Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

What is the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

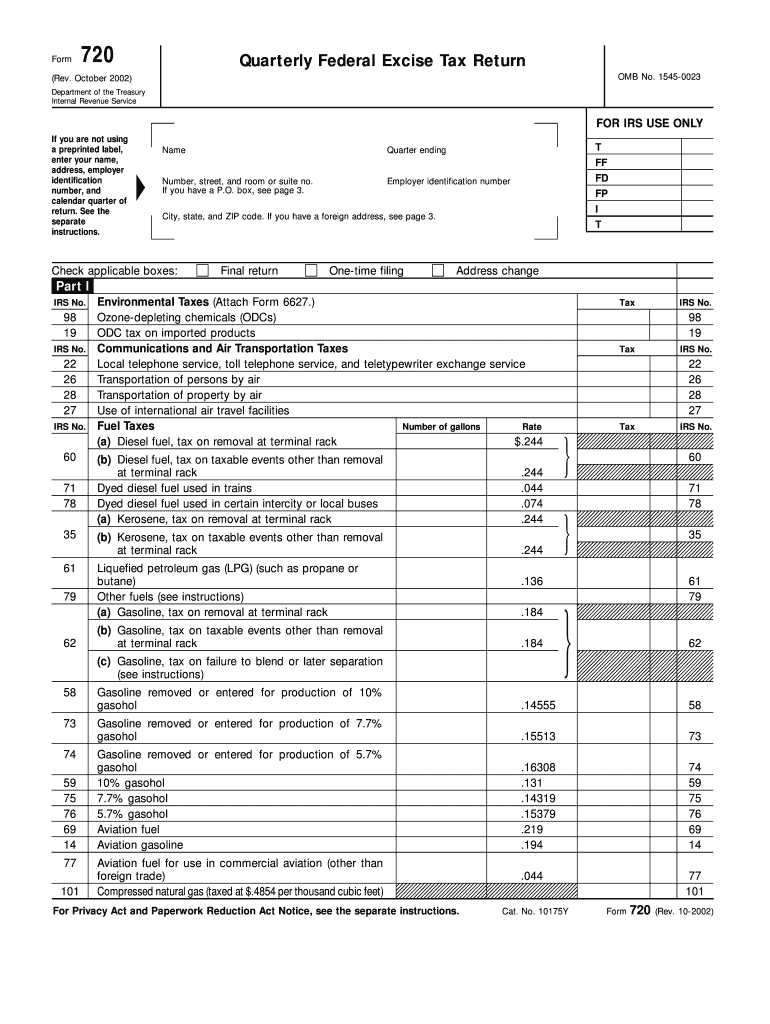

The Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return is a tax form used by businesses to report and pay federal excise taxes. This form is essential for entities that manufacture or sell certain products, such as fuel, tobacco, and alcohol, or provide specific services subject to excise tax. It allows taxpayers to report taxable activities on a quarterly basis, ensuring compliance with federal tax regulations.

How to use the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

To use the Form 720, taxpayers must first determine their eligibility and the specific excise taxes applicable to their business activities. The form must be filled out accurately, providing details about the types of products or services sold, the quantity, and the corresponding tax amounts. After completing the form, it should be submitted to the IRS by the designated deadline, either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

Completing the Form 720 involves several key steps:

- Gather necessary information, including business details, product or service descriptions, and sales figures.

- Access the latest version of the form from the IRS website or other reliable sources.

- Fill in the required sections, ensuring accuracy in reporting taxable amounts and calculations.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline, ensuring that payment for any owed taxes is included if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 are typically set on a quarterly basis. Taxpayers should be aware of the following important dates:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

It is crucial to file on time to avoid penalties and interest on any unpaid taxes.

Key elements of the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

The Form 720 contains several key elements that are important for accurate reporting:

- Identification information for the taxpayer, including name, address, and Employer Identification Number (EIN).

- Sections for reporting different types of excise taxes, categorized by product or service.

- Calculations for total taxable amounts and the corresponding tax owed.

- Signature and date fields to certify the accuracy of the information provided.

Penalties for Non-Compliance

Failure to file the Form 720 or to pay the required excise taxes can result in significant penalties. These may include:

- Late filing penalties, which can accumulate based on the length of delay.

- Interest on unpaid taxes, calculated from the due date until payment is made.

- Potential legal action for continued non-compliance, which could lead to further financial repercussions.

It is important for businesses to stay informed and compliant to avoid these issues.

Quick guide on how to complete form 720 rev october fill in version quarterly federal excise tax return

Complete [SKS] effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight essential parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure seamless communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev october fill in version quarterly federal excise tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return?

The Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return is a tax form used by businesses to report and pay federal excise taxes. This form is essential for accurately tracking taxes owed on various goods and services. Utilizing the airSlate SignNow platform can streamline the process of filling and submitting this important tax document.

-

How can airSlate SignNow help me with the Form 720 Rev October Fill in Version?

airSlate SignNow provides a user-friendly solution for companies to easily fill out and eSign the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return. With our intuitive design, you can complete and submit your taxes efficiently while ensuring compliance with federal regulations. Plus, our platform helps reduce errors and save time during tax season.

-

What features should I look for in software for the Form 720 Rev October Fill in Version?

When choosing software for the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return, look for features such as easy document editing, eSigning capabilities, and automated reminders for submission deadlines. airSlate SignNow offers all these features, ensuring that your tax reporting process is efficient and compliant with IRS regulations. Additionally, you should consider integrations with accounting software for seamless data transfer.

-

Is there a cost associated with using airSlate SignNow for Form 720 Rev October Fill in Version?

Yes, there is a cost associated with using airSlate SignNow for the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return. However, our pricing is competitive and offers various plans to suit different business needs. Investing in our solution can lead to cost savings over time by reducing errors and speeding up your tax preparation process.

-

What are the benefits of using airSlate SignNow for my tax forms?

Using airSlate SignNow for your tax forms, including the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return, offers signNow benefits. Our platform enhances collaboration with team members and clients through easy eSigning and document sharing. Additionally, you'll gain peace of mind knowing that your forms are secure and can be tracked throughout the submission process.

-

Can I integrate airSlate SignNow with my existing systems for Form 720 Rev October Fill in Version?

Yes, airSlate SignNow seamlessly integrates with various existing systems, allowing you to manage the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return within your current workflow. Whether you're using accounting software or CRM platforms, our integrations help maintain data accuracy and reduce manual entry. This connectivity ensures a smoother overall process for your tax reporting.

-

How can I ensure I am compliant when submitting the Form 720 Rev October Fill in Version?

To ensure compliance when submitting the Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return, utilize airSlate SignNow’s built-in features, which provide guidance on required fields and deadlines. Our platform is designed to help you stay updated with the latest IRS requirements, reducing the risk of errors that could lead to penalties. Regular review of the submitted forms also plays a key role in compliance.

Get more for Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

Find out other Form 720 Rev October Fill in Version Quarterly Federal Excise Tax Return

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF