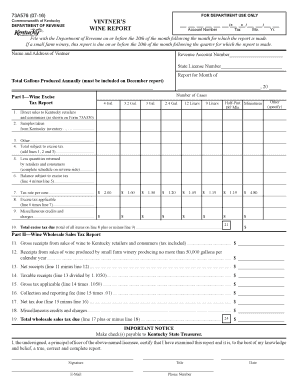

If a Small Farm Winery, This Report is Due on or Before the 20th of the Month Following the Quarter for Which the Report is Made 2016

What is the If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made

The form titled "If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made" is a regulatory document required for small farm wineries in the United States. This report serves to ensure compliance with state and federal regulations regarding the production and sale of wine. It typically includes details about production volumes, sales figures, and other relevant financial information that must be reported quarterly.

Steps to complete the If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made

Completing this report involves a series of steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and production logs. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect the correct reporting period. After completing the form, review it for any errors before signing. Finally, submit the report by the deadline, which is the 20th of the month following the quarter being reported.

Legal use of the If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made

This report is legally binding and must be completed in accordance with state and federal laws governing wineries. It is essential for maintaining compliance with the Alcohol and Tobacco Tax and Trade Bureau (TTB) regulations. Failure to submit this report on time can result in penalties, including fines and potential loss of licensing for the winery.

Filing Deadlines / Important Dates

Timely submission of this report is crucial. The deadline for filing is the 20th of the month following the end of each quarter. For example, for the first quarter ending on March 31, the report is due by April 20. It is important to mark these dates on your calendar to avoid any late submissions that could incur penalties.

Required Documents

To complete the report accurately, certain documents are required. These typically include:

- Sales records from the reporting quarter

- Production logs detailing the volume of wine produced

- Any relevant financial statements

- Previous reports for reference

Having these documents organized will streamline the process of filling out the report.

Form Submission Methods (Online / Mail / In-Person)

The report can be submitted through various methods. Many wineries opt for online submission, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate regulatory body or submitted in person at designated offices. It is advisable to keep a copy of the submitted report for your records, regardless of the submission method chosen.

Quick guide on how to complete if a small farm winery this report is due on or before the 20th of the month following the quarter for which the report is made

Your assistance manual on how to prepare your If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made

If you’re wondering how to create and submit your If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made, here are some straightforward guidelines to make tax submission easier.

To begin, you only need to sign up for your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to edit, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify details as necessary. Streamline your tax management with advanced PDF editing, electronic signing, and easy sharing.

Follow the instructions below to complete your If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made in just a few minutes:

- Create your account and start managing PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; browse through various versions and schedules.

- Click Get form to access your If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to return errors and delay refunds. Of course, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct if a small farm winery this report is due on or before the 20th of the month following the quarter for which the report is made

FAQs

-

After any small argument I tend to overthink about situations which may or may not be, for ex. if I argued with some moron driver on the way, I keep overthinking, is there a way to come out of this as I feel I'm wasting lot of time doing this?

I also have same exact problem. The only workable solution to this is to avoid any arguments with anyone. Keeping our cool, and not allowing the other person to take over our emotions requires quite a bit of practice and presence of mind. But the possibility of such a capability is not beyond anybody’s signNow. Just keep working for it. Listen to Sadguru’s videos, you will get some ideas of ‘inner engineering’!

-

How can I find out if a TV channel (AMC, to get "The Walking Dead") is available over-the-air BEFORE I have the big outdoor antenna installed (or sign up for Hulu)? Is there a map of which OTA channels are available based on where you live in U.S.?

Go to antennaweb.org, enter your addressAddressYou will get a list of channels depending on the strength of your antenna (color coded)

-

How can I find out which of my files have been sent via Bluetooth on the iPhone? For instance, if I think that some of my videos or pictures have been sent to another phone via Bluetooth, is there a way for me to check this?

iOS does not support traditional Bluetooth file transfer. Instead, it uses other methods and technologies like AirDrop which you would have to initiate.What makes you think some of your videos and pictures were sent to another phone via Bluetooth?

Create this form in 5 minutes!

How to create an eSignature for the if a small farm winery this report is due on or before the 20th of the month following the quarter for which the report is made

How to make an eSignature for your If A Small Farm Winery This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made online

How to generate an electronic signature for the If A Small Farm Winery This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made in Google Chrome

How to generate an eSignature for putting it on the If A Small Farm Winery This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made in Gmail

How to make an eSignature for the If A Small Farm Winery This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made from your mobile device

How to generate an eSignature for the If A Small Farm Winery This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made on iOS

How to create an electronic signature for the If A Small Farm Winery This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made on Android devices

People also ask

-

What is the significance of the report due date for small farm wineries?

If a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made. Timely submission is crucial for compliance with state regulations and to avoid penalties. Proper management of this deadline can help wineries stay organized and maintain good standing with regulatory bodies.

-

How can airSlate SignNow help small farm wineries manage their reporting requirements?

With airSlate SignNow, small farm wineries can easily eSign and send documents, including required reports. If a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made, and our platform ensures that you can prepare and submit these documents on time. The user-friendly interface makes it simple to track deadlines and manage documentation efficiently.

-

What features does airSlate SignNow offer for small farm wineries?

airSlate SignNow provides a range of features tailored for small farm wineries, including eSignature capabilities, document templates, and seamless integrations. If a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made, and our platform allows you to automate reminders for these deadlines. Additionally, you can securely store and share documents with ease.

-

Is airSlate SignNow cost-effective for small farm wineries?

Yes, airSlate SignNow is designed to be a cost-effective solution for small farm wineries looking to streamline their documentation processes. With flexible pricing plans, you can choose the option that best fits your budget while ensuring compliance with regulations, such as ensuring that if a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made.

-

Can airSlate SignNow integrate with other tools used by small farm wineries?

Absolutely! airSlate SignNow offers integrations with various tools commonly used by small farm wineries, such as accounting software and customer relationship management (CRM) systems. This compatibility ensures that if a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made, all related documents can be easily accessed and managed in one place.

-

How does airSlate SignNow ensure the security of documents for small farm wineries?

Security is a top priority for airSlate SignNow. We use advanced encryption protocols and compliance with industry standards to protect sensitive documents for small farm wineries. When preparing reports, such as if a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made, you can trust that your information is secure and confidential.

-

What benefits can small farm wineries expect from using airSlate SignNow?

Small farm wineries can expect numerous benefits from using airSlate SignNow, including increased efficiency, reduced paper clutter, and improved compliance with reporting deadlines. If a small farm winery, this report is due on or before the 20th of the month following the quarter for which the report is made, our platform streamlines the process, allowing wineries to focus more on their core business operations rather than paperwork.

Get more for If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made

Find out other If A Small Farm Winery, This Report Is Due On Or Before The 20th Of The Month Following The Quarter For Which The Report Is Made

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement