Form W 7A Rev September , Fill in Version Application for Taxpayer Identification Number for Pending U S Adoptions

Understanding the Form W-7A for Taxpayer Identification Numbers

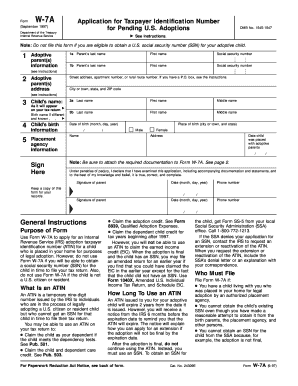

The Form W-7A, officially titled the Application for Taxpayer Identification Number for Pending U.S. Adoptions, is specifically designed for individuals seeking a taxpayer identification number (TIN) for children who are in the process of being adopted in the United States. This form is crucial for adoptive parents who need to fulfill tax obligations related to their adopted child, especially when claiming tax benefits or credits associated with adoption.

Steps to Complete the Form W-7A

Completing the Form W-7A involves several key steps:

- Gather necessary documentation, including proof of the child's identity and adoption status.

- Fill out the form accurately, providing all requested information such as the child's name, date of birth, and country of citizenship.

- Sign and date the form, ensuring that all information is correct to avoid delays.

- Submit the form along with required documentation to the appropriate IRS address, either by mail or in person.

Required Documents for Submission

When submitting the Form W-7A, certain documents must accompany the application to verify the child's identity and the adoption process. These documents typically include:

- A copy of the child's birth certificate.

- Legal documents confirming the adoption process, such as a court order or adoption decree.

- Proof of the adoptive parent's identity, such as a driver's license or passport.

Ensuring that all required documents are included will help facilitate a smoother processing of the application.

Filing Methods for Form W-7A

The Form W-7A can be submitted through various methods. The primary options include:

- Mailing the completed form and documentation to the IRS.

- Submitting the form in person at designated IRS offices.

It is important to check for any specific submission guidelines or addresses provided by the IRS to ensure proper handling of the application.

Eligibility Criteria for the Form W-7A

To be eligible to use the Form W-7A, the applicant must meet certain criteria. These include:

- The child must be in the process of being adopted within the United States.

- The adoptive parents must be U.S. citizens or residents.

- The application must be submitted for a child who does not already have a TIN.

Meeting these criteria is essential for a successful application process.

IRS Guidelines for Form W-7A

The IRS provides specific guidelines regarding the completion and submission of the Form W-7A. These guidelines include:

- Instructions on how to fill out each section of the form.

- Information on the types of documentation required for verification.

- Details on processing times and any potential follow-up needed.

Following the IRS guidelines carefully can help ensure that the application is processed efficiently and correctly.

Quick guide on how to complete form w 7a rev september fill in version application for taxpayer identification number for pending u s adoptions

Easily Set Up [SKS] on Any Device

Digital document management has gained immense traction among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without complications. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the document or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 7A Rev September , Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions

Create this form in 5 minutes!

How to create an eSignature for the form w 7a rev september fill in version application for taxpayer identification number for pending u s adoptions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 7A Rev September, Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions?

Form W 7A Rev September is a specific application form designed for individuals seeking a Taxpayer Identification Number (TIN) for pending U.S. adoptions. This fill-in version allows prospective parents to easily complete the required information online, streamlining the TIN application process.

-

How does airSlate SignNow assist with filling out Form W 7A Rev September?

airSlate SignNow provides an intuitive platform that simplifies the process of completing Form W 7A Rev September, Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions. Users can conveniently fill out the form online, ensuring all necessary information is accurately captured, thus reducing the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for Form W 7A Rev September?

Yes, airSlate SignNow offers competitive pricing for its services, which includes assistance with Form W 7A Rev September, Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions. Pricing plans are tailored to fit the needs of different users, from individuals to businesses, ensuring that everyone can access our user-friendly document signing solution.

-

What features does airSlate SignNow offer for completing Form W 7A Rev September?

airSlate SignNow includes various features to assist users with Form W 7A Rev September. These features include easy document editing, e-signature capabilities, secure cloud storage, and integration options, making the entire process seamless and efficient.

-

Can I store my Form W 7A Rev September on airSlate SignNow?

Absolutely! airSlate SignNow allows users to securely store completed forms, including the Form W 7A Rev September, Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions. This ensures that your important documents are easily accessible whenever you need them.

-

How does airSlate SignNow improve the submission process for Form W 7A Rev September?

By using airSlate SignNow, you can improve the submission process for Form W 7A Rev September by having the capability to fill out and e-sign the document online. This eliminates the need for printing and scanning, saving you time and making it much easier to submit your application quickly.

-

Does airSlate SignNow integrate with other software for processing Form W 7A Rev September?

Yes, airSlate SignNow seamlessly integrates with various software and applications, enhancing your workflow when processing the Form W 7A Rev September, Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions. This integration helps streamline your document management system, improving overall efficiency.

Get more for Form W 7A Rev September , Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions

Find out other Form W 7A Rev September , Fill in Version Application For Taxpayer Identification Number For Pending U S Adoptions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors