IA 1065 Partnership Return of Income, 41 016 2016

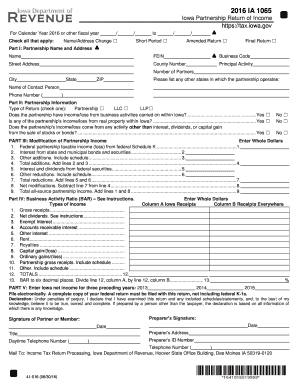

What is the IA 1065 Partnership Return Of Income?

The IA 1065 form, officially known as the Partnership Return of Income, is a tax document used by partnerships in Iowa to report income, deductions, and credits. This form is essential for partnerships to comply with state tax regulations. It provides a comprehensive overview of the partnership's financial activities over the tax year and is crucial for accurate tax reporting. Each partner's share of income and deductions is also reported on this form, which is necessary for their individual tax returns.

Steps to complete the IA 1065 Partnership Return Of Income

Completing the IA 1065 form involves several key steps:

- Gather financial records, including income statements, expense reports, and any relevant documentation for deductions.

- Fill out the partnership information section, including the partnership's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Detail all deductions, such as operating expenses, salaries, and other allowable deductions.

- Calculate the partnership's net income or loss and allocate each partner's share accordingly.

- Review the completed form for accuracy and ensure all necessary signatures are included.

- Submit the form by the designated filing deadline.

Key elements of the IA 1065 Partnership Return Of Income

The IA 1065 form includes several critical components:

- Partnership Information: Basic details about the partnership, including the name, address, and EIN.

- Income Reporting: A section to report all sources of income, ensuring accurate tax liability assessment.

- Deductions: A comprehensive list of allowable deductions that can reduce taxable income.

- Partner Allocations: A breakdown of each partner's share of income, deductions, and credits.

- Signature Section: Required signatures from partners to validate the form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IA 1065 form is crucial for compliance. Typically, the form is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form must be filed by March 15. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties.

Legal use of the IA 1065 Partnership Return Of Income

The IA 1065 form serves a legal purpose in the context of tax compliance. Partnerships are required to file this form to report their income and deductions accurately. Failure to file can result in penalties and interest on unpaid taxes. Additionally, the information reported on the IA 1065 is used by the Iowa Department of Revenue to assess the tax liability of each partner, making it a critical document for both the partnership and individual partners.

How to obtain the IA 1065 Partnership Return Of Income

The IA 1065 form can be obtained through the Iowa Department of Revenue's official website. It is available for download in PDF format, allowing easy access for businesses. Additionally, many tax preparation software programs include the IA 1065 form, streamlining the process for partnerships looking to file electronically. Ensuring you have the most current version of the form is important for compliance with state regulations.

Quick guide on how to complete ia 1065 partnership return of income 41 016

Accomplish IA 1065 Partnership Return Of Income, 41 016 easily on any gadget

Digital document administration has become increasingly favored by organizations and individuals alike. It serves as an excellent eco-conscious substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate format and securely preserve it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents rapidly without delays. Manage IA 1065 Partnership Return Of Income, 41 016 on any device with airSlate SignNow’s Android or iOS applications and streamline any document-centric task today.

The easiest way to modify and electronically sign IA 1065 Partnership Return Of Income, 41 016 effortlessly

- Obtain IA 1065 Partnership Return Of Income, 41 016 and then click Get Form to initiate.

- Utilize the tools we supply to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal standing as a traditional wet ink signature.

- Review the details carefully and then click on the Done button to save your changes.

- Choose how you would like to submit your form, by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign IA 1065 Partnership Return Of Income, 41 016 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 1065 partnership return of income 41 016

Create this form in 5 minutes!

How to create an eSignature for the ia 1065 partnership return of income 41 016

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ia 1065 form and why is it important?

The ia 1065 form is a partnership income tax return required in the state of Iowa. It is essential for partnerships operating in Iowa to report their income, gains, losses, and expenses accurately. Submitting the ia 1065 form ensures compliance with state tax laws and helps avoid penalties.

-

How does airSlate SignNow simplify the submission of the ia 1065 form?

airSlate SignNow streamlines the submission process of the ia 1065 form by allowing users to eSign and send documents securely. Our platform provides templates and easy document management, making it simple to fill out and submit your ia 1065 form quickly and efficiently.

-

What features does airSlate SignNow offer for managing the ia 1065 form?

airSlate SignNow offers key features such as eSigning, document sharing, and real-time collaboration for managing the ia 1065 form. These tools enhance efficiency, reduce errors, and ensure that your form is completed accurately and promptly.

-

Is there a cost associated with using airSlate SignNow for the ia 1065 form?

Yes, airSlate SignNow offers various pricing plans depending on your needs. Each plan provides access to essential features for managing documents like the ia 1065 form at a competitive rate, ensuring value for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software I use for the ia 1065 form?

Absolutely! airSlate SignNow can integrate with various popular software tools, enabling you to sync data and streamline workflows related to the ia 1065 form. This integration ensures that all necessary information is consolidated and easily accessible.

-

How secure is my data when using airSlate SignNow for the ia 1065 form?

airSlate SignNow prioritizes the security of your data, offering encryption and stringent security measures. When you use our platform for the ia 1065 form, you can trust that your information is protected and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for the ia 1065 form?

Using airSlate SignNow for the ia 1065 form offers numerous benefits, including faster processing times, reduced paperwork, and a simplified filing process. Our digital solution not only saves you time but also helps improve accuracy and compliance.

Get more for IA 1065 Partnership Return Of Income, 41 016

Find out other IA 1065 Partnership Return Of Income, 41 016

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form