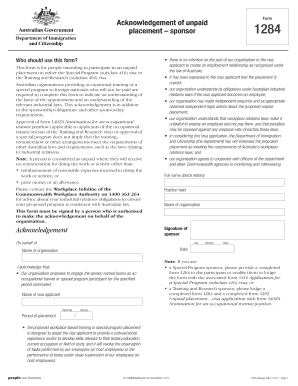

Form 1284

What is the Form 1284

The Form 1284 is a document used by the Internal Revenue Service (IRS) for specific tax-related purposes. It is primarily associated with the reporting of certain financial transactions and is essential for individuals and businesses seeking to comply with U.S. tax regulations. Understanding the purpose of this form is crucial for ensuring accurate reporting and adherence to IRS guidelines.

How to use the Form 1284

Using the Form 1284 involves several steps to ensure proper completion and submission. First, gather all necessary information, including financial details relevant to the transactions being reported. Next, accurately fill out each section of the form, ensuring that all data is correct and complete. Once the form is filled out, review it for any errors before submission. Depending on the requirements, the form can be submitted electronically or via mail, following the specific instructions provided by the IRS.

Steps to complete the Form 1284

Completing the Form 1284 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or other official sources.

- Read the instructions carefully to understand the requirements for each section.

- Fill in your personal or business information as required.

- Provide detailed financial information, ensuring accuracy in all figures.

- Double-check all entries for completeness and correctness.

- Sign and date the form where indicated.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Legal use of the Form 1284

The legal use of the Form 1284 is governed by IRS regulations, which stipulate how and when the form should be utilized. To ensure its legal validity, it is essential to comply with all relevant laws and guidelines. This includes using the form for its intended purpose, providing accurate information, and adhering to submission deadlines. Failure to comply with these regulations may result in penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1284 can vary based on the specific tax year and the type of transactions being reported. It is important to be aware of these deadlines to avoid late filing penalties. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, businesses may have different deadlines depending on their fiscal year and structure. Always check the IRS website for the most current information on filing dates.

Required Documents

To complete the Form 1284, certain documents may be required to support the information provided. These documents can include:

- Financial statements related to the transactions being reported.

- Previous tax returns that may provide context or additional information.

- Any correspondence from the IRS regarding prior filings.

- Identification documents, if necessary, to verify identity or business status.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 1284 can lead to various penalties imposed by the IRS. These may include fines for late submissions, inaccuracies, or failure to file altogether. It is crucial to understand the implications of non-compliance, as these penalties can significantly impact both individuals and businesses. Staying informed about filing requirements and deadlines is essential to avoid such consequences.

Quick guide on how to complete form 1284

Manage Form 1284 effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Handle Form 1284 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to edit and eSign Form 1284 with ease

- Obtain Form 1284 and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to submit your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1284 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1284

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1284 and how does it work with airSlate SignNow?

Form 1284 is a document used for various business purposes, including compliance and regulatory submissions. With airSlate SignNow, you can easily fill out, send, and eSign form 1284, streamlining your document management process and ensuring timely submissions.

-

What features does airSlate SignNow offer for managing form 1284?

airSlate SignNow provides a variety of features for managing form 1284, including customizable templates, real-time collaboration, and secure eSigning capabilities. These tools help ensure that your form 1284 is completed accurately and efficiently.

-

Can I integrate form 1284 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integrations with various applications, making it easy to manage form 1284. You can connect it with popular cloud services and CRM systems for increased efficiency and improved workflow.

-

Is airSlate SignNow cost-effective for businesses needing form 1284?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using this solution for form 1284, you can save money compared to traditional printing and mailing processes while improving your document workflow.

-

What are the benefits of using airSlate SignNow for form 1284 submissions?

Using airSlate SignNow for form 1284 offers numerous benefits, including enhanced security, faster processing times, and reduced paper usage. This ensures your submissions are not only compliant but also eco-friendly and easily trackable.

-

How secure is airSlate SignNow when handling form 1284?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect your form 1284 and other sensitive documents. You can confidently manage your documents knowing they are safe and secure.

-

Can I customize form 1284 templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize form 1284 templates to meet specific business requirements. You can add logos, modify fields, and tailor the layout to enhance branding and ensure all necessary information is captured.

Get more for Form 1284

Find out other Form 1284

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form