EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL D 'UNE FIDUCIE R Form

Understanding the Form

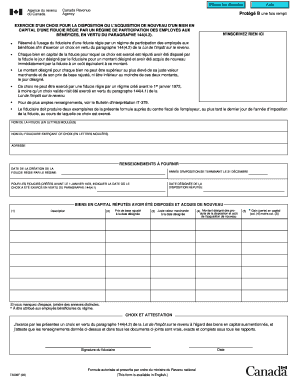

The form titled EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL D 'UNE FIDUCIE R GIE PAR UN R GIME DE PARTICIPATION DES EMPLOY S AUX B N FICES, EN VERTU DU PARAGRAPHE 1444 2 is a critical document for managing capital assets within a trust governed by an employee benefits participation plan. This form is essential for making informed decisions regarding the disposition or acquisition of capital assets, ensuring compliance with relevant tax regulations.

Steps to Complete the Form

Completing the form involves several key steps:

- Gather necessary documentation related to the capital asset.

- Review the specific provisions outlined in paragraph 1444(2) to ensure compliance.

- Fill out the form accurately, providing all required information regarding the asset and the trust.

- Verify the details for accuracy before submission.

Legal Use of the Form

This form serves a legal purpose by formalizing the choice regarding the disposition or acquisition of capital assets. It ensures that the actions taken are in accordance with the regulations governing trusts and employee benefits. Proper use of this form can help mitigate legal risks associated with asset management within a trust.

Required Documents

To complete the form, certain documents are typically required:

- Proof of ownership of the capital asset.

- Documentation of the trust agreement.

- Any prior correspondence with tax authorities regarding the asset.

IRS Guidelines

The IRS provides specific guidelines on the use of this form, emphasizing the importance of compliance with tax regulations. Understanding these guidelines can help individuals and businesses navigate the complexities of capital asset management within trusts.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines associated with this form. Missing these deadlines can result in penalties or complications with the trust's compliance status. Keeping a calendar of important dates related to the form can help ensure timely submission.

Quick guide on how to complete exercice d un choix pour la disposition ou l acquisition de nouveau d un bien en capital d une fiducie r gie par un r gime de

Accomplish [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The optimal method to modify and eSign [SKS] without breaking a sweat

- Find [SKS] and click Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize pertinent portions of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which is completed in seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exercice d un choix pour la disposition ou l acquisition de nouveau d un bien en capital d une fiducie r gie par un r gime de

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL D 'UNE FIDUCIE R GIE PAR UN R GIME DE PARTICIPATION DES EMPLOY S AUX B N FICES, EN VERTU DU PARAGRAPHE 1444 2?

The process for EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL D 'UNE FIDUCIE R GIE PAR UN R GIME DE PARTICIPATION DES EMPLOY S AUX B N FICES involves several steps. You'll need to evaluate your current assets and determine which new capital assets you want to acquire. Once decided, you'll complete the necessary documentation and submit your choice in accordance with the guidelines specified under paragraph 1444 2.

-

What are the benefits of using airSlate SignNow for my EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL?

Using airSlate SignNow for your EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL can enhance efficiency by streamlining document signing processes. It reduces paperwork, minimizes delays, and allows for secure electronic signatures, ensuring that your transactions are completed swiftly and safely. Additionally, it saves operational costs compared to traditional signing methods.

-

How does airSlate SignNow integrate with other tools for managing EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION?

airSlate SignNow seamlessly integrates with various tools to assist in the EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION process. Whether it's connecting with CRM software, document management systems, or accounting platforms, airSlate SignNow ensures that your workflows remain uninterrupted. This integration enhances your overall efficiency and keeps all processes synchronized.

-

Is there a trial period for airSlate SignNow when handling EXERCICE D 'UN CHOIX POUR LA DISPOSITION?

Yes, airSlate SignNow offers a free trial period that allows prospective users to explore its features when dealing with EXERCICE D 'UN CHOIX POUR LA DISPOSITION. This trial is a great opportunity to evaluate its functionalities and see how it suits your organization's needs. During this period, you can test the ease of document management and eSigning capabilities.

-

What are the pricing plans available for airSlate SignNow tailored to EXERCICE D 'UN CHOIX POUR LA DISPOSITION?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes when dealing with EXERCICE D 'UN CHOIX POUR LA DISPOSITION. The plans range from basic to advanced features, ensuring that you can select a package that meets your requirements and budget. Each plan is designed to enhance your document signing process while providing cost-effective solutions.

-

Can I customize templates for EXERCICE D 'UN CHOIX POUR LA DISPOSITION with airSlate SignNow?

Absolutely! airSlate SignNow provides options for customizing templates specifically for EXERCICE D 'UN CHOIX POUR LA DISPOSITION. This feature allows you to create and save documents tailored to your precise needs, ensuring that you can efficiently manage the disposition or acquisition processes. Custom templates save time and ensure consistency in your documentation.

-

What security features does airSlate SignNow provide for documents related to EXERCICE D 'UN CHOIX?

Security is a top priority for airSlate SignNow when handling documents related to EXERCICE D 'UN CHOIX. The platform employs state-of-the-art encryption, secure cloud storage, and access controls to protect your sensitive data. With these features, you can trust that your documents are safe from unauthorized access and data bsignNowes.

Get more for EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL D 'UNE FIDUCIE R

Find out other EXERCICE D 'UN CHOIX POUR LA DISPOSITION OU L 'ACQUISITION DE NOUVEAU D 'UN BIEN EN CAPITAL D 'UNE FIDUCIE R

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF