Form 8804 Fill in Version Annual Return for Partnership Withholding Tax Section 1446

What is Form 8804?

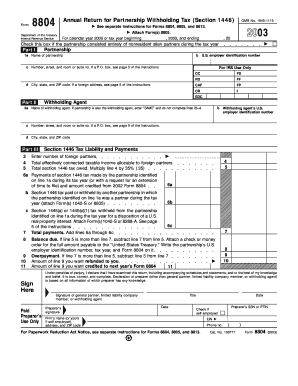

Form 8804, officially known as the Annual Return for Partnership Withholding Tax (Section 1446), is a tax document used by partnerships to report and pay withholding tax on effectively connected income allocable to foreign partners. This form is essential for partnerships that have foreign partners and are required to withhold taxes on their behalf. The withholding tax ensures that the IRS collects tax revenue from non-resident aliens who earn income in the United States, thereby maintaining compliance with U.S. tax laws.

Key Elements of Form 8804

Form 8804 includes several important sections that partnerships must complete accurately. Key elements include:

- Part I: Identification of the partnership, including name, address, and Employer Identification Number (EIN).

- Part II: Reporting of the total effectively connected income and the amount of tax withheld.

- Part III: Calculation of the total tax due and any payments made during the year.

- Signature Section: Certification by an authorized partner or representative.

Steps to Complete Form 8804

Completing Form 8804 involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary documentation, including financial statements and partner information.

- Fill out Part I with the partnership's identifying information.

- Calculate the effectively connected income and the corresponding withholding tax in Part II.

- Complete Part III to summarize total tax due and any payments made.

- Review the form for accuracy, ensuring all calculations are correct.

- Sign and date the form in the designated area.

Filing Deadlines for Form 8804

Partnerships must file Form 8804 by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15. It is crucial to adhere to this deadline to avoid penalties and ensure compliance with IRS regulations.

Legal Use of Form 8804

The legal use of Form 8804 is mandated by U.S. tax law for partnerships with foreign partners. Failure to file this form or to withhold the appropriate taxes can result in significant penalties. Partnerships must understand their obligations under Section 1446 of the Internal Revenue Code to avoid legal repercussions and ensure that they fulfill their tax responsibilities.

How to Obtain Form 8804

Form 8804 can be obtained directly from the IRS website, where it is available for download in PDF format. Partnerships may also request a paper copy by contacting the IRS directly. It is important to ensure that the most current version of the form is used to comply with the latest tax regulations.

Quick guide on how to complete form 8804 fill in version annual return for partnership withholding tax section 1446

Effortlessly prepare Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446 on any device

Digital document management has become increasingly favored by companies and individuals. It offers a fantastic eco-conscious alternative to conventional printed and signed materials, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446 on any device using airSlate SignNow apps for Android or iOS, and enhance any document-based task today.

The simplest way to edit and eSign Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446 with ease

- Locate Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important areas of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446 and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8804 fill in version annual return for partnership withholding tax section 1446

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8804 and who needs it?

Form 8804 is a U.S. tax form used by partnerships to report and pay the withholding tax on effectively connected income allocable to foreign partners. Businesses with foreign partners must file Form 8804 to comply with IRS regulations and ensure tax obligations are met.

-

How does airSlate SignNow help with filing Form 8804?

airSlate SignNow simplifies the process of managing Form 8804 by allowing users to collect eSignatures quickly and securely. This streamlines the agreement process and ensures that all necessary signatures are obtained, making it easier to file Form 8804 on time.

-

Is there a cost associated with using airSlate SignNow for Form 8804?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there may be a subscription fee, the service ultimately saves time and resources when handling Form 8804, making it a cost-effective solution for businesses.

-

What features of airSlate SignNow support Form 8804 submission?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the usability of Form 8804, ensuring that the process is efficient from start to finish.

-

Can airSlate SignNow integrate with accounting software for Form 8804?

Yes, airSlate SignNow offers integrations with popular accounting software, facilitating the smooth submission of Form 8804. This integration helps ensure that financial data is consistent and easily accessible, particularly when preparing tax documents.

-

What are the benefits of using airSlate SignNow for Form 8804?

Using airSlate SignNow for Form 8804 streamlines the signing process and reduces the likelihood of delays. Customers benefit from a user-friendly platform that minimizes administrative burdens and accelerates compliance with IRS requirements.

-

How secure is airSlate SignNow when handling Form 8804?

airSlate SignNow prioritizes security by using industry-standard encryption and secure data storage. This ensures that any sensitive information related to Form 8804 is protected throughout the signing and submission process.

Get more for Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446

- Provider referral bform requestb for pre bb

- Green gas lucknow online registration form

- Community helpers word jumble church forms

- New patient intake form all for kids pediatric therapy

- Form 4400 wdnr

- Soccer player contract template form

- Renewal agreement template form

- Renewal of tenancy agreement template form

Find out other Form 8804 Fill in Version Annual Return For Partnership Withholding Tax Section 1446

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online