Form 7004 Rev October , Fill in Version Application for Automatic Extension of Time to File Corporation Income Tax Return

What is the Form 7004 Rev October, Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return

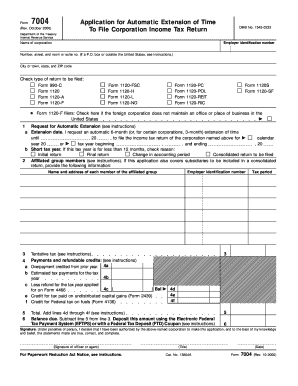

The Form 7004 Rev October is an official document used by corporations to request an automatic extension of time to file their income tax returns. This form is essential for businesses that need additional time beyond the standard filing deadline to prepare and submit their tax returns. By filing Form 7004, corporations can extend their filing deadline by up to six months, allowing them to ensure accuracy in their tax submissions without incurring penalties for late filing.

How to use the Form 7004 Rev October, Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return

Using Form 7004 involves a straightforward process. Corporations must complete the form with accurate information, including their name, address, and Employer Identification Number (EIN). Once the form is filled out, it can be submitted electronically or mailed to the appropriate IRS address. It is important to note that the extension granted by this form does not extend the time to pay any taxes owed; corporations must ensure that any estimated tax payments are made by the original due date to avoid penalties.

Steps to complete the Form 7004 Rev October, Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return

Completing Form 7004 requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your corporation's name, address, and EIN.

- Indicate the type of return for which you are requesting an extension.

- Provide the estimated tax liability for the year, if applicable.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form electronically via IRS e-file or mail it to the designated IRS address.

Filing Deadlines / Important Dates

Corporations must be aware of critical deadlines when filing Form 7004. The form should be submitted by the original due date of the corporation's tax return. For most corporations, this date is typically the fifteenth day of the fourth month following the end of the tax year. For calendar year corporations, this means the deadline is April 15. Failing to file by this deadline may result in penalties, so timely submission is crucial.

Penalties for Non-Compliance

Failure to file Form 7004 by the deadline can lead to significant penalties for corporations. If a corporation does not file its tax return on time, it may incur a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, if the corporation fails to pay the amount owed by the original due date, interest will accrue on the unpaid balance. Therefore, it is essential for corporations to utilize Form 7004 to avoid these penalties.

Eligibility Criteria

Eligibility to use Form 7004 is primarily determined by the type of business entity. Corporations, including C corporations and S corporations, can file this form to request an extension. However, certain entities, such as partnerships and sole proprietorships, must use different forms to request extensions. It is vital for businesses to ensure they meet the eligibility requirements before submitting Form 7004 to avoid complications in the extension process.

Quick guide on how to complete form 7004 rev october fill in version application for automatic extension of time to file corporation income tax return

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, amend, and eSign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to amend and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 7004 Rev October , Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 7004 rev october fill in version application for automatic extension of time to file corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 7004 Rev October, Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return?

The Form 7004 Rev October is a simplified application used by corporations to request an automatic extension for filing their income tax return. By using the Fill in Version of this form, businesses can ensure they provide all necessary information accurately, thus streamlining the extension process.

-

How can airSlate SignNow help with submitting Form 7004 Rev October?

airSlate SignNow enables businesses to complete and eSign the Form 7004 Rev October digitally, making the submission process quick and hassle-free. Our platform ensures that your application is securely submitted to the IRS, reducing the risk of errors that can occur with traditional paperwork.

-

What are the benefits of using the Fill in Version of Form 7004 Rev October?

Using the Fill in Version of the Form 7004 Rev October allows for clearer data entry, which minimizes mistakes during submission. Additionally, this version is designed for easy completion on digital platforms, helping speed up the process of requesting your corporate tax extension.

-

Is there a cost associated with submitting Form 7004 Rev October through airSlate SignNow?

Yes, airSlate SignNow offers affordable pricing plans that include features for submitting the Form 7004 Rev October. By investing in our solution, businesses gain access to a comprehensive suite of tools for document management and eSigning, which can save time and resources.

-

What features does airSlate SignNow provide for Form 7004 Rev October?

airSlate SignNow offers numerous features for processing the Form 7004 Rev October, including customizable templates, secure eSigning, and document tracking. These tools enhance user experience and provide peace of mind that your application is handled professionally and securely.

-

Can I integrate airSlate SignNow with other software for managing Form 7004 Rev October?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage the Form 7004 Rev October and other tax-related documents. This integration minimizes data re-entry and enhances your workflow efficiency.

-

How do I ensure the security of my Form 7004 Rev October when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies and comply with industry standards to ensure that your Form 7004 Rev October and other sensitive documents are securely stored and transmitted, protecting your business information.

Get more for Form 7004 Rev October , Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return

Find out other Form 7004 Rev October , Fill in Version Application For Automatic Extension Of Time To File Corporation Income Tax Return

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word