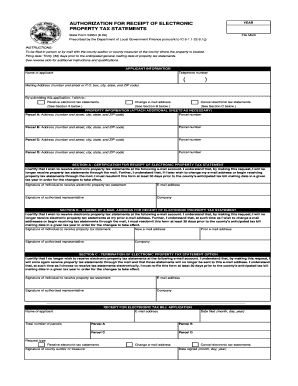

AUTHORIZATION for RECEIPT of ELECTRONIC PROPERTY TAX Indy Form

What is the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

The AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy is a form that allows property owners in Indianapolis to opt for electronic delivery of their property tax statements. This authorization streamlines the process of receiving tax documents, ensuring that property owners can access their information quickly and efficiently. By opting for electronic delivery, taxpayers can reduce paper waste and stay organized, receiving notifications directly to their email or preferred digital platform.

How to use the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

Using the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy involves a few straightforward steps. First, property owners need to complete the form with their personal and property information. Next, they must provide an email address where they wish to receive notifications and tax statements. After filling out the form, it should be submitted to the appropriate local tax authority, either online or via mail, depending on the submission methods available in their area.

Steps to complete the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

Completing the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy involves several key steps:

- Obtain the form from the local tax authority or their website.

- Fill in your name, address, and property details accurately.

- Provide a valid email address for electronic delivery.

- Sign and date the form to confirm your authorization.

- Submit the completed form as per the instructions provided.

Legal use of the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

The legal use of the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy ensures that property owners consent to receive their tax information electronically. This consent is critical as it aligns with federal and state regulations regarding electronic communications. By signing this form, property owners acknowledge their understanding of the implications of receiving electronic documents and affirm their right to access their tax information in a digital format.

Key elements of the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

Key elements of the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy include:

- Property owner's full name and contact information.

- Property address for which the authorization applies.

- Email address for receiving electronic notifications.

- Signature of the property owner to validate the authorization.

- Date of submission to establish a record of consent.

Eligibility Criteria

To be eligible for the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy, property owners must own real estate within Indianapolis and have a valid email address. Additionally, they should be in good standing with their property tax obligations. This ensures that they can receive timely notifications and updates regarding their tax statements without any interruptions.

Quick guide on how to complete authorization for receipt of electronic property tax indy

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed files, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

Create this form in 5 minutes!

How to create an eSignature for the authorization for receipt of electronic property tax indy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy?

The AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy is a crucial document that allows taxpayers to manage their electronic property tax payments efficiently. This authorization ensures that all communications and transactions related to your property tax are handled online, providing speed and convenience.

-

How can airSlate SignNow help me with the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy?

Using airSlate SignNow, you can easily prepare, send, and eSign your AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy in minutes. Our platform offers a user-friendly interface that simplifies the signing process, making it accessible for everyone, regardless of technical expertise.

-

What features does airSlate SignNow offer for managing electronic property tax documents?

airSlate SignNow provides a range of features for managing your AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy, including secure eSignatures, templates, and automated reminders. These tools help ensure that you never miss a deadline and that your documents remain organized and easily accessible.

-

Is airSlate SignNow affordable for small businesses handling property taxes?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy. We offer flexible pricing plans that cater to different budgets without compromising on the quality of our services.

-

Can I integrate airSlate SignNow with other applications for property tax management?

Absolutely! airSlate SignNow seamlessly integrates with various applications used for property tax management, allowing you to streamline your workflow. This means you can easily sync your AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy with accounting software or CRM systems for better efficiency.

-

What are the benefits of using airSlate SignNow for my property tax documents?

The benefits of using airSlate SignNow for your AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy include improved document security, time savings, and enhanced compliance. By digitizing your workflow, you reduce paper use, minimize errors, and ensure that your documents are processed promptly.

-

How secure is the process of signing the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy through airSlate SignNow?

The process of signing the AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy through airSlate SignNow is highly secure. We employ advanced encryption methods and adhere to strict privacy standards, ensuring that your sensitive information remains confidential and protected throughout the signing process.

Get more for AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

Find out other AUTHORIZATION FOR RECEIPT OF ELECTRONIC PROPERTY TAX Indy

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation