Form 8611 Rev January Fill in Capable Recapture of Low Income Housing Credit

What is the Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

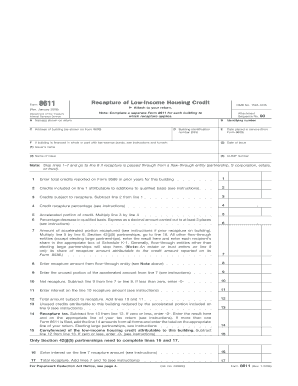

The Form 8611 is a tax form used in the United States to calculate the recapture of the Low Income Housing Credit (LIHC). This credit is designed to encourage the development and rehabilitation of affordable housing. When a property that has benefited from this credit is no longer used for low-income housing, the IRS requires the recapture of a portion of the credit. This form is essential for taxpayers who have previously claimed the LIHC and need to report any changes in the status of the property.

How to use the Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

To use Form 8611 effectively, taxpayers should first gather all relevant information regarding their low-income housing property. This includes the original credit claimed, any changes in property use, and the applicable recapture amount. The form guides users through the calculation process, allowing them to determine the amount that must be recaptured. It is important to follow the instructions carefully to ensure accurate reporting and compliance with IRS regulations.

Steps to complete the Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

Completing Form 8611 involves several steps:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Report the total amount of the Low Income Housing Credit previously claimed.

- Indicate the year in which the credit was claimed and any changes in the use of the property.

- Calculate the recapture amount based on the changes in property use.

- Complete any additional sections as required by the form's instructions.

- Review the completed form for accuracy before submission.

Key elements of the Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

The key elements of Form 8611 include:

- Taxpayer Information: Essential details such as name, address, and identification number.

- Credit Amount: The total Low Income Housing Credit claimed in previous years.

- Property Use Changes: Information regarding any changes in the use of the property that affect the credit.

- Recapture Calculation: A detailed calculation of the recapture amount based on IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for Form 8611 align with the tax return deadlines for the year in which the recapture occurs. Typically, this form must be submitted with your tax return by April fifteenth of the following year. If you file for an extension, ensure that the form is included with your extended return. Staying aware of these deadlines is crucial to avoid penalties and ensure compliance with IRS regulations.

Eligibility Criteria

Eligibility to use Form 8611 is primarily determined by whether you have previously claimed the Low Income Housing Credit and if there have been changes in the property's use. If the property is no longer used for low-income housing, you are required to complete this form to report the recapture of the credit. It is important to review IRS guidelines to ensure you meet all eligibility requirements before filing.

Quick guide on how to complete form 8611 rev january fill in capable recapture of low income housing credit

Complete [SKS] easily on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

Create this form in 5 minutes!

How to create an eSignature for the form 8611 rev january fill in capable recapture of low income housing credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

The Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit is designed for taxpayers who need to calculate and report the recapture of low-income housing credits. This form ensures compliance with federal tax regulations and allows taxpayers to accurately reflect any changes in their credit status. Leveraging the capabilities of airSlate SignNow can streamline this process.

-

How does airSlate SignNow support filling out Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

airSlate SignNow provides an intuitive platform for filling out Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit efficiently. Users can easily edit, save, and eSign the form digitally, ensuring accuracy and reducing the risk of errors. This not only simplifies the process but also saves valuable time for businesses.

-

Is there a cost associated with using airSlate SignNow for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans include features that allow users to handle Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit and other documents efficiently. Pricing is competitive, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

airSlate SignNow includes features such as document templates, e-signature capabilities, and automated workflows specifically designed for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit. These features help businesses streamline their document handling process while ensuring compliance with legal standards. The user-friendly interface also enhances the overall experience.

-

Can I integrate airSlate SignNow with other tools when handling Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

Absolutely! airSlate SignNow supports integrations with various business tools and platforms. This means you can incorporate it into your existing systems to handle Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit seamlessly, improving efficiency and centralizing document management.

-

How does eSigning with airSlate SignNow work for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

eSigning with airSlate SignNow is a straightforward process. Once you have filled out Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit, you can send it to relevant parties for their signatures electronically. This eliminates the need for printing, saving time and resources while ensuring that all signatures are legally binding.

-

What are the benefits of using airSlate SignNow for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit?

Using airSlate SignNow for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit allows for quick document processing, enhanced collaboration, and improved compliance with tax regulations. Additionally, the platform's cost-effectiveness makes it suitable for businesses of all sizes. Ultimately, it accelerates workflows and reduces administrative burdens.

Get more for Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

Find out other Form 8611 Rev January Fill In Capable Recapture Of Low Income Housing Credit

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple