Determine Who Can Claim the Deduction Line 21400 2022-2026

Eligibility criteria for claiming child care expenses

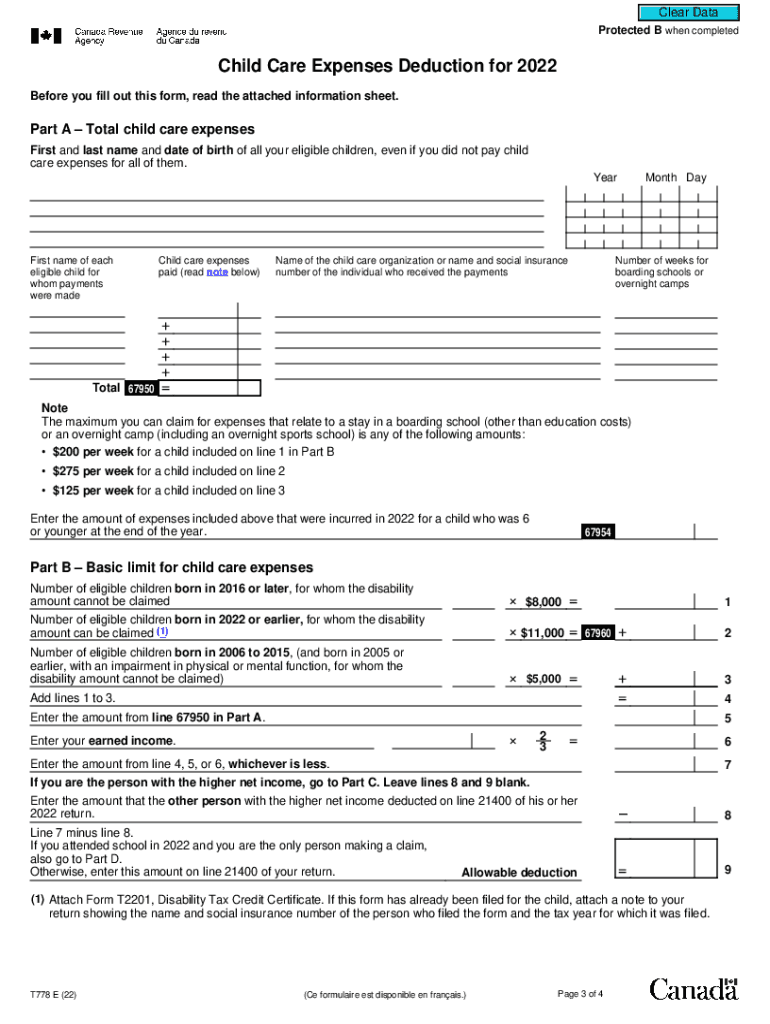

To claim child care expenses on the form T778, you must meet specific eligibility criteria. Generally, you can claim these expenses if you are a parent or guardian of a child under the age of 16 at the end of the year. Additionally, the child must reside with you for at least part of the year. The expenses must be incurred to allow you to work, attend school, or conduct research. It is essential to ensure that the child care provider is a registered entity or individual to qualify for the deduction.

Steps to complete the T778 form

Completing the T778 form involves several straightforward steps. First, gather all necessary documentation, including receipts for child care expenses and information about the child care provider. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Then, provide details about the child, including their name and age. Finally, list the expenses incurred and ensure that you keep a copy of the completed form for your records. Double-check all entries for accuracy before submission.

Required documents for submission

When submitting the T778 form, you must include specific documents to support your claim. These documents typically include receipts for child care expenses, which should detail the amount paid, the dates of service, and the provider's information. If applicable, include any relevant tax documents, such as your tax return, to provide context for your claim. Ensure that all documents are organized and legible to facilitate a smooth review process by the tax authorities.

IRS guidelines for child care expenses

The IRS provides clear guidelines regarding the deduction of child care expenses. According to IRS regulations, eligible expenses include payments made to care providers for children under the age of 13. The expenses must be necessary for you to work or seek employment. It's essential to understand the limits on the amount you can claim, as these limits may vary based on your income and the number of children you are claiming expenses for. Familiarizing yourself with these guidelines will help ensure compliance and maximize your deduction.

Filing deadlines for the T778 form

Filing deadlines for the T778 form are crucial to ensure that you receive your eligible deductions on time. Typically, the deadline for submitting your tax return, including the T778 form, is April 15 of the following year. However, if you file for an extension, you may have additional time to submit your forms. It's important to keep track of these dates to avoid penalties and ensure your claims are processed efficiently.

Form submission methods

The T778 form can be submitted through various methods, providing flexibility for taxpayers. You can file the form electronically using tax preparation software that supports the T778 form, which is often the quickest method. Alternatively, you can print the completed form and mail it to the appropriate IRS address. If you prefer in-person submission, check with your local IRS office for availability and procedures. Each method has its advantages, so choose the one that best suits your needs.

Quick guide on how to complete determine who can claim the deduction line 21400

Effortlessly Prepare Determine Who Can Claim The Deduction Line 21400 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, enabling you to find the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Determine Who Can Claim The Deduction Line 21400 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Determine Who Can Claim The Deduction Line 21400 with Ease

- Find Determine Who Can Claim The Deduction Line 21400 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Determine Who Can Claim The Deduction Line 21400 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct determine who can claim the deduction line 21400

Create this form in 5 minutes!

How to create an eSignature for the determine who can claim the deduction line 21400

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t778 form and why is it important?

The t778 form is a tax form used by Canadian taxpayers to apply for the Canada Child Benefit and the Climate Action Incentive. Understanding its requirements is crucial for accurate tax filing and to ensure compliance. airSlate SignNow simplifies the process of completing and submitting the t778 form, making it easy for families to claim their benefits.

-

How does airSlate SignNow help in filling out the t778 form?

airSlate SignNow offers an intuitive platform that allows users to easily fill out the t778 form electronically. With its user-friendly interface, you can quickly add, edit, and eSign your form, ensuring your information is accurate and secure. This streamlines the process and saves valuable time during tax season.

-

Is airSlate SignNow cost-effective for small businesses needing the t778 form?

Yes, airSlate SignNow provides a cost-effective solution for small businesses that need to manage documents like the t778 form. With various pricing plans, you can choose a package that suits your budget while benefiting from powerful eSignature features. This ensures that your business remains compliant without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing the t778 form?

Absolutely! airSlate SignNow integrates seamlessly with popular tools such as Google Drive, Dropbox, and more, facilitating easy access and submission of the t778 form. These integrations ensure that your documents are organized and accessible, allowing for efficient workflow management.

-

What are the benefits of using airSlate SignNow for the t778 form?

Using airSlate SignNow for the t778 form offers several benefits, including enhanced efficiency and improved document security. You can eSign your form from anywhere, ensuring rapid submission and compliance with tax regulations. Additionally, our platform keeps your information safe with advanced encryption.

-

Is it easy to eSign the t778 form with airSlate SignNow?

Yes, eSigning the t778 form with airSlate SignNow is a straightforward process. Our platform allows users to add electronic signatures effortlessly, ensuring that your documents are legally binding and valid. This feature saves time and enhances the overall experience of completing tax forms.

-

What types of documents besides the t778 form can airSlate SignNow handle?

In addition to the t778 form, airSlate SignNow can handle a wide variety of documents such as contracts, agreements, and consent forms. This flexibility makes it an ideal solution for businesses and individuals looking to streamline their document processes. With our platform, you can manage all your important documents in one place.

Get more for Determine Who Can Claim The Deduction Line 21400

Find out other Determine Who Can Claim The Deduction Line 21400

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple