Form 8849 Schedule 4 Rev January , Fill in Version Sales by Gasoline Wholesale Distributors

What is the Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors

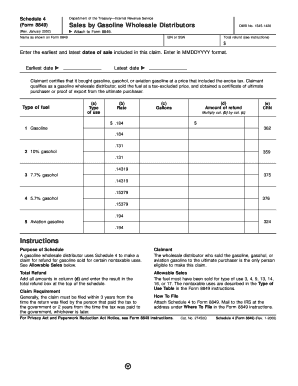

The Form 8849 Schedule 4 is a tax form used by gasoline wholesale distributors in the United States to report sales of gasoline. This form is part of the process for claiming refunds on federal excise taxes paid on gasoline that has been sold or used in specific ways. It is essential for businesses in the gasoline distribution industry to accurately complete this form to ensure compliance with IRS regulations and to receive any eligible refunds.

How to use the Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors

Using the Form 8849 Schedule 4 involves several steps. First, gather all necessary documentation related to your gasoline sales. This includes invoices, receipts, and any other relevant records. Next, fill out the form by providing details such as the quantity of gasoline sold, the total amount of excise tax paid, and any other required information. Once completed, the form can be submitted to the IRS either electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors

Completing the Form 8849 Schedule 4 requires careful attention to detail. Follow these steps:

- Begin by entering your business information, including name, address, and Employer Identification Number (EIN).

- Document the total gallons of gasoline sold during the reporting period.

- Calculate the total excise tax paid on these sales and enter the amount on the form.

- Provide any additional information required, such as the type of sales made and any exemptions applicable.

- Review the completed form for accuracy before submission.

Key elements of the Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors

The Form 8849 Schedule 4 includes several key elements that must be accurately reported. These elements consist of:

- Your business identification details, including the EIN.

- The total number of gallons of gasoline sold.

- The total amount of federal excise tax paid.

- Any applicable exemptions or special circumstances related to the sales.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 8849 Schedule 4. Typically, the form must be submitted by the end of the tax year in which the gasoline sales occurred. For most businesses, this means filing by April 15 of the following year. However, it's advisable to check the IRS guidelines for any specific dates or changes that may apply to your situation.

Penalties for Non-Compliance

Failure to accurately complete and submit the Form 8849 Schedule 4 can result in penalties imposed by the IRS. These penalties may include fines for late submissions, inaccuracies in reporting, or failure to file altogether. It is important for gasoline wholesale distributors to ensure compliance with all requirements to avoid these potential penalties and to maintain good standing with the IRS.

Quick guide on how to complete form 8849 schedule 4 rev january fill in version sales by gasoline wholesale distributors

Easily Prepare [SKS] on Any Device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to obtain the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Editing and eSigning [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Craft your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify your information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8849 Schedule 4 Rev January , Fill in Version Sales By Gasoline Wholesale Distributors

Create this form in 5 minutes!

How to create an eSignature for the form 8849 schedule 4 rev january fill in version sales by gasoline wholesale distributors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors?

Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors is a specialized IRS form used for claiming refunds for fuel taxes paid by wholesalers of gasoline. This form allows businesses to accurately report their fuel sales and claim refunds, ensuring compliance with tax regulations. Understanding how to fill this form correctly is crucial for maximizing your refunds.

-

How can airSlate SignNow assist with filling out Form 8849 Schedule 4?

airSlate SignNow streamlines the process of filling out Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors by providing an intuitive platform for document signing and management. Users can easily fill in necessary fields, sign, and send the form electronically. This not only saves time but also reduces the risk of errors.

-

What features does airSlate SignNow offer for managing Form 8849 Schedule 4?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure cloud storage for managing Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors. These features ensure that users can efficiently draft and share their tax forms with stakeholders while maintaining security and compliance.

-

Is airSlate SignNow a cost-effective solution for filling out tax forms like Form 8849 Schedule 4?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling documents like Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors. With affordable pricing plans and the ability to reduce paper-based processes, businesses can save both time and money in their document workflows.

-

Can airSlate SignNow integrate with other software for handling Form 8849 Schedule 4?

Absolutely! airSlate SignNow integrates with various accounting and tax preparation software, making it easier to manage Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors. These integrations help to sync data across platforms, enhancing the efficiency of your tax filing processes.

-

What are the benefits of using airSlate SignNow for Form 8849 Schedule 4?

Using airSlate SignNow for Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors offers several benefits, including ease of use, enhanced accuracy, and improved collaboration. The platform allows users to access their forms from anywhere, ensuring that all stakeholders can contribute and review documents at their convenience.

-

How secure is airSlate SignNow when handling sensitive documents like Form 8849 Schedule 4?

airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect sensitive information. When handling Form 8849 Schedule 4 Rev January, Fill in Version Sales By Gasoline Wholesale Distributors, users can trust that their data is safe and secure throughout the signing and submission process.

Get more for Form 8849 Schedule 4 Rev January , Fill in Version Sales By Gasoline Wholesale Distributors

Find out other Form 8849 Schedule 4 Rev January , Fill in Version Sales By Gasoline Wholesale Distributors

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online