Form 3K 1 Partner's Massachusetts InformationTax Year 2020

What is the Form 3K 1 Partner's Massachusetts Information Tax Year

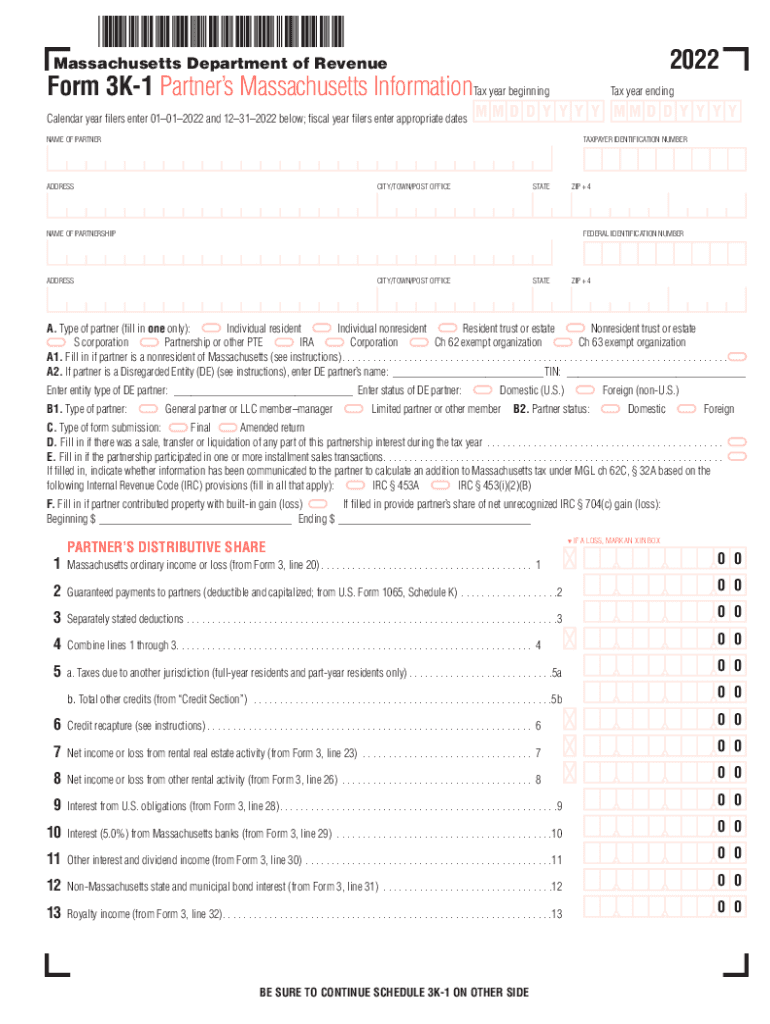

The Form 3K 1, officially known as the Partner's Massachusetts Information Tax Year, is a crucial document for partnerships operating in Massachusetts. This form provides essential information regarding each partner's share of income, deductions, and credits from the partnership. It is specifically designed to assist partners in reporting their respective shares on their individual tax returns. The information reported on the 3K 1 is derived from the partnership's overall tax return, ensuring accuracy and compliance with state tax regulations.

How to use the Form 3K 1 Partner's Massachusetts Information Tax Year

To effectively use the Form 3K 1, partners must first receive a copy from the partnership. This form details each partner's distributive share of income, losses, and other tax-related items. Partners should carefully review the information provided, ensuring it aligns with their records. When completing their individual Massachusetts tax returns, partners will need to incorporate the figures reported on the 3K 1. This ensures that all income and deductions are accurately reflected, facilitating compliance with state tax laws.

Steps to complete the Form 3K 1 Partner's Massachusetts Information Tax Year

Completing the Form 3K 1 involves several key steps:

- Receive the Form 3K 1 from the partnership.

- Review the information for accuracy, including your share of income and deductions.

- Use the figures from the 3K 1 to fill out your individual Massachusetts tax return.

- Ensure all entries are consistent with your personal tax records.

- Submit your tax return by the state deadline, including the information from the 3K 1.

Key elements of the Form 3K 1 Partner's Massachusetts Information Tax Year

The Form 3K 1 includes several key elements that partners should be aware of:

- Partner's Name and Address: Essential for identifying the partner receiving the form.

- Partnership's Name and Identification Number: Provides context regarding the source of the income.

- Distributive Share of Income: Details the amount of income allocated to the partner.

- Deductions and Credits: Lists any deductions or credits the partner is entitled to claim.

- Tax Year: Specifies the tax year for which the information is relevant.

Filing Deadlines / Important Dates

It is important for partners to be aware of the filing deadlines related to the Form 3K 1. Typically, the partnership must provide the 3K 1 to each partner by the federal tax return deadline, which is usually April fifteenth. Partners should ensure they receive this form in a timely manner to allow for accurate reporting on their individual returns. Additionally, partners must file their Massachusetts tax returns by the state’s deadline to avoid penalties.

Legal use of the Form 3K 1 Partner's Massachusetts Information Tax Year

The Form 3K 1 is legally required for partnerships operating in Massachusetts to report income distributions to their partners. Proper use of this form ensures compliance with state tax laws and allows partners to accurately report their income on individual tax returns. Failure to provide or accurately complete the 3K 1 can result in penalties for both the partnership and the individual partners, highlighting the importance of diligence in handling this document.

Quick guide on how to complete form 3k 1 partners massachusetts informationtax year

Complete Form 3K 1 Partner's Massachusetts InformationTax Year effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Form 3K 1 Partner's Massachusetts InformationTax Year on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Form 3K 1 Partner's Massachusetts InformationTax Year with ease

- Locate Form 3K 1 Partner's Massachusetts InformationTax Year and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 3K 1 Partner's Massachusetts InformationTax Year and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3k 1 partners massachusetts informationtax year

Create this form in 5 minutes!

How to create an eSignature for the form 3k 1 partners massachusetts informationtax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 Massachusetts Schedule 3K-1?

The 2019 Massachusetts Schedule 3K-1 is used by partnerships to report income, deductions, and credits applicable to each partner. This essential form allows businesses to ensure proper tax reporting and compliance in Massachusetts. Understanding this schedule is crucial for accurate tax preparation and can save partners from potential penalties.

-

How can airSlate SignNow help streamline filing for the 2019 Massachusetts Schedule 3K-1?

airSlate SignNow offers a user-friendly platform that simplifies the eSigning process for documents like the 2019 Massachusetts Schedule 3K-1. By allowing multiple signers in a secure environment, businesses can efficiently manage the approval and submission of tax forms. This saves time and enhances accuracy in the filing process.

-

What pricing options does airSlate SignNow offer for businesses needing to manage the 2019 Massachusetts Schedule 3K-1?

airSlate SignNow provides flexible pricing plans tailored to various business needs. Whether you are a small partnership or a large organization, there’s a plan that fits your budget while allowing you to manage documents like the 2019 Massachusetts Schedule 3K-1 effectively. Check the website for the latest pricing and offers.

-

What features does airSlate SignNow include for managing the 2019 Massachusetts Schedule 3K-1?

With airSlate SignNow, users benefit from features like customizable templates, automated workflows, and secure eSigning. These tools help businesses organize the documentation process for the 2019 Massachusetts Schedule 3K-1 and ensure that all essential information is captured accurately. This enhances overall productivity and compliance.

-

Are there integrations available with airSlate SignNow that can assist with the 2019 Massachusetts Schedule 3K-1?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management software. This allows users to sync their documents related to the 2019 Massachusetts Schedule 3K-1 effortlessly, streamlining processes and improving data accuracy. Integration helps ensure that all financial information is consolidated and easily accessible.

-

What are the benefits of using airSlate SignNow for the 2019 Massachusetts Schedule 3K-1?

Using airSlate SignNow for the 2019 Massachusetts Schedule 3K-1 provides numerous advantages, such as improved speed and accuracy in document handling. The platform's ease of use reduces administrative burdens, allowing teams to focus on core business tasks. Enhanced security features also protect sensitive information during the signing process.

-

How safe is my information when using airSlate SignNow for the 2019 Massachusetts Schedule 3K-1?

airSlate SignNow prioritizes user security, employing advanced encryption and data protection protocols. When handling documents like the 2019 Massachusetts Schedule 3K-1, you can feel confident that your sensitive information is safeguarded against unauthorized access. Compliance with industry standards is a key aspect of the platform.

Get more for Form 3K 1 Partner's Massachusetts InformationTax Year

Find out other Form 3K 1 Partner's Massachusetts InformationTax Year

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online