Form 990 Schedule A, Fill in Version Organization Exempt under Section 501c3

What is the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

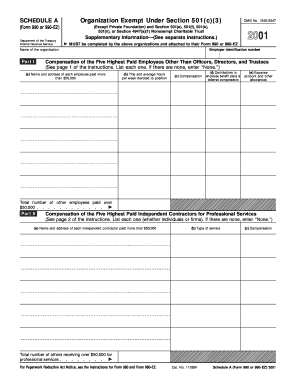

The Form 990 Schedule A is a crucial document for organizations that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code. This form provides detailed information about the organization’s public charity status and its eligibility for tax-exempt status. It is a supplemental form that must be filed alongside the main Form 990, which is the annual return for tax-exempt organizations. Schedule A helps the IRS determine whether the organization meets the requirements to maintain its tax-exempt status and provides transparency to the public regarding its operations and funding sources.

How to use the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

Using the Form 990 Schedule A involves several steps that ensure accurate reporting of an organization’s financial activities and compliance with IRS regulations. Organizations must first gather relevant financial data, including income, expenditures, and contributions. Once the necessary information is compiled, the organization can begin filling out the form. Each section of the Schedule A must be completed carefully, as it includes questions regarding the organization’s public support, operational activities, and governance. After completing the form, it should be reviewed for accuracy before submission with the main Form 990.

Steps to complete the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

Completing the Form 990 Schedule A requires a systematic approach. Here are the key steps:

- Gather documentation: Collect financial statements, donor records, and any other relevant documents.

- Fill out the identification section: Include the organization’s name, address, and Employer Identification Number (EIN).

- Complete the public support section: Report on the organization’s contributions and revenue sources to demonstrate public support.

- Answer operational questions: Provide details about the organization’s activities, governance, and compliance with IRS regulations.

- Review the completed form: Ensure all information is accurate and complete before submission.

- Submit with Form 990: File the completed Schedule A along with the main Form 990 by the designated deadline.

Legal use of the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

The legal use of Form 990 Schedule A is essential for maintaining compliance with federal tax laws. Organizations that fail to file this form may jeopardize their tax-exempt status. The form serves as a declaration of the organization’s financial integrity and transparency, which is vital for public trust and donor confidence. Furthermore, accurate reporting on Schedule A helps organizations avoid penalties and ensures they meet the requirements set forth by the IRS for 501(c)(3) entities.

Key elements of the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

Several key elements are integral to the Form 990 Schedule A. These include:

- Public support test: This section assesses the organization’s reliance on public contributions and grants.

- Operational activities: Organizations must detail their primary activities and how they align with their exempt purpose.

- Governance structure: Information about the board of directors and organizational policies must be included.

- Financial reporting: Accurate financial data is crucial for demonstrating compliance and transparency.

Filing Deadlines / Important Dates

Filing deadlines for Form 990 Schedule A are aligned with the main Form 990 submission. Generally, organizations must file their returns by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a May fifteenth deadline. Extensions may be requested, but it is important to ensure that all forms are submitted timely to avoid penalties and maintain tax-exempt status.

Quick guide on how to complete form 990 schedule a fill in version organization exempt under section 501c3

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule a fill in version organization exempt under section 501c3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3?

The Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3 is a part of the IRS documentation that nonprofits must complete to maintain their tax-exempt status. This form provides necessary information about the organization’s eligibility and financial operations as required by the 501(c)(3) classification.

-

How can airSlate SignNow help with the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3?

airSlate SignNow simplifies the process of filling out and signing the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3. With our platform, organizations can easily collaborate, edit, and eSign documents, ensuring that all necessary information is accurately captured and securely submitted.

-

What features does airSlate SignNow offer for managing the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3?

airSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures that are vital for managing the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3. These tools ensure efficiency and compliance in completing your nonprofit's documentation.

-

Is there a pricing plan available for using airSlate SignNow for Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3?

Yes, airSlate SignNow provides flexible pricing plans that cater to nonprofits needing to fill out the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3. Our cost-effective solutions ensure that organizations of all sizes can access the tools necessary for efficient document management.

-

Can airSlate SignNow integrate with other tools I use for Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3?

Absolutely! airSlate SignNow supports integration with various accounting and document management software, enhancing your workflow for the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3. This means you can connect and streamline your operations for seamless data exchange.

-

What are the benefits of using airSlate SignNow for nonprofit organizations?

Using airSlate SignNow helps nonprofit organizations easily complete and eSign important documents like the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3. Our platform increases productivity by automating the document flow, thus freeing up valuable time for other critical tasks.

-

How secure is the airSlate SignNow platform for handling Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3?

airSlate SignNow prioritizes the security of your documents, including the Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3. We employ advanced encryption and comply with industry standards to ensure that your sensitive information remains protected throughout the entire process.

Get more for Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

- Dir form a 1 131 instructions

- Flexible spending account fsa data collection worksheet benefits form

- Student registration form naui national association of

- Executive director39s annual performance review nadoorg nado

- Screm form

- Kinecta skip a payment form

- Samples of iaq plans form

- Wedding registration form

Find out other Form 990 Schedule A, Fill in Version Organization Exempt Under Section 501c3

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe