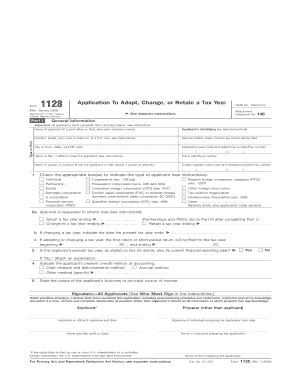

Form 1128 Rev January Fill in Capable Application to Adopt, Change, or Retain a Tax Year

Understanding Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year

The Form 1128 Rev January is a crucial document for businesses and individuals seeking to adopt, change, or retain a specific tax year. This application is essential for ensuring compliance with IRS regulations regarding tax year selection. By submitting this form, taxpayers can request approval for a tax year that aligns with their financial and operational needs. Understanding the purpose and implications of this form is vital for effective tax planning.

Steps to Complete the Form 1128 Rev January

Completing Form 1128 requires careful attention to detail. The process typically involves the following steps:

- Gather necessary information, such as your business's legal name, address, and Employer Identification Number (EIN).

- Determine the desired tax year and the reason for the change or retention.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline.

Key Elements of the Form 1128 Rev January

Several key elements must be included in the Form 1128 to ensure its validity:

- Taxpayer Information: This includes the legal name, address, and EIN of the business or individual.

- Requested Tax Year: Specify the tax year you wish to adopt, change, or retain.

- Reason for Change: Clearly articulate the reason for the request, as this will be evaluated by the IRS.

- Signature: Ensure that the form is signed by an authorized individual.

Filing Deadlines for Form 1128 Rev January

Timely submission of Form 1128 is critical. The IRS has specific deadlines that must be adhered to in order to avoid penalties. Generally, the form should be filed:

- By the due date of the return for the year in which the change is to take effect.

- For a new tax year, the form should be submitted no later than the end of the first tax year.

Eligibility Criteria for Form 1128 Rev January

Not all taxpayers are eligible to use Form 1128. Eligibility criteria include:

- Businesses and individuals who wish to change their tax year.

- Taxpayers who meet specific IRS guidelines regarding their business structure and tax reporting.

Application Process & Approval Time for Form 1128 Rev January

The application process for Form 1128 involves submitting the completed form to the IRS. Upon receipt, the IRS will review the application, which may take several weeks. It is advisable to keep a copy of the submitted form for your records. Approval time can vary based on the volume of applications being processed and the complexity of your request.

Quick guide on how to complete form 1128 rev january fill in capable application to adopt change or retain a tax year

Effortlessly complete [SKS] on any device

The management of online documents has surged in popularity among both entities and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to initiate.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year

Create this form in 5 minutes!

How to create an eSignature for the form 1128 rev january fill in capable application to adopt change or retain a tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year?

The Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year allows businesses to formally request a change in their tax year. This application is essential for compliance with IRS regulations regarding tax periods.

-

How does airSlate SignNow help with the Form 1128 Rev January Fill In Capable Application?

With airSlate SignNow, you can easily fill in, sign, and send the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year digitally. Our platform streamlines the process, ensuring accuracy and efficiency.

-

Are there any costs associated with using airSlate SignNow for Form 1128?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. You can choose a plan that best fits your requirements for processing documents like the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year.

-

What features does airSlate SignNow offer for completing the Form 1128?

airSlate SignNow provides features such as templates, electronic signatures, and secure document storage. These tools make completing the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year faster and more efficient.

-

Can multiple users collaborate on the Form 1128 with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year in real-time. This ensures that all necessary signatures and inputs are collected seamlessly.

-

Is it easy to integrate airSlate SignNow with other applications for managing the Form 1128?

Yes, airSlate SignNow offers integrations with a variety of popular applications and services. This makes it easy to import or export the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year across different platforms.

-

What benefits do businesses gain from using airSlate SignNow for tax applications?

By using airSlate SignNow for tax applications like the Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year, businesses benefit from increased efficiency, reduced processing time, and enhanced compliance. These advantages streamline tax management signNowly.

Get more for Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year

- Personal property return as of january 1 due april 15 form

- Linguisystems downloads form

- Nome eskimo community form

- Yearbook senior ad form everettsdorg

- Rwa letter 423492929 form

- Apostille certificate of authentication request form 41475157

- Fabian zulu form

- Principles of form and design wucius wong pdf download

Find out other Form 1128 Rev January Fill In Capable Application To Adopt, Change, Or Retain A Tax Year

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement