Michigan Department of Treasury, Page 1 Form

What is the Michigan Department Of Treasury, Page 1

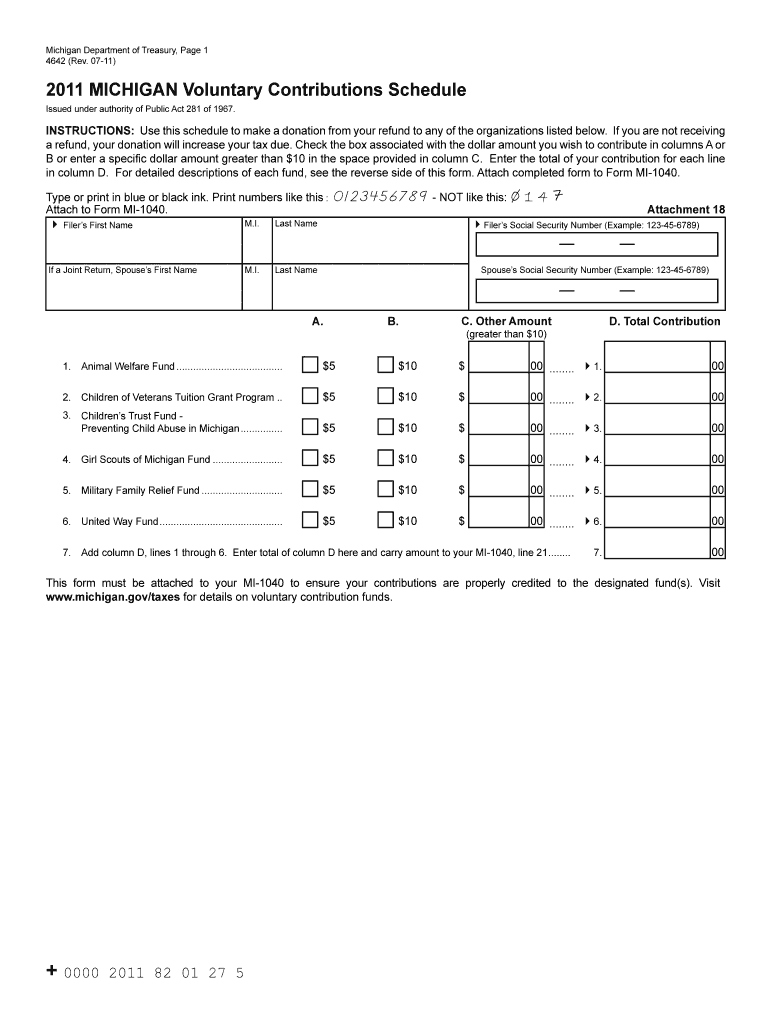

The Michigan Department of Treasury is a state agency responsible for managing the state's financial resources, including tax collection, revenue distribution, and financial reporting. Page 1 of the associated form typically outlines essential information required for various tax-related processes. This may include details about income, deductions, and credits relevant to taxpayers in Michigan. Understanding this page is crucial for ensuring compliance with state tax regulations and for accurately reporting financial information.

Steps to complete the Michigan Department Of Treasury, Page 1

Completing Page 1 of the Michigan Department of Treasury form involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Review the instructions provided on the form to understand the specific requirements for completion.

- Fill out the required sections accurately, ensuring all information is current and complete.

- Double-check calculations, especially if reporting income or deductions, to avoid errors.

- Sign and date the form as required before submission.

Required Documents

To successfully complete Page 1 of the Michigan Department of Treasury form, you may need several supporting documents, including:

- Previous year’s tax return for reference.

- W-2 forms from employers for reported income.

- 1099 forms for any additional income sources.

- Documentation for deductions, such as receipts or statements.

Form Submission Methods

There are multiple methods available for submitting the Michigan Department of Treasury form. Taxpayers can choose from:

- Online submission through the Michigan Department of Treasury website, which offers a streamlined process.

- Mailing a physical copy of the completed form to the appropriate address listed on the form.

- In-person submission at designated state offices, which may provide immediate assistance if needed.

Eligibility Criteria

Eligibility for completing the Michigan Department of Treasury form typically depends on various factors, including:

- Your residency status in Michigan.

- Your income level, which may determine the type of form you need to file.

- Specific tax situations, such as self-employment or retirement income.

Penalties for Non-Compliance

Failing to comply with the requirements of the Michigan Department of Treasury can result in significant penalties, including:

- Fines for late submission or underreporting income.

- Interest on unpaid taxes, which accumulates over time.

- Possible legal action for severe cases of non-compliance.

Quick guide on how to complete michigan department of treasury page 1

Fill out [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents swiftly and without hindrances. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

How to edit and eSign [SKS] seamlessly

- Access [SKS] and click Get Form to begin.

- Use our provided tools to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details thoroughly and hit the Done button to save your updates.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Michigan Department Of Treasury, Page 1

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury page 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Department Of Treasury, Page 1?

The Michigan Department Of Treasury, Page 1, provides essential resources and forms for businesses and individuals dealing with tax obligations. It’s an official platform to navigate intricate tax requirements and submit necessary documents efficiently.

-

How does airSlate SignNow integrate with the Michigan Department Of Treasury, Page 1?

airSlate SignNow seamlessly integrates with the Michigan Department Of Treasury, Page 1, allowing users to eSign and send forms directly from the platform. This integration simplifies compliance and accelerates document processing, ensuring timely submissions.

-

What are the pricing options for airSlate SignNow for Michigan Department Of Treasury, Page 1 services?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes dealing with the Michigan Department Of Treasury, Page 1. The contributions include customizable packages allowing users to select features that meet their specific document signing needs.

-

What features does airSlate SignNow provide for handling documents related to the Michigan Department Of Treasury, Page 1?

airSlate SignNow offers multiple features such as customizable templates, bulk sending, and real-time tracking for documents related to the Michigan Department Of Treasury, Page 1. These features enhance efficiency, ensuring that every document is properly managed and legally compliant.

-

How can airSlate SignNow benefit my business in managing Michigan Department Of Treasury, Page 1 forms?

Using airSlate SignNow to manage Michigan Department Of Treasury, Page 1 forms can streamline your workflow and reduce processing time signNowly. It enhances accuracy and minimizes errors, which is crucial for maintaining compliance with state regulations.

-

Is airSlate SignNow compliant with Michigan Department Of Treasury, Page 1 requirements?

Yes, airSlate SignNow is fully compliant with the requirements set forth by the Michigan Department Of Treasury, Page 1. The platform ensures that all electronic signatures meet legal standards necessary for official submissions.

-

Can I access airSlate SignNow from any device while dealing with the Michigan Department Of Treasury, Page 1?

Absolutely! airSlate SignNow is accessible from any device - be it a computer, tablet, or smartphone. This flexibility allows you to manage and eSign documents for the Michigan Department Of Treasury, Page 1 anytime and anywhere.

Get more for Michigan Department Of Treasury, Page 1

Find out other Michigan Department Of Treasury, Page 1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors