Form 4506 Rev November Fill in Capable Request for Copy of Tax Return

What is the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return

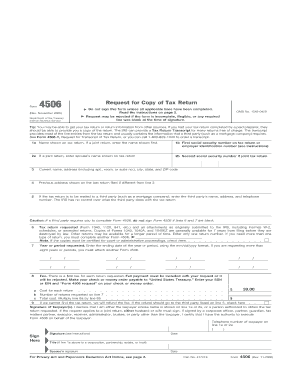

The Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return is an official document used by taxpayers in the United States to request copies of their previously filed tax returns from the Internal Revenue Service (IRS). This form is essential for individuals who need to provide proof of income or tax information for various purposes, such as applying for loans, mortgages, or financial aid. The form allows taxpayers to specify the tax years for which they are requesting copies, ensuring they receive the necessary documentation for their specific needs.

How to use the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return

Using the Form 4506 involves a straightforward process. Taxpayers should begin by downloading the form from the IRS website or accessing it through a digital platform that supports electronic filing. Once the form is obtained, individuals must fill out their personal information, including their name, Social Security number, and address. Additionally, they need to indicate the specific tax years for which they are requesting copies and provide the purpose of the request. After completing the form, taxpayers can submit it to the IRS via mail or electronically, depending on the options available.

Steps to complete the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return

Completing the Form 4506 requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or a trusted source.

- Fill in your name, Social Security number, and address accurately.

- Specify the tax years for which you need copies of your tax returns.

- Indicate the purpose of your request in the designated section.

- Sign and date the form to certify that the information provided is correct.

- Submit the completed form to the IRS via the preferred submission method.

Required Documents

When submitting the Form 4506, taxpayers must ensure they include any necessary documentation that may support their request. This may include a copy of a valid identification document, such as a driver's license or passport, to verify identity. If the request is made by a third party, a power of attorney or authorization form may also be required to ensure compliance with privacy regulations.

Form Submission Methods

Taxpayers have several options for submitting the Form 4506. The primary methods include:

- Mail: Send the completed form to the appropriate IRS address based on the state of residence.

- Online: Use electronic filing options available through authorized e-filing providers that support the submission of Form 4506.

- In-Person: Visit a local IRS office to submit the form directly, although this option may require an appointment.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4506. Taxpayers should ensure they follow the instructions carefully to avoid delays in processing. It is important to check for any updates or changes to the form or submission process, as the IRS may revise requirements periodically. Adhering to these guidelines helps ensure that the request is processed efficiently and that the taxpayer receives the requested documents in a timely manner.

Quick guide on how to complete form 4506 rev november fill in capable request for copy of tax return

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to edit and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools available through airSlate SignNow designed specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 4506 rev november fill in capable request for copy of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return used for?

The Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return is used to request a copy of your tax return from the IRS. This form is essential for individuals and businesses needing to retrieve past tax documents for various purposes, such as loan applications or audit support. By using airSlate SignNow, you can easily fill out and submit this form with eSignature capabilities.

-

How does airSlate SignNow simplify the process of using the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return?

airSlate SignNow provides an intuitive platform that allows you to fill out the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return quickly and efficiently. You can sign and send your completed forms in just a few clicks. This not only saves time but also reduces the potential for errors during the submission process.

-

Are there any costs associated with using airSlate SignNow for the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return?

Yes, airSlate SignNow operates on a subscription model, offering various pricing plans based on your needs. These plans grant you access to features that facilitate the filling and signing of documents like the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return. Check our pricing page for specific details and to find the plan that best suits your business.

-

Can I integrate airSlate SignNow with other applications when filling out the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, allowing you to streamline your workflow when working with the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return. Whether you use CRM systems or cloud storage solutions, our integrations ensure that you can manage your documents effectively.

-

What security measures does airSlate SignNow have in place for the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return?

airSlate SignNow prioritizes the security of your documents, including the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return. We implement robust encryption and follow strict compliance protocols to ensure that your data remains safe throughout the eSigning and document management process. You can trust that your personal information is protected.

-

Is it possible to track the status of my Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return once submitted through airSlate SignNow?

Yes, you can conveniently track the status of your Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return after submission through airSlate SignNow. Our platform offers real-time updates and notifications so you can stay informed about the progress of your request and any actions needed.

-

What types of businesses can benefit from using the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return through airSlate SignNow?

All types of businesses can benefit from using the Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return through airSlate SignNow. Whether you're a small business or a large corporation, having easy access to tax records is essential for financial planning, audits, and compliance purposes. Our eSignature solution makes this process straightforward for everyone.

Get more for Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return

Find out other Form 4506 Rev November Fill In Capable Request For Copy Of Tax Return

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation