features does airSlate SignNow provide for managing Form 8907 Nonconventional Source Fuel Credit documentation?

airSlate SignNow includes powerful features like template creation, automated reminders, and secure cloud storage for all documents related to the Form 8907 Nonconventional Source Fuel Credit. These tools enhance collaboration and keep your documents organized. This ensures that all necessary files are easily accessible when needed.

-

Is airSlate SignNow a cost-effective solution for handling Form 8907 Nonconventional Source Fuel Credit?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their Form 8907 Nonconventional Source Fuel Credit documentation. With competitive pricing plans and no hidden fees, companies can leverage the platform without breaking the bank. This can lead to increased savings when filing for credits.

-

Can I integrate airSlate SignNow with other software for my Form 8907 Nonconventional Source Fuel Credit needs?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software to facilitate your Form 8907 Nonconventional Source Fuel Credit processes. By connecting these systems, you can ensure data consistency and reduce the workload associated with managing multiple platforms.

-

How secure is airSlate SignNow when it comes to sensitive Form 8907 Nonconventional Source Fuel Credit information?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and complies with data security standards to protect your sensitive Form 8907 Nonconventional Source Fuel Credit information. Users can confidently store and share documents knowing their data is safeguarded.

-

What benefits does using airSlate SignNow offer for tracking Form 8907 Nonconventional Source Fuel Credit submissions?

Using airSlate SignNow provides numerous benefits, such as real-time tracking of Form 8907 Nonconventional Source Fuel Credit submissions. This feature allows businesses to monitor the status of their documents and receive notifications on completion. Enhanced visibility and tracking improve the overall management of critical submissions.

Get more for Form 8907 Nonconventional Source Fuel Credit

Find out other Form 8907 Nonconventional Source Fuel Credit

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document