T778 Fill 19e PDF Clear Data Child Care Expenses 2019

Understanding the T778 Form for Child Care Expenses

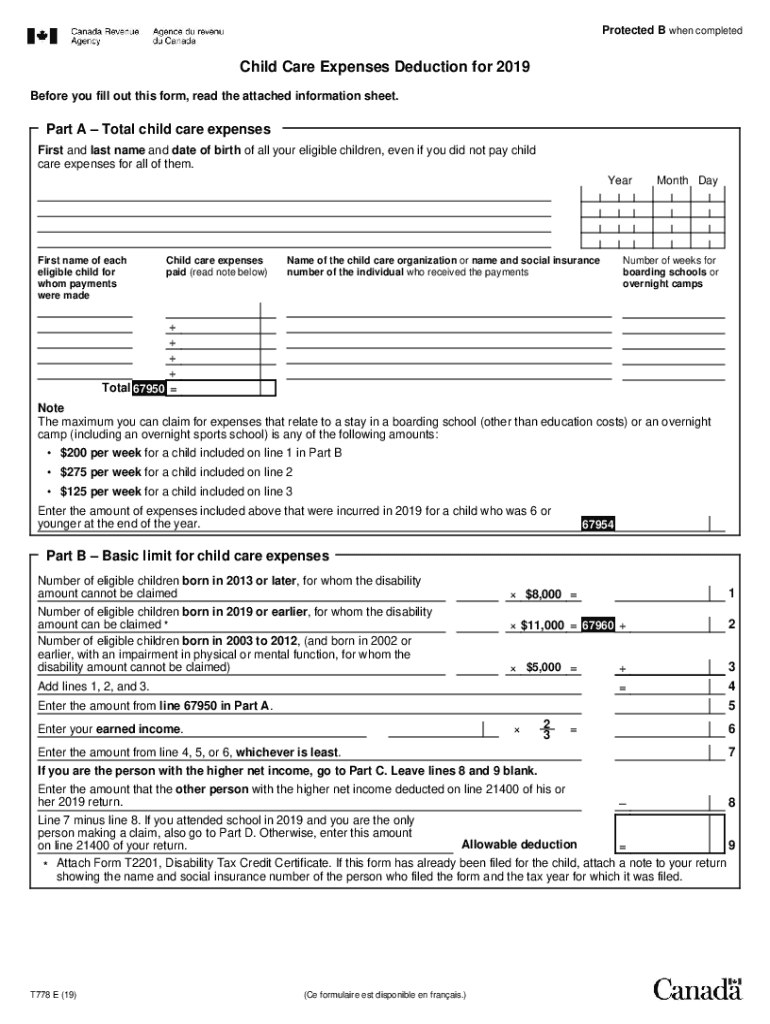

The T778 form, also known as the T778 tax form, is specifically designed for individuals claiming child care expenses on their tax returns. This form allows taxpayers to detail the costs incurred for child care services, which can be deducted from their taxable income. Understanding the purpose and requirements of the T778 is essential for maximizing potential tax benefits. It is important to ensure that all information provided is accurate and complete to avoid any issues during the filing process.

Steps to Complete the T778 Form

Completing the T778 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for child care expenses and information about the child or children for whom the expenses were incurred. Next, fill out the form by entering your personal information, detailing the child care expenses, and providing any required signatures. After completing the form, review it thoroughly to ensure all sections are filled out correctly. Finally, submit the form either online or via mail, depending on your preference and the guidelines provided by the Canada Revenue Agency (CRA).

Eligibility Criteria for Claiming Child Care Expenses

To qualify for deductions using the T778 form, specific eligibility criteria must be met. Generally, the taxpayer must have incurred child care expenses for children under the age of 16 or for children with disabilities. Additionally, the expenses must be necessary for the taxpayer to work, attend school, or conduct research. It is crucial to keep documentation that verifies the expenses and the relationship between the taxpayer and the child to support the claim during tax assessments.

Legal Use of the T778 Form

The T778 form is legally recognized for the purpose of claiming child care expenses on tax returns in Canada. To ensure the form's legal validity, it must be completed accurately and in accordance with the regulations set forth by the CRA. Utilizing a reliable digital platform, such as airSlate SignNow, can enhance the security and legality of the eSignature process, ensuring that all submissions are compliant with relevant eSignature laws, including ESIGN and UETA. This compliance is essential for the form to be accepted by tax authorities.

