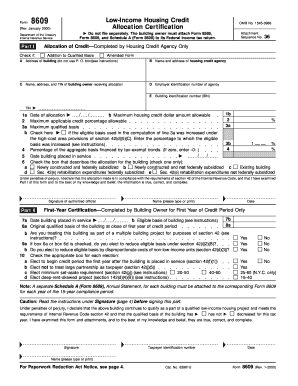

Form 8609 Rev January , Fill in Version Low Income Housing Credit Allocation Certification

What is the Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification

The Form 8609 Rev January is a crucial document used in the context of the Low Income Housing Tax Credit (LIHTC) program. This form serves as the Allocation Certification for properties that qualify for low-income housing credits. It is utilized by owners of qualified low-income housing projects to establish eligibility for tax credits, which can significantly reduce their federal tax liability. The form is essential for ensuring compliance with IRS regulations and for maintaining the integrity of the LIHTC program.

How to use the Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification

Using the Form 8609 involves several steps to ensure accurate completion. Property owners must fill out the form to certify the allocation of low-income housing credits for their projects. This includes providing information about the property, the number of units, and the income levels of tenants. Once completed, the form must be submitted to the appropriate state housing agency or the IRS, depending on the specific requirements of the project. It is important to follow the instructions carefully to avoid delays or issues with tax credit allocation.

Steps to complete the Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification

Completing the Form 8609 requires careful attention to detail. The following steps outline the process:

- Gather necessary documentation, including property information and tenant income details.

- Fill in the property name, address, and other identifying information in the designated sections of the form.

- Indicate the number of low-income units and the applicable income limits for tenants.

- Ensure that all calculations regarding the tax credit allocation are accurate and reflect the current tax laws.

- Review the completed form for any errors or omissions before submission.

Legal use of the Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification

The legal use of Form 8609 is governed by IRS regulations pertaining to the Low Income Housing Tax Credit program. This form must be used by property owners to certify their eligibility for tax credits, which are intended to encourage the development of affordable housing. Proper completion and submission of the form are essential to comply with federal tax laws and to avoid potential penalties. Misuse or incorrect information on the form can lead to disqualification from receiving tax credits.

Eligibility Criteria

To qualify for the Low Income Housing Tax Credit and to use Form 8609, certain eligibility criteria must be met. These include:

- The property must be designated for low-income housing and meet specific affordability requirements.

- At least twenty percent of the units must be occupied by tenants whose income does not exceed fifty percent of the area median income, or at least forty percent of the units must be occupied by tenants whose income does not exceed sixty percent of the area median income.

- The property must comply with all relevant local, state, and federal regulations regarding housing.

Filing Deadlines / Important Dates

Filing deadlines for Form 8609 are critical to ensure compliance with the LIHTC program. Typically, the form must be submitted to the appropriate state agency or the IRS by the end of the tax year in which the property is placed in service. It is advisable to check for any specific state deadlines or requirements that may differ from federal guidelines. Timely submission is essential to avoid penalties and ensure the allocation of tax credits.

Quick guide on how to complete form 8609 rev january fill in version low income housing credit allocation certification

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents efficiently without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form – via email, SMS, or an invitation link, or download it directly to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8609 Rev January , Fill in Version Low Income Housing Credit Allocation Certification

Create this form in 5 minutes!

How to create an eSignature for the form 8609 rev january fill in version low income housing credit allocation certification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification?

Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification is a tax form used by allocating agencies to designate low-income housing tax credits to developers. This form ensures compliance with IRS regulations and helps in the proper distribution of credits for affordable housing projects.

-

How can airSlate SignNow help with completing Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification?

airSlate SignNow offers streamlined functionality to easily fill out and eSign Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification. Our platform simplifies the completion process, allowing users to quickly input relevant information and securely send the form for signatures.

-

Are there any costs associated with using airSlate SignNow for Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification?

Yes, airSlate SignNow offers various pricing plans based on your needs. Our pricing is designed to be cost-effective, allowing you to manage and eSign important documents like Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification without breaking the bank.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides robust features such as customizable templates, document tracking, and seamless eSignature capabilities. These features enhance the management of important documents like Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification, making it easier for users to ensure accuracy and compliance.

-

Is it easy to integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers easy integration with various applications and tools that businesses use. This flexibility allows for the efficient handling of Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification documents alongside other processes, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification?

Using airSlate SignNow for Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification provides a secure, efficient, and legally binding way to complete your documentation. The platform ensures that your forms are filled out correctly and are sent for signatures quickly, reducing delays and improving compliance.

-

Can I access my signed Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification documents anytime?

Yes, airSlate SignNow offers cloud storage for all of your signed documents, including Form 8609 Rev January, Fill in Version Low Income Housing Credit Allocation Certification. You can access your documents at any time from anywhere, ensuring that important files are always within signNow.

Get more for Form 8609 Rev January , Fill in Version Low Income Housing Credit Allocation Certification

Find out other Form 8609 Rev January , Fill in Version Low Income Housing Credit Allocation Certification

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer