LOUISIANA Tax Forms and Instructions 2023-2026

Understanding Louisiana Income Tax Forms and Instructions

The Louisiana income tax filing process requires specific forms and detailed instructions to ensure compliance with state regulations. The primary form used for individual income tax is the Louisiana Individual Income Tax Return (Form IT-540). This form must be filled out accurately to report your income, deductions, and credits. Additionally, there are various schedules that may need to accompany the main form, depending on your financial situation. Understanding the purpose of each form and the instructions provided is crucial for a successful filing.

Steps to Complete Louisiana Income Tax Forms

Completing your Louisiana income tax forms involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which affects your tax rates and deductions.

- Fill out the main form, ensuring that all income is reported accurately.

- Complete any additional schedules or forms required based on your situation.

- Double-check all calculations and information for accuracy.

- Sign and date the form before submission.

Required Documents for Louisiana Income Tax Filing

To file your Louisiana income tax, you will need several key documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Any previous year tax returns for reference

- Proof of residency if applicable

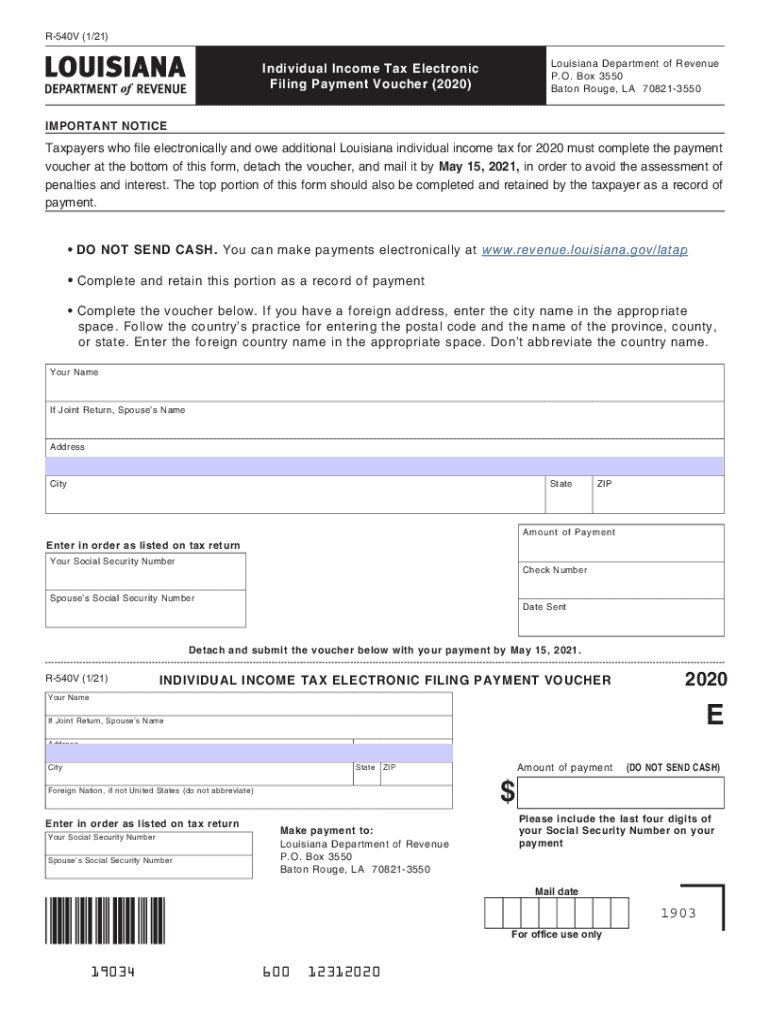

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential to avoid penalties. For most individuals, the deadline to file Louisiana income tax returns is typically May 15 of the following year. If you need more time, you may request an extension, but this does not extend the time to pay any taxes owed. It is important to keep track of any changes in deadlines that may occur due to state regulations.

Form Submission Methods for Louisiana Income Tax

Louisiana offers several methods for submitting your income tax forms:

- Online: You can file electronically through the Louisiana Department of Revenue's website.

- Mail: Paper forms can be mailed to the address specified in the instructions.

- In-Person: You may also submit your forms at local Department of Revenue offices.

Penalties for Non-Compliance with Louisiana Income Tax Filing

Failing to file your Louisiana income tax return on time can result in penalties and interest on any unpaid taxes. The state may impose a late filing penalty, which can be a percentage of the unpaid tax amount. Additionally, if you underreport your income or fail to pay taxes owed, further penalties may apply. It is advisable to file even if you cannot pay the full amount to minimize potential penalties.

Quick guide on how to complete louisiana tax forms and instructions

Complete LOUISIANA Tax Forms And Instructions seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage LOUISIANA Tax Forms And Instructions on any platform using airSlate SignNow Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and eSign LOUISIANA Tax Forms And Instructions with ease

- Find LOUISIANA Tax Forms And Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for such purposes.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign LOUISIANA Tax Forms And Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the louisiana tax forms and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in Louisiana income tax filing?

airSlate SignNow simplifies the process of Louisiana income tax filing by allowing users to easily send and eSign necessary documents. This ensures that all forms are completed accurately and submitted on time, reducing the risk of errors. Our platform is designed to streamline the workflow for both individuals and businesses.

-

How does airSlate SignNow ensure compliance with Louisiana income tax filing regulations?

Our platform is built with compliance in mind, ensuring that all documents meet Louisiana income tax filing regulations. We provide templates that are regularly updated to reflect any changes in tax laws. This helps users stay compliant and avoid potential penalties.

-

What are the pricing options for using airSlate SignNow for Louisiana income tax filing?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users, whether individuals or businesses. Our plans are cost-effective, making it easier for users to manage their Louisiana income tax filing without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for Louisiana income tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your Louisiana income tax filing experience. This integration allows for easy data transfer and document management, making the filing process more efficient. You can connect with tools you already use to streamline your workflow.

-

What features does airSlate SignNow offer for Louisiana income tax filing?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage, all of which are essential for Louisiana income tax filing. These features help users prepare and submit their tax documents quickly and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow suitable for both individuals and businesses for Louisiana income tax filing?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses, making it an ideal solution for Louisiana income tax filing. Whether you're filing as a sole proprietor or managing a larger organization, our platform can accommodate your needs effectively. We provide the tools necessary for all types of users.

-

How secure is airSlate SignNow for handling Louisiana income tax filing documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your documents during Louisiana income tax filing. This ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for LOUISIANA Tax Forms And Instructions

- Authorization for release of information form danbury hospital

- Letter of intent to purchase cook animal health products form

- Arizona assumed form

- Forms board of registered nursing state of california

- Gopinkjhcom home page skrinner form

- Health history questionnaire date patient form

- Physician authorization form note the physician

- Minnesota certified copy certificate form

Find out other LOUISIANA Tax Forms And Instructions

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form