Required Documents for the T778 Form

When preparing to submit the T778 form, certain documents are required to substantiate the claims made. These may include receipts or invoices from child care providers, proof of payment, and any relevant identification for the child or children involved. Additionally, if applicable, documentation that verifies the taxpayer's employment or educational status may be necessary to demonstrate the need for child care expenses. Keeping organized records will facilitate a smoother filing process.

Form Submission Methods

The T778 form can be submitted through various methods, providing flexibility for taxpayers. Individuals can file the form online using the CRA's electronic filing system, which is often the quickest method. Alternatively, the form can be mailed to the appropriate CRA office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs and timeline.

Examples of Using the T778 Form

Understanding practical scenarios can help clarify how the T778 form is used. For instance, a working parent who pays for daycare services while they are employed can claim these expenses using the T778 form. Similarly, a student who incurs child care costs while attending classes can also utilize this form to claim deductions. Each example illustrates the importance of accurately documenting expenses and adhering to eligibility requirements to maximize tax benefits.

Quick guide on how to complete t778 fill 19epdf clear data child care expenses

Handle T778 fill 19e pdf Clear Data Child Care Expenses seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and sign your documents quickly without delays. Manage T778 fill 19e pdf Clear Data Child Care Expenses on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and sign T778 fill 19e pdf Clear Data Child Care Expenses effortlessly

- Locate T778 fill 19e pdf Clear Data Child Care Expenses and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and sign T778 fill 19e pdf Clear Data Child Care Expenses and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t778 fill 19epdf clear data child care expenses

Create this form in 5 minutes!

How to create an eSignature for the t778 fill 19epdf clear data child care expenses

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the formulaire t778, and how can it help my business?

The formulaire t778 is a specific tax form that can streamline the filing process for businesses. Utilizing airSlate SignNow, you can easily prepare, send, and eSign the formulaire t778, saving you time and eliminating the hassle of paper documents.

-

Are there any costs associated with using the formulaire t778 on airSlate SignNow?

AirSlate SignNow offers a range of pricing plans, making it cost-effective for businesses of all sizes. You can access the formulaire t778 feature at a competitive rate, which is justified by the time and resources you save on document management.

-

What features does airSlate SignNow offer for the formulaire t778?

AirSlate SignNow provides robust features for the formulaire t778, including reusable templates, advanced security protocols, and seamless eSignature functionality. These features help ensure that your documents are both compliant and secure.

-

Can I integrate airSlate SignNow with other applications while using the formulaire t778?

Yes, airSlate SignNow offers integration capabilities with various applications, allowing businesses to incorporate the formulaire t778 into their existing workflows. This ensures a streamlined process, combining your document management with other business tools.

-

What are the security measures for processing the formulaire t778 with airSlate SignNow?

AirSlate SignNow prioritizes security, using encryption and authentication measures to protect your data when processing the formulaire t778. Your documents are stored securely, giving you peace of mind while managing sensitive information.

-

How does using airSlate SignNow for the formulaire t778 improve efficiency?

Using airSlate SignNow for the formulaire t778 signNowly enhances efficiency by eliminating manual paperwork and reducing errors. With an intuitive interface, you can quickly prepare and send documents, accelerating your business's overall workflow.

-

Is customer support available for issues related to the formulaire t778?

Yes, airSlate SignNow provides dedicated customer support to assist users with the formulaire t778. Our support team is available to help resolve any inquiries, ensuring you can efficiently manage your document processes.

Get more for T778 fill 19e pdf Clear Data Child Care Expenses

- Owners or sellers affidavit of no liens wisconsin form

- Affidavit occupancy form

- Complex will with credit shelter marital trust for large estates wisconsin form

- Notice hearing criminal form

- Bail bond 497430763 form

- Order for competency examination wisconsin form

- Incompetency form

- Petition and stipulation to waive appearance and hearing and order judgment wisconsin form

Find out other T778 fill 19e pdf Clear Data Child Care Expenses

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word