If You Are Not Required to Make Estimated Tax Payments for , You Can Discard This Package Form

What is the If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package

The statement "If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package" serves as a notification for taxpayers who do not need to submit estimated tax payments for a given tax year. This package typically contains information and forms related to estimated tax payments, which are generally required for individuals who expect to owe tax of a certain amount when filing their annual return. If you receive this package but do not meet the criteria for making estimated payments, it is advisable to discard it to avoid confusion.

Key elements of the If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package

This package usually includes several important components:

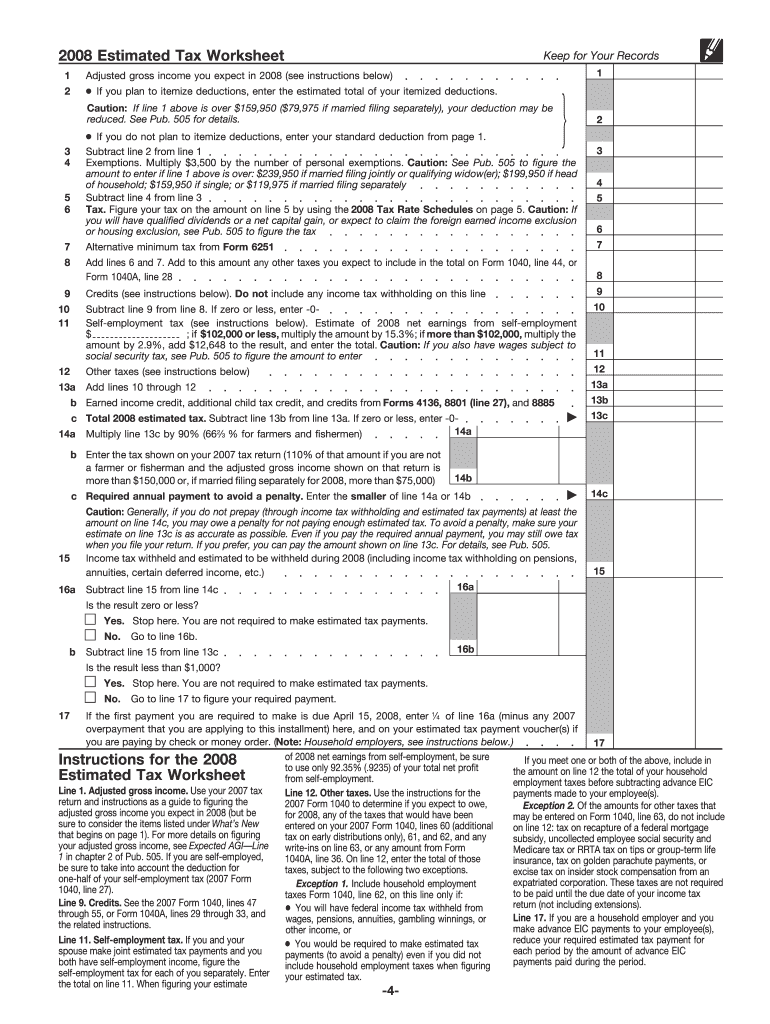

- Estimated Tax Payment Forms: These forms outline the necessary steps for submitting estimated payments.

- Payment Schedules: Information detailing when estimated payments are due throughout the year.

- Eligibility Criteria: Guidelines that clarify who is required to make estimated payments based on income levels and tax liabilities.

- Contact Information: Resources for taxpayers to reach out for assistance or clarification regarding their tax obligations.

Eligibility Criteria

To determine whether you are required to make estimated tax payments, consider the following criteria:

- You expect to owe at least one thousand dollars in tax after subtracting your withholding and refundable credits.

- Your withholding and refundable credits will be less than the smaller of 90% of the tax for the current year or 100% of the tax for the prior year.

- Your tax situation has changed significantly, such as through increased income or changes in employment status.

Steps to complete the If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package

If you find that you do not need to make estimated tax payments, follow these steps:

- Review the package to confirm that it is indeed not applicable to your situation.

- Ensure that you understand your tax obligations for the current year.

- Discard the package securely to protect any personal information it may contain.

IRS Guidelines

The Internal Revenue Service (IRS) provides clear guidelines regarding estimated tax payments. Taxpayers should refer to IRS publications or their official website for detailed information on:

- Who is required to make estimated payments.

- The calculation methods for estimated tax payments.

- Deadlines for payments and filing.

Filing Deadlines / Important Dates

Understanding the deadlines is crucial for taxpayers who are required to make estimated payments. Generally, estimated tax payments are due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Who Issues the Form

The package and the associated forms are typically issued by the IRS. Taxpayers may receive these documents based on their previous year's tax filings or if they have been identified as needing to make estimated payments. It is important to ensure that you are receiving the correct documents relevant to your tax situation.

Quick guide on how to complete if you are not required to make estimated tax payments for you can discard this package

Complete [SKS] effortlessly on any gadget

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package

Create this form in 5 minutes!

How to create an eSignature for the if you are not required to make estimated tax payments for you can discard this package

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package.' mean?

This statement indicates that if you're not obligated to make estimated tax payments for your income, the associated tax package can be disregarded. It's essential to know your tax obligations to avoid penalties. If you have further questions about your tax status, consider consulting a tax professional.

-

How can airSlate SignNow help with managing tax-related documents?

airSlate SignNow streamlines the signing and sending process for tax documents, ensuring you can easily manage and organize your files. Features like eSignatures and document templates save time and improve accuracy in your tax documentation, which is particularly beneficial if you are unsure about your estimated tax payments.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs. Each plan comes with features designed to enhance productivity and document management. If you are not required to make estimated tax payments for your business, you can select a plan that suits your workflow and budget.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with many popular software applications, enhancing its functionality. This allows you to connect your workflows and share documents across platforms efficiently. If you are not required to make estimated tax payments for your business, these integrations can still optimize your document processes.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow offers several benefits, including increased efficiency, better compliance, and simplified workflows. By empowering you to send and eSign documents effortlessly, it saves you time that can be redirected towards your core business activities. Importantly, if you are not required to make estimated tax payments for your business, you’ll still enjoy these advantages without unnecessary costs.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. It employs advanced encryption techniques and compliance with industry standards to protect sensitive information. Even if you are not required to make estimated tax payments for your business, it’s crucial to ensure that all documents are securely managed.

-

Can I customize my document templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize document templates to fit your specific needs. This feature is particularly useful for businesses that frequently use similar forms, such as tax documents. If you are not required to make estimated tax payments for , you can simplify your documentation process with tailored templates.

Get more for If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package

- Group membership change form kirkwood

- Activity 5 2 check writing 101 form

- Wh 1606a the south carolina department of revenue form

- Notice of special appearance pdf 33938869 form

- Form gst reg 25 certificate of provisional registration tampcol

- Nj chapter 51 form

- Hospital discharge papers for asthma form

- Dunblane lifestyle estate homeowners association form

Find out other If You Are Not Required To Make Estimated Tax Payments For , You Can Discard This Package

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors