Form 9325 Rev March Fill in Capable Acknowledgement and General Information for Taxpayers Who File Returns Electronically

What is the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

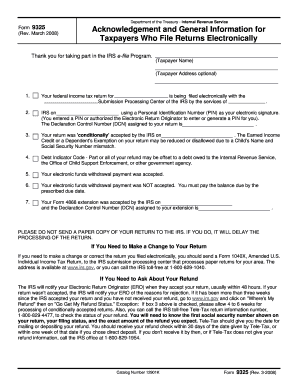

The Form 9325 Rev March is an important document used by taxpayers who file their tax returns electronically. This form serves as an acknowledgment of the electronic filing and provides general information about the process. It confirms that the IRS has received the taxpayer's electronic submission and outlines key details that may be relevant for future reference. Understanding this form is crucial for ensuring compliance and maintaining accurate records of electronic filings.

How to use the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Using the Form 9325 Rev March involves a straightforward process. Taxpayers must complete the form after submitting their electronic tax return. This form can be filled out digitally, allowing for easier completion and submission. It is essential to ensure that all required information is accurately entered, including the taxpayer's name, Social Security number, and details of the electronic submission. Once completed, the form should be saved for personal records and may be printed if needed for documentation purposes.

Steps to complete the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Completing the Form 9325 Rev March involves several key steps:

- Access the form through the IRS website or a tax preparation software that supports electronic filing.

- Fill in the required fields, ensuring that all personal and tax return information is accurate.

- Review the completed form for any errors or omissions.

- Save the form for your records, and consider printing a copy for documentation.

- Retain the form as proof of your electronic filing for future reference or in case of an audit.

Key elements of the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

The Form 9325 Rev March contains several key elements that are vital for taxpayers. These include:

- Taxpayer Information: This section requires the taxpayer's name, address, and Social Security number.

- Filing Information: Details about the electronic submission, including the date filed and the type of return submitted.

- IRS Acknowledgment: A confirmation that the IRS has received the electronic return, which is crucial for record-keeping.

- Additional Instructions: Guidance on what to do next and how to maintain compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 9325 Rev March. It is essential for taxpayers to familiarize themselves with these guidelines to ensure proper usage. The IRS recommends that taxpayers keep a copy of the form along with their tax records for at least three years. This is important for verifying the electronic filing in case of inquiries or audits. Additionally, the IRS emphasizes the importance of accurate information to avoid complications in the filing process.

Form Submission Methods (Online / Mail / In-Person)

The Form 9325 Rev March is primarily used in conjunction with electronic filings, and therefore, it is typically submitted online. However, if a taxpayer needs to provide a paper copy for their records, they can print the completed form. It is important to note that the form itself does not need to be mailed to the IRS unless specifically requested. Taxpayers should ensure they follow the electronic submission process to maintain compliance with IRS regulations.

Quick guide on how to complete form 9325 rev march fill in capable acknowledgement and general information for taxpayers who file returns electronically

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Construct your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to submit your form, whether via email, SMS, invitation link, or download it directly to your computer.

Forget the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Create this form in 5 minutes!

How to create an eSignature for the form 9325 rev march fill in capable acknowledgement and general information for taxpayers who file returns electronically

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically?

Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically is an essential document that verifies the electronic filing of tax returns. This form provides confirmation of submissions and important details about the returns filed, ensuring compliance with IRS regulations.

-

How does airSlate SignNow assist in completing the Form 9325 Rev March?

airSlate SignNow offers a streamlined process to complete the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically. Our platform allows users to fill in, sign, and send the form digitally, ensuring accuracy and compliance with IRS requirements.

-

What are the pricing options for using airSlate SignNow for Form 9325 Rev March?

airSlate SignNow provides cost-effective pricing plans tailored to meet your document management needs. Plans include various features that simplify the completion of the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically, allowing you to choose based on your usage requirements.

-

What features does airSlate SignNow offer for handling Form 9325 Rev March?

Our platform includes features such as document templates, eSignature capabilities, and cloud storage to make managing the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically efficient. These features ensure you can easily track, manage, and store your electronic filings.

-

What benefits does airSlate SignNow provide for electronically filing Form 9325 Rev March?

Using airSlate SignNow for your Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically simplifies the filing process. The solution enhances accuracy, improves turnaround time, and ensures that you stay compliant with IRS electronic filing rules.

-

Can airSlate SignNow integrate with other software for filing Form 9325 Rev March?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software solutions to streamline your workflow for filing Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically. This integration facilitates easy data import and supports efficient electronic filing.

-

Is support available for using airSlate SignNow for Form 9325 Rev March?

Absolutely! airSlate SignNow provides customer support to assist you with any queries related to completing the Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically. Our dedicated team is available via live chat, email, or phone to ensure you have a smooth experience.

Get more for Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Find out other Form 9325 Rev March Fill In Capable Acknowledgement And General Information For Taxpayers Who File Returns Electronically

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation