Use Form 6198 to Figure the Current Year Profit Loss from an at Risk Activity for Part I

Understanding Form 6198

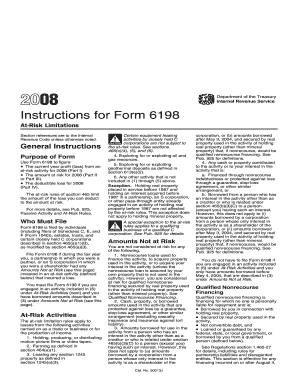

Form 6198, officially titled "Use Form 6198 To Figure The Current Year Profit or Loss From An At-Risk Activity For Part I," is a crucial document for taxpayers who engage in activities where their investment is at risk. This form is primarily used to calculate the allowable loss from such activities, which can significantly impact your overall tax liability. Understanding the purpose of this form is essential for accurately reporting your income and losses to the IRS.

Steps to Complete Form 6198

Completing Form 6198 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant financial information regarding your at-risk activities, including income, expenses, and any prior year losses. Next, fill out the form by providing your name, taxpayer identification number, and the details of the activity in question. Calculate the allowable loss based on the at-risk rules, which may include contributions of cash, property, or borrowed amounts for which you are personally liable. Finally, review the completed form for accuracy before submitting it with your tax return.

Obtaining Form 6198

Form 6198 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to ensure you are using the most current version of the form, as tax laws and requirements may change annually. If you prefer a physical copy, you can also request it by calling the IRS or visiting a local IRS office.

Key Elements of Form 6198

Several key elements are essential to understand when filling out Form 6198. These include the identification of the at-risk activity, the calculation of the amount at risk, and the determination of the allowable loss. Additionally, it is important to understand how prior year losses may affect the current year's calculations. Each section of the form is designed to capture specific financial details that contribute to the overall assessment of your tax situation.

IRS Guidelines for Form 6198

The IRS provides specific guidelines for completing Form 6198, which are crucial for ensuring compliance. These guidelines outline the types of activities considered at-risk, the documentation required to support your claims, and the calculation methods for determining allowable losses. Familiarizing yourself with these guidelines can help prevent errors and potential audits by the IRS.

Filing Deadlines for Form 6198

Filing deadlines for Form 6198 align with the general tax filing deadlines in the United States. Typically, individual taxpayers must submit their tax returns by April fifteen of each year. If you require additional time, you may file for an extension, but it is essential to ensure that Form 6198 is submitted accurately and on time to avoid penalties.

Examples of Using Form 6198

Understanding practical examples of Form 6198 can enhance your comprehension of its application. For instance, if you invested in a rental property and incurred losses due to repairs and maintenance, you would use Form 6198 to calculate the allowable loss based on the amount you have at risk in the property. Another example could involve a business venture where you are personally liable for loans taken out to fund the business. In both cases, accurately reporting these losses can provide significant tax benefits.

Quick guide on how to complete use form 6198 to figure the current year profit loss from an at risk activity for part i

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you want to send your form, either by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Use Form 6198 To Figure The Current Year Profit loss From An At risk Activity For Part I

Create this form in 5 minutes!

How to create an eSignature for the use form 6198 to figure the current year profit loss from an at risk activity for part i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6198 and how can I use it?

Form 6198 is utilized to determine the current year profit or loss from an at-risk activity for Part I. To effectively use Form 6198 to figure the current year profit loss from an at-risk activity for Part I, you will need to gather pertinent financial information about your business operations and investments. This form helps you assess the risk associated with your investments, ensuring accurate reporting on your taxes.

-

How can airSlate SignNow help me with Form 6198?

airSlate SignNow facilitates the eSigning and document management process, allowing you to easily manage Form 6198. By using airSlate SignNow, you can streamline your workflow, ensuring that all necessary signatures are obtained efficiently. To maximize transparency, you can store and share your documents seamlessly while keeping track of your submissions related to figuring the current year profit loss from an at-risk activity for Part I.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features such as customizable templates, secure storage, and real-time collaboration. These tools are essential for efficiently managing documents like Form 6198. Using airSlate SignNow, you can ensure that your calculations for the current year profit loss from an at-risk activity for Part I are documented and stored securely.

-

Is there a pricing plan for using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit different business needs. Whether you are a small business or a larger enterprise, you can choose a plan that allows you to utilize our tools for executing and tracking documents like Form 6198. Investing in airSlate SignNow simplifies the process of figuring the current year profit loss from an at-risk activity for Part I, ultimately saving you time and resources.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow supports numerous integrations with popular software which enhance its functionality. You can link airSlate SignNow to accounting or financial software to make it easier to gather the information needed to use Form 6198 to figure the current year profit loss from an at-risk activity for Part I. This will provide a seamless workflow across your business processes.

-

What are the benefits of using airSlate SignNow for tax documents?

One of the main benefits of using airSlate SignNow is the ease of accessing and managing your tax documents securely. It helps you maintain an organized system for handling important forms, such as Form 6198. By simplifying your workflow for figuring the current year profit loss from an at-risk activity for Part I, you can focus more on your business strategies and less on paperwork.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes document security by implementing advanced encryption and authentication measures. Your documents, including Form 6198, are protected against unauthorized access, ensuring that your information remains confidential. This level of security is essential when you are using Form 6198 to figure the current year profit loss from an at-risk activity for Part I.

Get more for Use Form 6198 To Figure The Current Year Profit loss From An At risk Activity For Part I

Find out other Use Form 6198 To Figure The Current Year Profit loss From An At risk Activity For Part I

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement