Form 1118 Schedule I Rev December

What is the Form 1118 Schedule I Rev December

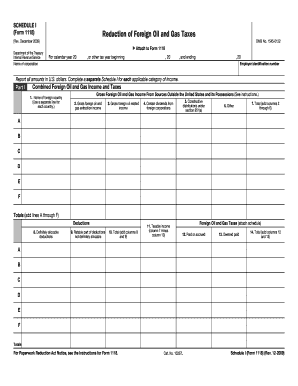

The Form 1118 Schedule I Rev December is a tax form used by U.S. corporations to claim a foreign tax credit. This credit allows businesses to reduce their U.S. tax liability based on taxes paid to foreign governments. The form is essential for corporations that earn income from international sources, ensuring they do not face double taxation on the same income. Understanding this form is crucial for compliance with U.S. tax laws and for optimizing tax obligations.

How to use the Form 1118 Schedule I Rev December

To effectively use the Form 1118 Schedule I Rev December, corporations must first gather all necessary financial data related to foreign income and taxes paid. The form requires detailed reporting of foreign taxes, including the country where the income was earned and the corresponding tax amounts. It is important to accurately complete each section to ensure that the foreign tax credit is calculated correctly, which can significantly impact the overall tax liability. Corporations should also keep thorough records of all foreign income and taxes paid for future reference and compliance purposes.

Steps to complete the Form 1118 Schedule I Rev December

Completing the Form 1118 Schedule I Rev December involves several key steps:

- Gather all relevant financial documents, including income statements and records of foreign taxes paid.

- Fill out the identification section, providing the corporation's name, address, and Employer Identification Number (EIN).

- Report foreign source income in the appropriate sections, ensuring to distinguish between various types of income.

- Detail the foreign taxes paid, specifying the country and the amount for each type of income reported.

- Calculate the foreign tax credit using the provided formulas, ensuring accuracy to avoid potential audits.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form 1118 Schedule I Rev December. Generally, the form is due on the same date as the corporation's income tax return. For most corporations, this is the fifteenth day of the fourth month after the end of the tax year. If additional time is needed, corporations can file for an extension, which typically allows for an additional six months. It is essential to stay informed about any changes in deadlines that the IRS may announce, as these can affect compliance.

Key elements of the Form 1118 Schedule I Rev December

The Form 1118 Schedule I Rev December includes several key elements that are crucial for accurate reporting:

- Identification Information: This section requires the corporation's basic details, including the name and EIN.

- Income Reporting: Corporations must categorize foreign source income, such as dividends, interest, and royalties.

- Foreign Taxes Paid: Detailed reporting of foreign taxes is necessary, including the amount and the country of origin.

- Credit Calculation: This section involves calculating the allowable foreign tax credit based on reported income and taxes.

Legal use of the Form 1118 Schedule I Rev December

The legal use of the Form 1118 Schedule I Rev December is governed by U.S. tax laws, specifically those pertaining to foreign tax credits. Corporations must ensure that they comply with all IRS regulations when using this form. Accurate reporting is essential to avoid penalties and ensure that the foreign tax credit is applied correctly. Misuse or inaccuracies in the form can lead to audits, additional taxes owed, or penalties. Therefore, it is advisable for corporations to consult with tax professionals when completing the form to ensure compliance.

Quick guide on how to complete form 1118 schedule i rev december

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without any hold-ups. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1118 Schedule I Rev December

Create this form in 5 minutes!

How to create an eSignature for the form 1118 schedule i rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1118 Schedule I Rev December?

Form 1118 Schedule I Rev December is a tax form used by U.S. corporations to claim a foreign tax credit. This form helps businesses calculate the foreign taxes they can claim against their U.S. tax liability. Understanding this form is crucial for companies operating internationally to optimize their tax benefits.

-

How can airSlate SignNow assist with Form 1118 Schedule I Rev December?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form 1118 Schedule I Rev December. Our solution streamlines the process, ensuring that all signatures and documentation are securely handled, making it easier for businesses to manage their tax forms efficiently.

-

Is airSlate SignNow a cost-effective solution for handling Form 1118 Schedule I Rev December?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for handling Form 1118 Schedule I Rev December. With our platform, you can save both time and money by simplifying document management and e-signature processes.

-

What features does airSlate SignNow offer for Form 1118 Schedule I Rev December?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage for your Form 1118 Schedule I Rev December. These tools enhance the efficiency of the signing process, allowing for better document organization and compliance.

-

Can I integrate airSlate SignNow with other software for handling Form 1118 Schedule I Rev December?

Absolutely! airSlate SignNow offers integrations with various software, including accounting and tax management platforms, to streamline your workflow for Form 1118 Schedule I Rev December. This allows teams to enhance productivity by connecting their existing tools to our e-signature solution.

-

What are the benefits of using airSlate SignNow for Form 1118 Schedule I Rev December?

Using airSlate SignNow for Form 1118 Schedule I Rev December offers numerous benefits, including enhanced security, faster turnaround times, and improved collaboration among team members. Organizations can also reduce their reliance on paper documents, leading to a more sustainable operation.

-

Is it easy to use airSlate SignNow for signing Form 1118 Schedule I Rev December?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to sign Form 1118 Schedule I Rev December. With our intuitive interface, users can quickly navigate through the signing process without requiring extensive training or technical knowledge.

Get more for Form 1118 Schedule I Rev December

Find out other Form 1118 Schedule I Rev December

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed