Florida Dr97 2017-2026

What is the Florida DR-97?

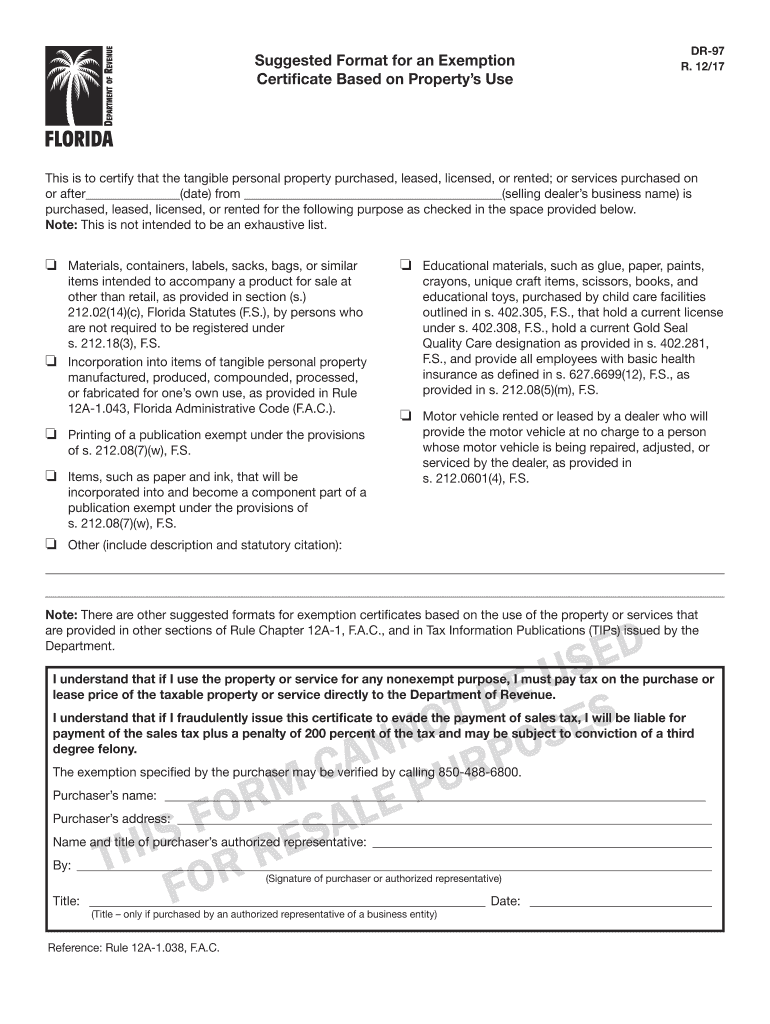

The Florida DR-97 is a tax exemption form used by businesses and organizations in Florida to claim sales tax exemptions. This form is essential for entities that qualify for tax-exempt status, allowing them to make purchases without paying sales tax. The DR-97 is particularly relevant for non-profit organizations, government entities, and certain educational institutions. By completing this form, eligible entities can demonstrate their tax-exempt status to vendors, ensuring compliance with state tax regulations.

How to use the Florida DR-97

To effectively use the Florida DR-97, eligible organizations must first complete the form accurately. This involves providing necessary information such as the entity's name, address, and tax-exempt number. Once filled out, the form should be presented to vendors at the time of purchase. Vendors may retain a copy of the DR-97 for their records to validate the tax-exempt transaction. It is important to ensure that the form is used only for qualifying purchases to maintain compliance with Florida tax laws.

Steps to complete the Florida DR-97

Completing the Florida DR-97 involves several key steps:

- Obtain the form: Access the Florida DR-97 from the Florida Department of Revenue website or through authorized channels.

- Fill in the required information: Provide details such as the organization’s name, address, and tax-exempt number.

- Specify the type of exemption: Indicate the reason for the tax exemption, ensuring it aligns with the organization’s status.

- Review the form: Double-check all entries for accuracy to avoid issues during transactions.

- Sign and date the form: Ensure that an authorized representative of the organization signs the form before presenting it to vendors.

Legal use of the Florida DR-97

The legal use of the Florida DR-97 is crucial for maintaining compliance with state tax laws. Organizations must ensure that they are genuinely eligible for tax-exempt status before using this form. Misuse of the DR-97 can result in penalties, including back taxes and fines. It is advisable for organizations to keep documentation that supports their tax-exempt status in case of audits or inquiries from the Florida Department of Revenue.

Examples of using the Florida DR-97

Organizations can use the Florida DR-97 in various scenarios. For instance, a non-profit organization purchasing office supplies can present the DR-97 to avoid paying sales tax on those items. Similarly, a government agency may use the form when acquiring equipment for public use. Each instance must align with the qualifying criteria for tax exemption to ensure proper use of the form.

Eligibility Criteria

To qualify for using the Florida DR-97, organizations must meet specific eligibility criteria. Generally, this includes being a non-profit entity, a government agency, or an educational institution. The organization must also possess a valid tax-exempt number issued by the Florida Department of Revenue. It is important to review the full list of eligibility requirements to ensure compliance and avoid any potential issues when using the form.

Quick guide on how to complete tc 721 utah sales tax exemption certificate adesa

Your assistance manual on preparing your Florida Dr97

If you’re curious about how to finalize and submit your Florida Dr97, here are a few brief suggestions to make tax preparation simpler.

To start, you simply need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document management tool that allows you to modify, create, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to edit responses when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Florida Dr97 in just a few minutes:

- Create your profile and start working on PDFs in no time.

- Use our directory to find any IRS tax document; navigate through variations and schedules.

- Click Obtain form to access your Florida Dr97 in our editor.

- Complete the necessary fillable sections with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Keep in mind that filing by hand can lead to return inaccuracies and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct tc 721 utah sales tax exemption certificate adesa

Create this form in 5 minutes!

How to create an eSignature for the tc 721 utah sales tax exemption certificate adesa

How to create an electronic signature for your Tc 721 Utah Sales Tax Exemption Certificate Adesa in the online mode

How to make an electronic signature for your Tc 721 Utah Sales Tax Exemption Certificate Adesa in Chrome

How to make an electronic signature for signing the Tc 721 Utah Sales Tax Exemption Certificate Adesa in Gmail

How to generate an eSignature for the Tc 721 Utah Sales Tax Exemption Certificate Adesa straight from your mobile device

How to generate an eSignature for the Tc 721 Utah Sales Tax Exemption Certificate Adesa on iOS devices

How to create an electronic signature for the Tc 721 Utah Sales Tax Exemption Certificate Adesa on Android

People also ask

-

What is a tax exempt form Florida?

A tax exempt form Florida is a document used by organizations or individuals in Florida to claim exemption from sales tax on certain purchases. This form is essential for qualifying entities such as non-profit organizations and government agencies to avoid paying unnecessary sales tax on eligible items.

-

How can I obtain a tax exempt form Florida?

You can obtain a tax exempt form Florida from the Florida Department of Revenue's website or through your local county tax collector's office. Additionally, airSlate SignNow offers integrations that streamline the process of applying and managing your tax exempt forms efficiently.

-

Does airSlate SignNow support tax exempt form Florida management?

Yes, airSlate SignNow supports the management of tax exempt form Florida by allowing you to create, send, and eSign these forms quickly. This ensures that your organization can easily handle documentation without delays, making compliance seamless.

-

Is there a cost associated with using airSlate SignNow for tax exempt form Florida?

airSlate SignNow offers a cost-effective solution for managing tax exempt form Florida and includes various pricing plans to suit your needs. With different tiers, you can find an option that provides the features necessary for your organization's document management at a reasonable price.

-

What features does airSlate SignNow provide for tax exempt form Florida?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and easy collaboration for tax exempt form Florida. These tools help streamline the process of completing and filing forms, reducing the time spent on administrative tasks.

-

Can I integrate airSlate SignNow with other applications related to tax exempt form Florida?

Absolutely! airSlate SignNow offers integrations with various applications such as CRM and document management systems, which can help you manage your tax exempt form Florida more effectively. This enables your team to work seamlessly and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax exempt form Florida?

The benefits of using airSlate SignNow for tax exempt form Florida include enhanced document security, faster processing times, and the ability to easily track form submissions. By digitizing your workflows, you can save time and reduce the risk of errors associated with paper-based forms.

Get more for Florida Dr97

- Mean and standard deviation distributions independent practice worksheet answers form

- Sled background check form

- Nys supreme court order to show cause forms for queens county

- Specimen de signature form

- Doctor confirmation letter form

- Foundation check request lsu form

- Sample motion to seal record ohio form

- Plumbing permit application city of indianapolis indy form

Find out other Florida Dr97

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple