T778 2017

What is the T778?

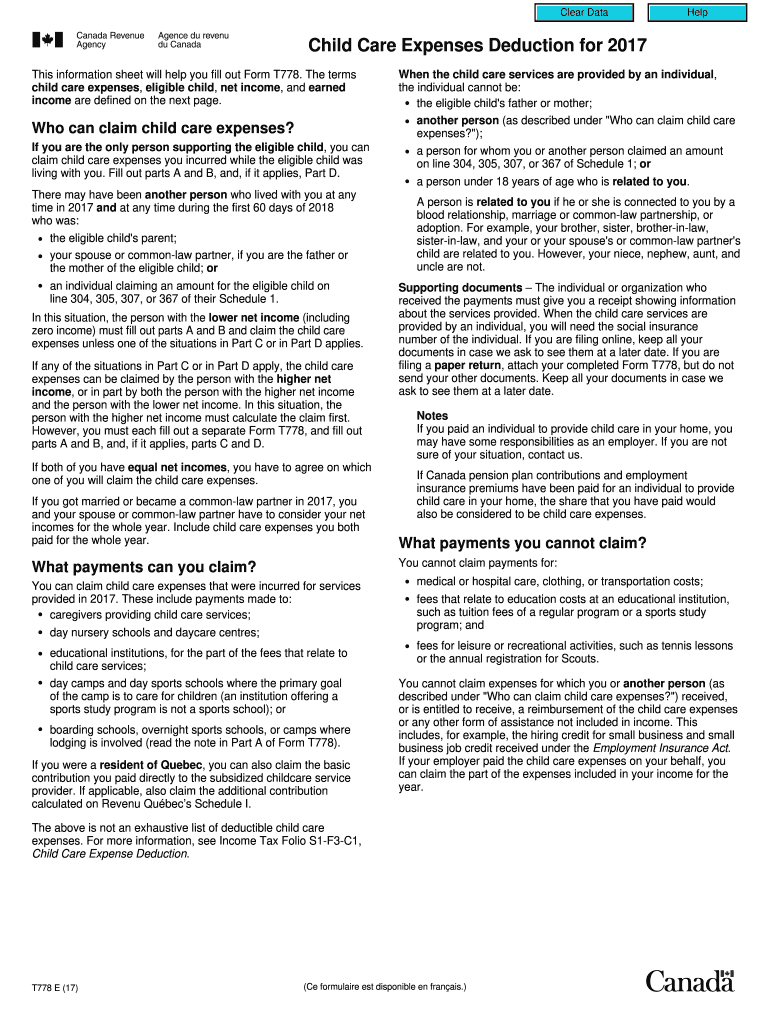

The T778 form, known as the Child Care Expenses Deduction, is a tax document used in Canada to claim eligible child care expenses. This form allows parents or guardians to deduct certain costs incurred for child care while they work, attend school, or conduct research. The T778 is essential for reducing taxable income and maximizing tax benefits related to child care. Understanding the specifics of this form can help families manage their finances more effectively.

How to use the T778

Using the T778 form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including receipts for child care expenses. Next, fill out the form with precise details regarding the child care provider, the amount spent, and the purpose of the expenses. It is crucial to ensure that the expenses claimed are eligible under the guidelines set by the Canada Revenue Agency (CRA). After completing the form, it can be submitted along with your tax return, either electronically or by mail.

Steps to complete the T778

Completing the T778 form requires careful attention to detail. Follow these steps:

- Collect receipts and relevant documentation for all child care expenses.

- Fill out your personal information, including your name and social insurance number.

- Provide details about the child care provider, including their name, address, and registration number if applicable.

- List all eligible expenses incurred during the tax year, ensuring they align with CRA guidelines.

- Review the completed form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the Child Care Expenses Deduction using the T778 form, certain eligibility criteria must be met. Generally, the individual claiming the deduction must be a parent or guardian of the child for whom care is provided. Additionally, the child must be under the age of 16 at the end of the tax year. The expenses claimed must be incurred to allow the parent or guardian to work, attend school, or conduct research. It is essential to ensure that all claimed expenses are documented and fall within the limits set by the CRA.

Required Documents

When filing the T778 form, specific documents are required to substantiate your claims. These include:

- Receipts from child care providers detailing the services rendered and amounts charged.

- Proof of the child's age, such as a birth certificate, if necessary.

- Any additional documentation that supports the eligibility of the claimed expenses.

Having these documents ready will facilitate a smoother filing process and help avoid potential issues with the CRA.

Form Submission Methods

The T778 form can be submitted through various methods. Taxpayers have the option to file electronically using tax software that supports CRA submissions, which is often the most efficient method. Alternatively, the form can be printed and mailed directly to the CRA. In-person submissions are generally not available, so it is essential to choose the method that best suits your needs and ensures timely processing of your tax return.

Quick guide on how to complete child care expenses deduction for 2017 canadaca

A concise guide on how to prepare your T778

Locating the correct template can be a challenge when you need to submit formal international documentation. Even if you possess the necessary form, it can be cumbersome to swiftly prepare it in accordance with all the requirements when using printed copies instead of handling everything electronically. airSlate SignNow is the online electronic signature platform that assists you in navigating these challenges. It allows you to obtain your T778 and promptly fill out and sign it on-site without the need to reprint documents if you make an error.

Here are the steps you should follow to prepare your T778 with airSlate SignNow:

- Click the Get Form button to instantly add your document to our editor.

- Begin with the first blank space, enter your details, and move on using the Next tool.

- Complete the empty fields with the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to mark the most important information.

- Click on Image and upload one if your T778 requires it.

- Use the right-side pane to add more sections for you or others to fill out if needed.

- Review your entries and confirm the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete editing by clicking the Done button and selecting your file-sharing options.

Once your T778 is prepared, you can share it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders based on your preferences. Don’t spend time on manual form completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct child care expenses deduction for 2017 canadaca

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How much time does it take to get a yes/no answer for Canada Express Entry after filling out all the form & signing up? How many points are needed for a positive answer, i.e. how many points do the people that are getting accepted have on average?

The minimum that I know people got accepted is from 450 to 470 points.Usually when you fill up the information it tells you straight up if you are in the pool or not.By experience Canada’a express entry system is THE WORST THING EVER happened to the Canada’s immigration. It is literally a nightmare! The portal crashes, and sometimes only open between midnight and 3am. You literally need to be the luckiest person to have it work normally. What is worst about it: Is that the Canadian government keeps on saying they will fix issues, and in the same time calling it the best system ever, where it is the worst system I have ever seen. NO technical support whatsoever.Good luck in your application.My advice also, Canada is not as it advertises. It s quite hard out there, and people are racist (not to your face, but we a smile and in their mind, which is to the worst).I do not recommend Canada as a land for immigration, but I recommend Canada for studying. Schools there are pretty multicultural, and you do not feel the racism only when you go in the labour market or create your company.

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

Create this form in 5 minutes!

How to create an eSignature for the child care expenses deduction for 2017 canadaca

How to make an eSignature for the Child Care Expenses Deduction For 2017 Canadaca in the online mode

How to create an eSignature for the Child Care Expenses Deduction For 2017 Canadaca in Chrome

How to create an eSignature for putting it on the Child Care Expenses Deduction For 2017 Canadaca in Gmail

How to create an electronic signature for the Child Care Expenses Deduction For 2017 Canadaca straight from your smart phone

How to generate an eSignature for the Child Care Expenses Deduction For 2017 Canadaca on iOS

How to make an electronic signature for the Child Care Expenses Deduction For 2017 Canadaca on Android

People also ask

-

What is the t778 child care expenses deduction?

The t778 child care expenses deduction allows taxpayers to claim certain eligible expenses incurred for the care of children under 16 years of age. This deduction can signNowly reduce your taxable income, making it easier for families to manage child care costs. Understanding this deduction is essential for maximizing your tax benefits.

-

How can I claim the t778 child care expenses deduction?

To claim the t778 child care expenses deduction, you must file the correct form and provide details about your eligible expenses. Make sure you keep all receipts from your child care providers and submit them along with your tax return. Utilizing a reliable eSignature service like airSlate SignNow can simplify the document submission process.

-

What expenses qualify for the t778 child care expenses deduction?

Eligible expenses for the t778 child care expenses deduction typically include costs for daycare, babysitters, and after-school programs. These expenses must be necessary for you to work or look for work. Familiarizing yourself with the eligibility criteria will help you maximize your deductions.

-

Is there a limit on the t778 child care expenses deduction?

Yes, there are limits based on the age of the children and the number of dependents you have. The maximum claim amounts can vary, so reviewing the guidelines for the t778 child care expenses deduction is crucial. This enables you to accurately determine how much you can potentially deduct from your taxes.

-

How can airSlate SignNow assist with the t778 child care expenses deduction process?

airSlate SignNow offers a streamlined eSignature solution that helps you organize and send documents related to the t778 child care expenses deduction quickly. With easy-to-use features, you can manage your tax-related documents efficiently. This saves you time and ensures you don’t miss important filing deadlines.

-

What documents do I need for the t778 child care expenses deduction?

To support your t778 child care expenses deduction claim, you will need receipts or invoices from your childcare providers, as well as your tax return. It's essential to keep these documents organized to avoid any potential issues with tax authorities. Using airSlate SignNow can help you manage and store these documents securely.

-

Can I claim the t778 child care expenses deduction if I work from home?

Yes, you can claim the t778 child care expenses deduction even if you work from home, provided that the child care is necessary for you to work or look for work. Be sure to gather all relevant documentation to support your claim. This deduction can help alleviate some of the financial burdens associated with balancing home and work responsibilities.

Get more for T778

- Direct petition of refund alabama dept of revenue form

- Quarterly percentage tax return form

- Lincoln financial group distinctive payee arrangements form

- Encantado pink dolphin of the amazon pdf form

- Form no din 1 application for allotment of director gsl

- Cg2134 form

- Student additional information

- Direct deposit sign up form south korea social

Find out other T778

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF