Form Department of the Treasury Internal Revenue Service 1040A Label See Page 21

What is the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

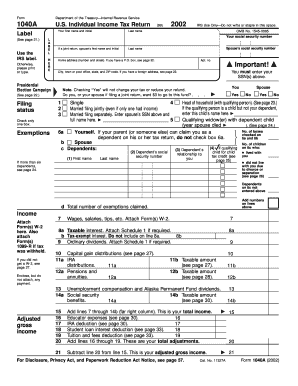

The Form Department Of The Treasury Internal Revenue Service 1040A is a simplified version of the standard tax return form used by individual taxpayers in the United States. This form is designed for those with straightforward tax situations, allowing for the reporting of income, adjustments, and tax credits. The label on this form, which directs users to see page 21, typically contains important instructions or additional information that is crucial for accurate completion. It is essential for taxpayers to understand the specific requirements and guidelines associated with this form to ensure compliance with IRS regulations.

How to use the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

Using the Form 1040A involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions provided on the form, paying close attention to the label that refers to page 21. This page may contain specific guidelines or examples that clarify how to report certain types of income or claim deductions. Completing the form accurately is crucial, as errors can lead to delays in processing or potential penalties.

Steps to complete the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

Completing the Form 1040A involves a systematic approach. Start by entering your personal information, including your name, address, and Social Security number. Next, report your income by filling in the appropriate lines with figures from your financial documents. Be sure to consult the label that directs you to page 21 for any specific instructions regarding income reporting or deductions. After entering all necessary information, review the form for accuracy before submitting it. Double-checking your entries can help avoid common mistakes that may lead to complications with the IRS.

Key elements of the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

The Form 1040A includes several key elements that are important for taxpayers to understand. These elements typically include sections for reporting income, claiming deductions, and calculating tax liability. The label directing users to page 21 may highlight particular items that require special attention, such as specific tax credits or adjustments. Understanding these key components is essential for ensuring that the form is filled out correctly and that all eligible deductions and credits are claimed.

Legal use of the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

The legal use of the Form 1040A is governed by IRS regulations, which dictate who is eligible to use this simplified tax return form. Generally, individuals with a taxable income below a certain threshold, who do not have complex tax situations, can utilize this form. The label indicating page 21 may provide additional legal context or stipulations that must be adhered to when completing the form. It is important for taxpayers to ensure that they meet the eligibility criteria to avoid issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040A are typically aligned with the standard tax filing dates set by the IRS. Generally, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these deadlines to avoid late filing penalties. The label on the form may also reference any specific dates related to extensions or other important filing information.

Quick guide on how to complete form department of the treasury internal revenue service 1040a label see page 21

Accomplish [SKS] effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and streamline any document-oriented task today.

The simplest way to modify and eSign [SKS] without stress

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of the documents or obscure confidential information with tools provided by airSlate SignNow for that specific need.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal authority as a traditional ink signature.

- Review the information and then click the Done button to finalize your edits.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form retrieval, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

Create this form in 5 minutes!

How to create an eSignature for the form department of the treasury internal revenue service 1040a label see page 21

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21, and why is it important?

The Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21 provides essential information for taxpayers filing their 1040A tax returns. This specific label guides users through certain criteria and requirements laid out by the IRS, ensuring accurate filings. It's crucial for maintaining compliance and avoiding potential penalties.

-

How can airSlate SignNow assist with completing the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21?

airSlate SignNow offers a user-friendly eSignature and document management platform that simplifies the completion and submission of the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21. Users can fill out required fields electronically, ensuring all necessary information is captured accurately and efficiently. Additionally, the platform keeps your documents organized for easy access.

-

What features does airSlate SignNow provide to enhance the signing process for the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21?

With airSlate SignNow, you gain access to features like advanced eSignature tools, document templates, and real-time tracking. These functionalities ensure that the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21 is signed promptly and securely. Furthermore, the drag-and-drop interface makes it easy to customize your signing experience.

-

Is airSlate SignNow compatible with other applications for filing the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21?

Yes, airSlate SignNow integrates seamlessly with various software applications, including accounting platforms and CRM systems. This compatibility allows users to streamline workflows related to the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21. By integrating with existing tools, you can improve efficiency and maintain organized records.

-

What is the pricing structure for using airSlate SignNow for the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, starting with a free trial option. The plans are designed to be cost-effective while providing full access to features required for managing the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21. By choosing airSlate SignNow, you ensure high-quality service at a competitive price.

-

Can airSlate SignNow help me track the status of my Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21 in real-time. You will receive notifications when the document is viewed or signed, ensuring you stay informed throughout the process.

-

What support does airSlate SignNow offer for issues related to the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21?

airSlate SignNow provides comprehensive customer support, including a knowledge base, live chat, and email assistance. If you encounter any challenges while completing the Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21, our dedicated support team is here to help. We aim to ensure that your experience is smooth and hassle-free.

Get more for Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

Find out other Form Department Of The Treasury Internal Revenue Service 1040A Label See Page 21

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile