Form 13 Employees Provident Fund Organisation, Regional Office 2022-2026

What is the Form 13 Employees Provident Fund Organisation, Regional Office

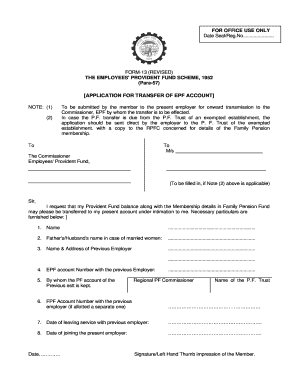

The Form 13 is a crucial document under the Employees Provident Fund Organisation (EPFO) that facilitates the transfer of provident fund balances from one account to another. This form is primarily used when an employee changes jobs and wishes to transfer their accumulated provident fund savings to their new employer's provident fund account. The form ensures that the employee's contributions and interest earned are seamlessly moved, maintaining the continuity of their retirement savings.

Steps to complete the Form 13 Employees Provident Fund Organisation, Regional Office

Completing the Form 13 involves several steps to ensure accuracy and compliance with EPFO regulations. Follow these steps:

- Gather necessary information, including your EPF account details, new employer's EPF account number, and personal identification.

- Fill in the required fields in the form, ensuring that all information matches your official documents to avoid delays.

- Sign the form, confirming that the information provided is accurate and that you authorize the transfer of funds.

- Submit the completed form to your current employer for verification and subsequent submission to the EPFO.

Legal use of the Form 13 Employees Provident Fund Organisation, Regional Office

The Form 13 is legally binding when filled out correctly and submitted through the appropriate channels. It is essential to ensure that all details are accurate to prevent any legal issues or delays in the transfer process. The form must be signed by both the employee and the employer, confirming that the transfer of funds is authorized. Adhering to EPFO guidelines and maintaining compliance with relevant laws is crucial for the legal validity of the form.

Required Documents

To successfully complete and submit Form 13, certain documents are required. These include:

- A copy of your previous EPF account statement.

- Your new employer's EPF registration number.

- Proof of identity, such as a government-issued ID or passport.

- Any additional documents requested by your employer to facilitate the transfer.

Form Submission Methods (Online / Mail / In-Person)

Form 13 can be submitted through various methods, depending on your employer's processes and EPFO guidelines. Common submission methods include:

- Online: Many employers allow electronic submission of Form 13 through their HR portals, streamlining the process.

- Mail: You may also send the completed form via postal service to your employer or directly to the EPFO office.

- In-Person: Submitting the form in person at your employer's HR department or the EPFO office is another option.

Eligibility Criteria

To use Form 13, employees must meet specific eligibility criteria. These criteria typically include:

- Being a member of the Employees Provident Fund.

- Having a valid EPF account with a previous employer.

- Changing employment and joining a new organization that is also registered under the EPF scheme.

Quick guide on how to complete form 13 employees provident fund organisation regional office

Complete Form 13 Employees Provident Fund Organisation, Regional Office effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without any delays. Manage Form 13 Employees Provident Fund Organisation, Regional Office on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 13 Employees Provident Fund Organisation, Regional Office with ease

- Locate Form 13 Employees Provident Fund Organisation, Regional Office and click on Get Form to initiate.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 13 Employees Provident Fund Organisation, Regional Office and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13 employees provident fund organisation regional office

Create this form in 5 minutes!

How to create an eSignature for the form 13 employees provident fund organisation regional office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the provident fund scheme 1952 form 13?

The provident fund scheme 1952 form 13 is used for transferring an employee's Provident Fund (PF) balance from one account to another. This form facilitates seamless migration when an employee changes jobs, ensuring that their retirement savings continue to grow without disruption.

-

How do I fill out the provident fund scheme 1952 form 13?

Filling out the provident fund scheme 1952 form 13 requires basic details such as your PF number, name, and the details of both your previous and current employers. Ensure all information is accurate to avoid processing delays, and consider using eSignature tools like airSlate SignNow for ease of use.

-

Are there any fees associated with the provident fund scheme 1952 form 13?

Generally, there are no fees for submitting the provident fund scheme 1952 form 13. However, it is advisable to check with your employer or the EPFO for any specific charges that might apply to your situation. Utilizing airSlate SignNow can help eliminate costs associated with printing and mailing the form.

-

What are the benefits of using airSlate SignNow for the provident fund scheme 1952 form 13?

Using airSlate SignNow for the provident fund scheme 1952 form 13 ensures a streamlined, efficient process. You can eSign documents securely, access them from anywhere, and reduce processing time signNowly. This convenience allows you to focus on other aspects of your job transition.

-

Can I integrate airSlate SignNow with other tools for my provident fund scheme 1952 form 13?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms to enhance your workflow. This means you can link your HR software or document management systems to easily handle the provident fund scheme 1952 form 13 and other essential documents.

-

How long does it take to process the provident fund scheme 1952 form 13?

The processing time for the provident fund scheme 1952 form 13 varies, typically taking about 7 to 15 days. By submitting the form electronically through airSlate SignNow, you might expedite the process, allowing you to access your funds sooner.

-

Where can I find the provident fund scheme 1952 form 13?

The provident fund scheme 1952 form 13 can be obtained directly from the EPFO website or through your employer's HR department. To enhance your experience, you can use airSlate SignNow to fill out and eSign the form online for added convenience.

Get more for Form 13 Employees Provident Fund Organisation, Regional Office

- Short term disability claim form mutual of omaha

- At imt 1971 fillable form

- Forsyth county self work affidavit form

- Cola wars continue coke and pepsi in pdf form

- Cd 405 corporation tax return form

- Guarantee of title form fill out and sign printable pdf

- High school student information sheet the foundation for tfec

- Noncompete agreement template form

Find out other Form 13 Employees Provident Fund Organisation, Regional Office

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast