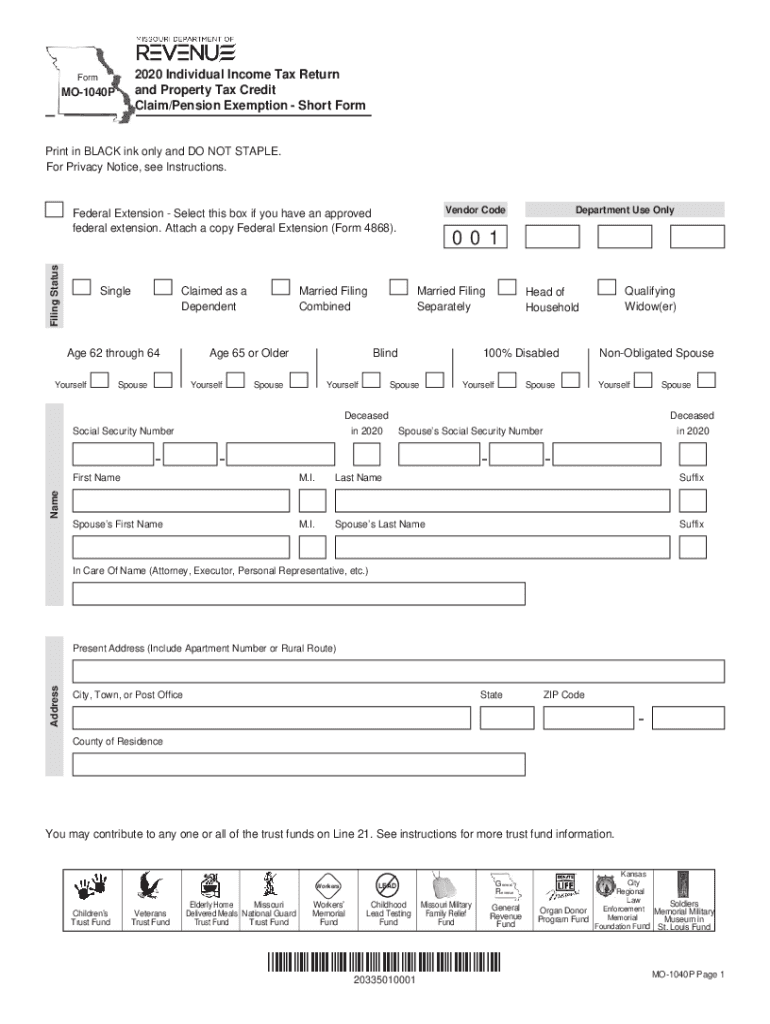

Mo 1040p Form

What is the Mo 1040p?

The Mo 1040p is a tax form used by residents of Missouri to claim a property tax credit. This form is specifically designed for individuals who meet certain eligibility criteria, allowing them to receive a credit against their state income tax based on property taxes paid. The Mo 1040p is essential for those looking to reduce their tax burden and ensure compliance with state tax regulations.

How to use the Mo 1040p

Using the Mo 1040p involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility based on income and property ownership criteria. Once eligibility is confirmed, they should gather necessary documentation, such as proof of property taxes paid. The completed form must then be submitted to the Missouri Department of Revenue, either electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Mo 1040p

Completing the Mo 1040p requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including proof of property tax payments and income statements.

- Fill out the form accurately, ensuring all personal information and financial details are correct.

- Calculate the credit amount based on the guidelines provided for property taxes paid.

- Review the completed form for any errors or omissions.

- Submit the form to the Missouri Department of Revenue by the specified deadline.

Eligibility Criteria

To qualify for the Mo 1040p credit, taxpayers must meet specific eligibility criteria. Generally, applicants must be Missouri residents, have a qualifying income level, and own or rent property in the state. Additionally, the property must be the applicant's primary residence. Understanding these criteria is crucial for successfully claiming the credit.

Required Documents

When filling out the Mo 1040p, certain documents are required to support the claim. These typically include:

- Proof of property tax payments, such as receipts or tax bills.

- Income documentation, including W-2 forms or other income statements.

- Identification documents, such as a driver's license or Social Security number.

Filing Deadlines / Important Dates

Filing deadlines for the Mo 1040p are essential to ensure timely submission and avoid penalties. Typically, the form must be filed by April fifteenth of the year following the tax year. It is important for taxpayers to be aware of any changes to these dates, as they may vary from year to year.

Quick guide on how to complete mo 1040p 538433486

Complete Mo 1040p effortlessly on all devices

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the functionalities required to create, modify, and electronically sign your documents swiftly and without delays. Manage Mo 1040p on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign Mo 1040p with ease

- Find Mo 1040p and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, a process that takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mo 1040p and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 1040p 538433486

Create this form in 5 minutes!

How to create an eSignature for the mo 1040p 538433486

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo mo1040p credit?

The mo mo1040p credit refers to a specific tax credit available to eligible taxpayers. This credit can reduce your tax liability, making it beneficial when preparing your tax forms. For businesses utilizing airSlate SignNow, understanding this credit can enhance financial planning and document preparation.

-

How does airSlate SignNow help with applying for the mo mo1040p credit?

airSlate SignNow simplifies the process of gathering and signing the necessary documents for the mo mo1040p credit. With our eSignature capabilities, you can efficiently manage your tax paperwork, ensuring everything is submitted on time. This streamlining can save both time and resources as you work through your tax obligations.

-

Are there any costs associated with using airSlate SignNow for the mo mo1040p credit?

Using airSlate SignNow involves a subscription fee, but it provides a cost-effective solution for managing documents related to the mo mo1040p credit. The investment often pays off by minimizing errors and enhancing efficiency in your tax filing process. We offer various plans to suit different business needs, ensuring value for your investment.

-

What features of airSlate SignNow are beneficial for managing mo mo1040p credit documents?

airSlate SignNow offers features like customizable templates, secure cloud storage, and real-time tracking, which are crucial for managing mo mo1040p credit documents. These tools ensure that your records are organized, easily accessible, and securely stored. This enhances your ability to respond quickly to tax requirements and deadlines.

-

Can I integrate airSlate SignNow with my existing accounting software to manage mo mo1040p credit efficiently?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your mo mo1040p credit efficiently. This integration means you can directly pull documents, eSign them, and store them all in one system. This reduces manual work and increases accuracy in your financial documentation.

-

What are the benefits of using airSlate SignNow for businesses regarding mo mo1040p credit?

Utilizing airSlate SignNow for your mo mo1040p credit needs streamlines the document signing and management process. This not only reduces processing time but also enhances compliance with tax regulations. Ultimately, it helps businesses focus on growth while ensuring their tax affairs, including credits like the mo mo1040p, are handled efficiently.

-

Is there customer support available for questions related to the mo mo1040p credit when using airSlate SignNow?

Yes, airSlate SignNow provides robust customer support for any inquiries related to the mo mo1040p credit. Whether you need help with document preparation or technical support, our team is available to assist you. This ensures that you can navigate the complexities of tax credits and filings with confidence.

Get more for Mo 1040p

- Entry of default wyoming form

- Request for setting wyoming form

- Order setting divorce trial and requiring pretrial statements wyoming form

- Required pretrial disclosures in divorce actions wyoming form

- Divorce with children form

- Vital statistics form state of wyoming department of health absolute divorce or annulment for plaintiff without children wyoming

- Complaint for divorce for plaintiff without children wyoming form

- Summons wyoming form

Find out other Mo 1040p

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online