Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department of RevenueAbout Form 1040 V, Pay 2021

Understanding the Louisiana Form 540V Electronic Filing Payment Voucher

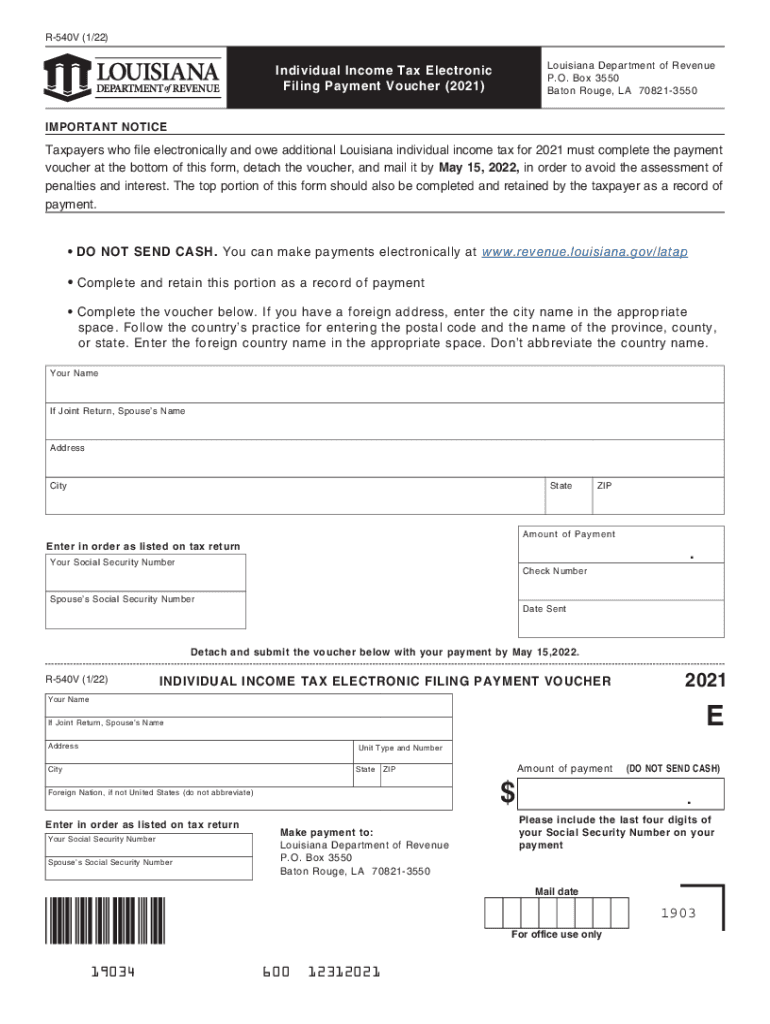

The Louisiana Form 540V is an essential document for individuals filing their income tax electronically. This payment voucher is used to submit any balance due when filing your Louisiana individual income tax return. It ensures that your payment is properly credited to your account and is a crucial part of the tax filing process for the year 2023. The Louisiana Department of Revenue requires this form to facilitate the electronic payment of taxes owed, providing a streamlined approach for taxpayers.

Steps to Complete the Louisiana Form 540V Electronic Filing Payment Voucher

Completing the Louisiana Form 540V involves several key steps. Begin by entering your personal information, including your name, address, and Social Security number. Next, indicate the tax year for which you are making the payment. You will also need to provide the amount you are paying, ensuring it matches the balance due from your income tax return. Finally, sign and date the form to validate your submission. It is important to double-check all entries for accuracy before submitting to avoid any delays in processing.

How to Obtain the Louisiana Form 540V Electronic Filing Payment Voucher

The Louisiana Form 540V can be easily obtained from the Louisiana Department of Revenue's official website. It is available for download in a printable format, allowing you to fill it out at your convenience. Additionally, many tax preparation software programs include this form as part of their filing process, making it accessible for those who prefer digital solutions. Ensure you are using the correct version for the 2023 tax year to avoid any complications.

Filing Deadlines for the Louisiana Form 540V

Timely filing is crucial to avoid penalties. The deadline for submitting the Louisiana Form 540V coincides with the due date for your income tax return, typically April fifteenth. If you are unable to file your return by this date, ensure that your payment voucher is submitted on time to avoid interest and penalties on any unpaid balance. Keeping track of these deadlines will help maintain compliance with Louisiana tax regulations.

Required Documents for Filing the Louisiana Form 540V

When filing the Louisiana Form 540V, certain documents are necessary to ensure a smooth process. You will need a copy of your completed Louisiana income tax return, as this will provide the information needed to accurately fill out the payment voucher. Additionally, gather any supporting documentation related to your income and deductions, as these may be required for verification purposes by the Louisiana Department of Revenue.

Penalties for Non-Compliance with Louisiana Tax Regulations

Failure to file the Louisiana Form 540V or to pay the required amount by the deadline can result in significant penalties. The Louisiana Department of Revenue imposes interest on unpaid balances, along with additional penalties for late payments. Understanding these consequences emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens. Staying informed about compliance requirements will help you navigate the tax process effectively.

Quick guide on how to complete louisiana form 540v electronic filing payment voucherindividual income tax louisiana department of revenueabout form 1040 v

Finalize Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without any holdups. Manage Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

Ways to modify and eSign Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay effortlessly

- Locate Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay and then click Obtain Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature utilizing the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Complete button to save your modifications.

- Select your preferred method to send your form: via email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced papers, frustrating form hunts, or errors that require reprinting document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and eSign Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay to guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana form 540v electronic filing payment voucherindividual income tax louisiana department of revenueabout form 1040 v

Create this form in 5 minutes!

How to create an eSignature for the louisiana form 540v electronic filing payment voucherindividual income tax louisiana department of revenueabout form 1040 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Louisiana income tax form?

The 2023 Louisiana income tax form is a document used to report your income and calculate the amount of state taxes you owe. It includes various sections for deductions and credits that can help maximize your refund. Ensure you download the correct form for accuracy and compliance when preparing your taxes.

-

How can airSlate SignNow help with the 2023 Louisiana income tax form?

airSlate SignNow streamlines the process of completing the 2023 Louisiana income tax form by allowing you to fill out and sign documents electronically. This reduces the hassle of printing and scanning while ensuring that you stay compliant with all state requirements. With our intuitive interface, preparing your tax forms has never been easier.

-

Is there a cost associated with using airSlate SignNow for the 2023 Louisiana income tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, whether you are an individual or a business. By choosing the right plan, you gain access to powerful features that can help you efficiently manage your 2023 Louisiana income tax form and other documents. Pricing is competitive and designed to provide great value for your signing and document management needs.

-

What features does airSlate SignNow offer for completing the 2023 Louisiana income tax form?

airSlate SignNow provides features like electronic signatures, document sharing, and templates that simplify the process of completing the 2023 Louisiana income tax form. You can also track the status of documents and receive notifications, ensuring that you never miss a deadline. These features enhance your workflow and improve productivity during tax season.

-

Can I integrate airSlate SignNow with other software for the 2023 Louisiana income tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, allowing for a seamless experience when managing your 2023 Louisiana income tax form. By connecting your favorite tools, you can easily sync data and minimize errors, making tax preparation more efficient overall.

-

What benefits do I gain by using airSlate SignNow for the 2023 Louisiana income tax form?

Using airSlate SignNow for the 2023 Louisiana income tax form provides numerous benefits, including increased efficiency and organization of your tax documents. The electronic signature feature speeds up the process of getting approvals, while cloud storage ensures you have access to your documents anytime, anywhere. Plus, enhanced security measures keep your sensitive information protected.

-

Is airSlate SignNow easy to use for completing the 2023 Louisiana income tax form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the 2023 Louisiana income tax form without any hassle. The platform guides you through each step, ensuring you understand what information is needed. Whether you are tech-savvy or not, you will find it straightforward to navigate our solution.

Get more for Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay

Find out other Louisiana Form 540V Electronic Filing Payment VoucherIndividual Income Tax Louisiana Department Of RevenueAbout Form 1040 V, Pay

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online