December Department of the Treasury Internal Revenue Service Certificate of Foreign Status of Beneficial Owner for United States Form

Understanding the Certificate of Foreign Status

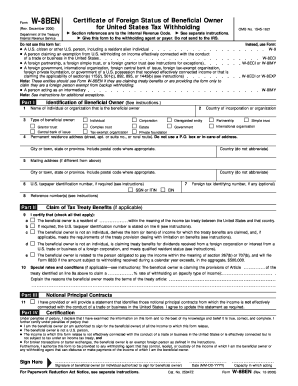

The December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding is a crucial document for non-U.S. residents and entities. This form, often referred to as Form W-8BEN, certifies that the beneficial owner of certain types of income is a foreign person. It helps establish the individual's or entity's foreign status and can reduce or eliminate U.S. tax withholding on income such as dividends, interest, and royalties.

How to Complete the Certificate of Foreign Status

Filling out the Certificate requires careful attention to detail. The form typically includes sections for providing the name of the beneficial owner, country of citizenship, and the type of income being received. It is essential to ensure that all information is accurate and complete to avoid delays in processing. Additionally, the form must be signed and dated by the beneficial owner or an authorized representative, confirming the information provided is true and correct.

Obtaining the Certificate of Foreign Status

The Certificate can be obtained directly from the Internal Revenue Service (IRS) website or through tax professionals who assist with international tax matters. It is advisable to ensure that you are using the most current version of the form, as updates may occur. The IRS provides clear guidelines on how to access and download the form, ensuring that all users have access to the necessary documentation.

Key Elements of the Certificate of Foreign Status

Several key elements must be included in the Certificate to ensure its validity. These include:

- Identification of the beneficial owner, including name and address.

- Country of citizenship or incorporation.

- Tax identification number from the foreign country, if applicable.

- Signature of the beneficial owner or authorized representative.

- Date of signature.

Each of these components plays a vital role in the processing and acceptance of the form by the IRS and withholding agents.

Legal Use of the Certificate of Foreign Status

The Certificate is legally binding and must be used in accordance with IRS regulations. It is primarily used to claim a reduced rate of withholding tax under an income tax treaty or to certify that the beneficial owner is not a U.S. person. Misuse of the form can lead to penalties, including back taxes and interest on unpaid amounts. Therefore, it is essential to understand the legal implications of submitting the Certificate accurately.

Filing Deadlines and Important Dates

While there is no specific deadline for submitting the Certificate of Foreign Status, it is important to provide it to withholding agents before any payments are made to ensure the correct withholding tax rate is applied. Keeping track of relevant tax deadlines is crucial, especially for businesses and individuals receiving income from U.S. sources.

Quick guide on how to complete december department of the treasury internal revenue service certificate of foreign status of beneficial owner for united

Accomplish [SKS] effortlessly on every device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS apps and streamline any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to initiate.

- Employ the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States

Create this form in 5 minutes!

How to create an eSignature for the december department of the treasury internal revenue service certificate of foreign status of beneficial owner for united

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding?

The December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding is a crucial form required for foreign entities to signNow their beneficial ownership. This certificate helps in establishing tax status and ensuring compliance with U.S. tax regulations as outlined in the Internal Revenue Code. Understanding how to utilize this form can signNowly impact international tax obligations.

-

How does airSlate SignNow assist in completing the IRS Certificate of Foreign Status?

airSlate SignNow streamlines the process of completing the December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding. Our platform allows users to easily fill out, sign, and send this IRS form electronically. This ensures that businesses can manage their international tax documentation efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for tax documents?

Yes, there are various pricing plans available for using airSlate SignNow, which provide different levels of service and features. Our pricing is designed to be cost-effective, especially for businesses looking to manage their December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding efficiently. Explore our plans to find the one that fits your needs.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers a variety of features tailored for handling tax-related documents, including document editing, eSigning, and secure storage. Specifically, our platform facilitates the completion of the December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding quickly and securely. These features simplify compliance and document management for stakeholders.

-

Can I integrate airSlate SignNow with other tools for tax documentation?

Absolutely! airSlate SignNow integrates seamlessly with various applications and business tools, making it easy to manage your December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding within your existing workflows. This integration capability enhances productivity and ensures that your tax documentation is always accessible and organized.

-

What benefits does using airSlate SignNow provide for foreign entities?

For foreign entities navigating U.S. tax regulations, airSlate SignNow offers signNow benefits when handling the December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding. Our user-friendly platform allows for quick eSigning and secure sharing of essential documents. This helps businesses to stay compliant and manage their tax-related obligations effortlessly.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including the December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding, are protected. Our platform employs industry-standard encryption and compliance measures to safeguard your sensitive data, giving you peace of mind when managing tax-related forms.

Get more for December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States

Find out other December Department Of The Treasury Internal Revenue Service Certificate Of Foreign Status Of Beneficial Owner For United States

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors