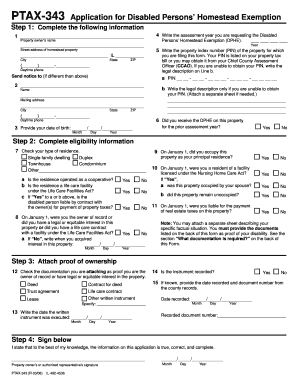

PTAX 343 Application for Disables Persons' Homestead Form

What is the PTAX 343 Application For Disabled Persons' Homestead

The PTAX 343 Application For Disabled Persons' Homestead is a form used in the United States to apply for property tax exemptions available to individuals with disabilities. This application allows eligible homeowners to reduce their property tax burden, making homeownership more affordable. The exemption is typically granted at the local or state level, depending on the jurisdiction, and is designed to support individuals who may face additional financial challenges due to their disabilities.

Eligibility Criteria

To qualify for the PTAX 343 Application For Disabled Persons' Homestead, applicants must meet specific eligibility requirements, which may vary by state. Generally, the criteria include:

- Proof of disability, typically documented by a medical professional.

- Ownership of the property for which the exemption is sought.

- Residency in the property as the primary residence.

- Compliance with any income limitations set by the local taxing authority.

Steps to Complete the PTAX 343 Application For Disabled Persons' Homestead

Filling out the PTAX 343 Application involves several steps to ensure accuracy and compliance with local regulations. Here’s a general outline of the process:

- Gather necessary documentation, including proof of disability and ownership.

- Obtain the PTAX 343 form from your local tax assessor's office or online.

- Fill out the form completely, providing all required information.

- Review the application for accuracy before submission.

- Submit the completed application by the specified deadline to your local tax authority.

Required Documents

When applying for the PTAX 343 Application, specific documents are typically required to support your application. These may include:

- A completed PTAX 343 form.

- Medical documentation confirming the disability.

- Proof of property ownership, such as a deed or tax bill.

- Any additional forms or documentation requested by the local tax authority.

Form Submission Methods

The PTAX 343 Application can usually be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission through the local tax authority's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at the local tax assessor's office.

Application Process & Approval Time

The application process for the PTAX 343 can vary by jurisdiction, but typically involves the following stages:

- Submission of the application and supporting documents.

- Review by the local tax authority for completeness and eligibility.

- Notification of approval or denial, which may take several weeks to months.

It is advisable to check with your local tax office for specific timelines and any additional steps that may be required.

Quick guide on how to complete ptax 343 application for disables persons39 homestead

Finalize [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

The easiest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to submit your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PTAX 343 Application For Disables Persons' Homestead

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 application for disables persons39 homestead

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 343 Application For Disables Persons' Homestead?

The PTAX 343 Application For Disables Persons' Homestead is a form that allows individuals with disabilities to apply for a property tax exemption. This exemption can signNowly reduce property tax liability, making homeownership more affordable. Ensuring accurate completion of the PTAX 343 application can help eligible homeowners benefit from these savings.

-

How can airSlate SignNow assist with the PTAX 343 Application For Disables Persons' Homestead?

AirSlate SignNow offers a user-friendly platform that streamlines the completion and submission of the PTAX 343 Application For Disables Persons' Homestead. With eSignature capabilities, users can easily sign and send their application securely. This simplifies the process, ensuring that applications are submitted accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the PTAX 343 Application For Disables Persons' Homestead?

Yes, airSlate SignNow provides various pricing plans that cater to different user needs, ranging from individual users to large teams. Each plan includes features suitable for managing the PTAX 343 Application For Disables Persons' Homestead efficiently. This makes it a cost-effective solution for those needing to process important documents.

-

What features does airSlate SignNow offer for managing the PTAX 343 Application For Disables Persons' Homestead?

AirSlate SignNow includes features such as customizable templates, electronic signatures, document tracking, and secure data storage. These tools are instrumental in managing the PTAX 343 Application For Disables Persons' Homestead, ensuring that users can handle their documents with confidence. Additionally, the interface is designed to be intuitive for all users.

-

Can airSlate SignNow integrate with other applications to facilitate the PTAX 343 Application For Disables Persons' Homestead?

Yes, airSlate SignNow offers integrations with various applications and software systems, enhancing workflow efficiency. Users can integrate it with CRM systems, cloud storage services, and more to streamline the entire process of completing the PTAX 343 Application For Disables Persons' Homestead. This connectivity helps ensure that all data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for the PTAX 343 Application For Disables Persons' Homestead?

By using airSlate SignNow for the PTAX 343 Application For Disables Persons' Homestead, users can save time, reduce errors, and enhance document security. The ability to eSign documents means quicker turnaround times and fewer delays, while the platform ensures compliance with legal standards. Overall, it makes the process seamless and efficient.

-

How can I ensure my PTAX 343 Application For Disables Persons' Homestead is submitted correctly?

To ensure your PTAX 343 Application For Disables Persons' Homestead is submitted accurately, follow all required guidelines and utilize the templates provided by airSlate SignNow. The platform assists with document validation, reducing common submission errors. Additionally, taking advantage of the document review features can enhance accuracy before final submission.

Get more for PTAX 343 Application For Disables Persons' Homestead

Find out other PTAX 343 Application For Disables Persons' Homestead

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement