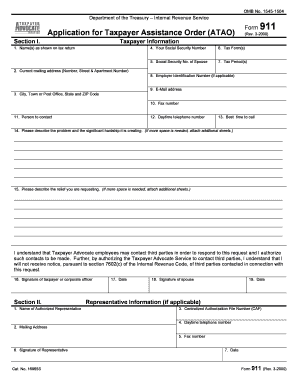

1545 1504 Department of the Treasury Internal Revenue Service Application for Taxpayer Assistance Order ATAO Section I Form

What is the Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

The Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I is a form used by taxpayers seeking assistance from the IRS. This application allows individuals to request a Taxpayer Assistance Order, which is a formal request for help in resolving tax-related issues. The form is essential for those facing difficulties with their tax obligations or who require special assistance due to unique circumstances.

Key elements of the Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

This application includes several critical components that must be completed accurately. Key elements consist of:

- Taxpayer Information: Personal details such as name, address, and taxpayer identification number.

- Reason for Assistance: A clear explanation of the issues prompting the request for assistance.

- Supporting Documentation: Any relevant documents that support the request, which may include tax returns or correspondence with the IRS.

- Signature: The taxpayer's signature is required to validate the application.

Steps to complete the Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

Completing the application involves several straightforward steps:

- Gather necessary personal and tax information.

- Clearly articulate the reason for requesting assistance.

- Collect any supporting documents that may strengthen your case.

- Fill out the form accurately, ensuring all sections are completed.

- Review the application for any errors or omissions.

- Sign the form to confirm its accuracy.

- Submit the application to the appropriate IRS office.

How to obtain the Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

The application can be obtained directly from the IRS website or through local IRS offices. It is essential to ensure that you are using the most recent version of the form to avoid any processing delays. Additionally, the form may be available through various tax assistance programs or community organizations that provide support to taxpayers.

Eligibility Criteria

To qualify for assistance through the ATAO, taxpayers must meet specific eligibility criteria, which may include:

- Demonstrating a genuine hardship or difficulty in resolving tax issues.

- Providing sufficient documentation to support the request.

- Being compliant with existing tax obligations, where applicable.

Application Process & Approval Time

The application process for the ATAO typically involves submitting the completed form along with any required documentation to the IRS. Once submitted, the approval time can vary based on the complexity of the case and the volume of requests the IRS is handling. Taxpayers are encouraged to follow up on their application status if they do not receive a response within a reasonable timeframe.

Quick guide on how to complete 1545 1504 department of the treasury internal revenue service application for taxpayer assistance order atao section i

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

Create this form in 5 minutes!

How to create an eSignature for the 1545 1504 department of the treasury internal revenue service application for taxpayer assistance order atao section i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

The 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I is a form used to request taxpayer assistance from the IRS. This application can help taxpayers who have difficulties resolving issues with their tax accounts and need additional support.

-

How can airSlate SignNow help with the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

airSlate SignNow streamlines the process of completing and submitting the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I. Our platform allows you to fill out the form electronically, ensuring accuracy and reducing the likelihood of errors during submission.

-

What are the pricing options for using airSlate SignNow for the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you're an individual taxpayer or a business needing to manage multiple applications like the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I, we have affordable packages to support your requirements.

-

What features does airSlate SignNow provide for completing IRS forms like the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

Our platform provides a wide array of features including electronic signatures, document templates, and secure cloud storage. These tools simplify the process of completing IRS forms such as the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I and ensure a smooth user experience.

-

Is airSlate SignNow compliant with IRS regulations for the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

Yes, airSlate SignNow is designed to comply with all IRS regulations related to e-signatures and form submissions. When using our platform for the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I, you can trust that your submissions will meet required compliance standards.

-

What benefits can I expect from using airSlate SignNow for tax-related documents like the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

Using airSlate SignNow for tax-related documents like the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I enhances efficiency and reduces processing time. Our platform provides a user-friendly interface, enabling quick access to necessary forms and ensuring a smooth filing process.

-

Can I integrate airSlate SignNow with other software for managing the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions that help manage your documents effectively. This means you can easily incorporate the 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I into your existing workflows for better efficiency.

Get more for 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

Find out other 1545 1504 Department Of The Treasury Internal Revenue Service Application For Taxpayer Assistance Order ATAO Section I

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed