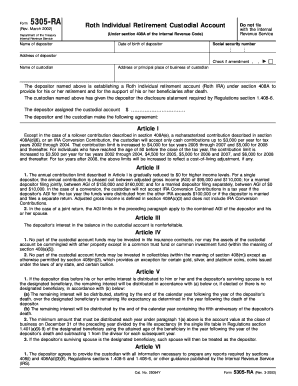

Under Section 408A of the Internal Revenue Code Date of Birth of Depositor Form

Understanding the Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

The term "Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor" refers to a specific requirement related to the establishment of a Roth IRA. This date is crucial as it helps identify the age of the account holder, which can affect contribution limits and eligibility for certain tax benefits. The Internal Revenue Service (IRS) mandates that financial institutions collect this information to ensure compliance with tax regulations.

Steps to Complete the Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

Completing the date of birth section for a Roth IRA under Section 408A involves a few straightforward steps:

- Gather necessary identification documents that confirm your date of birth, such as a birth certificate or driver's license.

- Locate the designated section on the Roth IRA application form where the date of birth is required.

- Enter your date of birth in the format requested, typically MM/DD/YYYY.

- Review the information for accuracy before submitting the application to avoid delays.

Legal Use of the Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

The date of birth of the depositor is legally required for the establishment of a Roth IRA under Section 408A. This information is used to determine eligibility for contributions and withdrawals, particularly concerning the age-related rules set by the IRS. Failing to provide accurate information may lead to compliance issues or penalties.

Required Documents for the Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

When filling out the date of birth section, you may need to provide specific documentation to verify your identity. Commonly required documents include:

- Birth certificate

- Government-issued identification, such as a driver's license or passport

- Social Security card, which may also contain your date of birth

IRS Guidelines for the Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

The IRS provides clear guidelines regarding the collection and use of the date of birth for Roth IRAs. According to IRS regulations, financial institutions must verify the depositor's date of birth to ensure compliance with contribution limits and eligibility criteria. This information must be kept secure and confidential, in line with privacy laws.

Examples of Using the Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

Understanding how the date of birth impacts Roth IRA accounts can help individuals make informed decisions. For instance:

- A depositor under the age of fifty can contribute up to six thousand dollars annually.

- Individuals aged fifty or older may contribute an additional one thousand dollars as a catch-up contribution.

- Withdrawals of contributions can be made tax-free at any time, but earnings may be subject to penalties if withdrawn before age fifty-nine and a half.

Quick guide on how to complete under section 408a of the internal revenue code date of birth of depositor

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The Simplest Way to Modify and Electronically Sign [SKS]

- Find [SKS] and click Get Form to commence.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure exceptional communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the under section 408a of the internal revenue code date of birth of depositor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the date of birth of the depositor under Section 408A of the Internal Revenue Code?

The date of birth of the depositor under Section 408A of the Internal Revenue Code is crucial for establishing eligibility for certain retirement accounts, such as Roth IRAs. This information impacts contribution limits and withdrawal rules, ensuring that account holders adhere to federal regulations.

-

How can airSlate SignNow assist in managing documents related to Section 408A accounts?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning documents pertaining to Section 408A accounts. Our features ensure compliance and security, allowing users to manage their documents efficiently while keeping track of important dates and signatures.

-

Is there a cost associated with using airSlate SignNow for documents involving Section 408A compliance?

Yes, airSlate SignNow offers various pricing plans that fit different business needs, ensuring cost-effective solutions for managing Section 408A documentation. We provide a free trial to help users assess how our platform can streamline their compliance processes before committing.

-

What features does airSlate SignNow offer to enhance the signing process for Section 408A documents?

AirSlate SignNow features advanced options like template creation, automated reminders, and secure cloud storage, making it easier to handle documents related to Section 408A efficiently. These tools help ensure all necessary information, including the date of birth of the depositor, is accurately captured.

-

Can airSlate SignNow integrate with other financial software for managing Section 408A accounts?

Absolutely, airSlate SignNow integrates seamlessly with various financial and accounting software, enabling users to manage their Section 408A-related documents efficiently. This integration helps streamline workflows and maintain updated records, including depositors' key information.

-

What benefits does airSlate SignNow provide for businesses handling Section 408A documentation?

Using airSlate SignNow simplifies the eSigning process, ensuring that documents related to Section 408A compliance are processed quickly and securely. The platform enhances collaboration between parties, reducing turnaround time and improving overall efficiency.

-

How does airSlate SignNow ensure the security of documents related to Section 408A accounts?

airSlate SignNow employs industry-standard encryption to protect sensitive information, including the date of birth of the depositor under Section 408A of the Internal Revenue Code. Our commitment to data security ensures peace of mind for businesses handling critical financial documents.

Get more for Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

- Kindergarten parent questionnaire form

- Appeal online form iaft 2 fillable online

- Naf leave form

- College fee waiver program for veterans dependents fillable form

- Share transfer form sh 4

- Choices living well at the end of life form

- Dance team application template form

- Stanbic mutual funds online redemption form

Find out other Under Section 408A Of The Internal Revenue Code Date Of Birth Of Depositor

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online