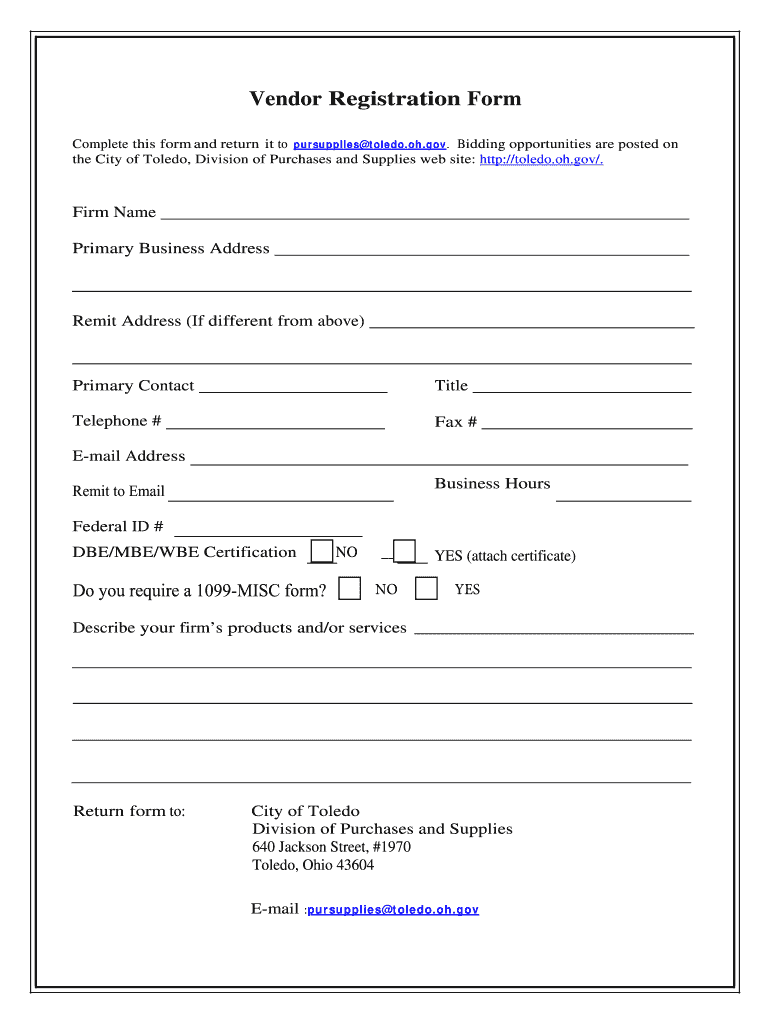

Complete This Form and Return it to Pursuppliestoledo

Understanding the W-9 Form

The W-9 form is a crucial document used in the United States for tax purposes. It is primarily utilized by businesses to request the taxpayer identification number (TIN) of individuals and entities they pay. This form is essential for freelancers, contractors, and vendors who provide services to businesses, as it helps ensure accurate reporting of income to the Internal Revenue Service (IRS).

When a business needs to report payments made to a contractor or vendor, it requires a completed W-9 form to collect the necessary information. This includes the name, business name (if applicable), address, and TIN of the payee. The information on the W-9 is used to prepare tax documents such as the 1099 form, which reports non-employee compensation.

Steps to Complete the W-9 Form

Filling out the W-9 form is straightforward. Here are the steps to ensure it is completed accurately:

- Provide your name: Enter your legal name as it appears on your tax return.

- Business name (if applicable): If you operate under a different business name, include it in this section.

- Select your tax classification: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Enter your address: Provide your complete mailing address, including city, state, and ZIP code.

- Taxpayer Identification Number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Signature and date: Sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Form

The W-9 form serves a specific legal purpose in the context of U.S. tax law. It is used to certify a taxpayer's TIN and to confirm that they are not subject to backup withholding. This form is essential for businesses that need to report payments to the IRS accurately. Failure to provide a completed W-9 can result in backup withholding, where the payer must withhold a percentage of payments made to the payee for tax purposes.

Additionally, the information on the W-9 must be kept confidential and used solely for tax reporting purposes. Misuse of this information can lead to legal consequences for both the payer and the payee.

Filing Deadlines and Important Dates

While the W-9 form itself does not have a filing deadline, it is crucial for timely tax reporting. Businesses typically request a completed W-9 from contractors or vendors before issuing any payments. The information collected from the W-9 is used to prepare 1099 forms, which must be filed with the IRS by January thirty-first of the following year.

For example, if a business pays a contractor in twenty twenty-three, they need to collect the W-9 form by the end of that year to ensure they can file the corresponding 1099 by the deadline in January twenty-four.

Form Submission Methods

The W-9 form can be submitted in various ways, depending on the preferences of the payer and payee. Common submission methods include:

- Email: The completed W-9 can be scanned and emailed directly to the requesting party.

- Mail: A physical copy of the W-9 can be mailed to the business requesting it.

- In-person: The form can be filled out and submitted in person, especially in cases where immediate processing is needed.

It is important to ensure that the submission method chosen maintains the confidentiality and security of the personal information included in the W-9.

Taxpayer Scenarios for the W-9 Form

Different taxpayer scenarios may require the use of the W-9 form. Here are some common situations:

- Freelancers and independent contractors: Individuals providing services to businesses often need to complete a W-9 to receive payment.

- Partnerships and LLCs: These entities may also need to provide a W-9 to report income accurately.

- Retirees receiving pension payments: Some retirees may need to submit a W-9 if they receive income from pensions or annuities.

Understanding these scenarios helps ensure that the correct information is provided and that all parties comply with tax regulations.

Quick guide on how to complete complete this form and return it to pursuppliestoledo

Prepare Complete This Form And Return It To Pursuppliestoledo effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle Complete This Form And Return It To Pursuppliestoledo on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and electronically sign Complete This Form And Return It To Pursuppliestoledo with ease

- Obtain Complete This Form And Return It To Pursuppliestoledo and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Complete This Form And Return It To Pursuppliestoledo and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the complete this form and return it to pursuppliestoledo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-9 form, and when should I use it?

A W-9 form is a document used in the United States by businesses to request the tax identification number and certification of a taxpayer. You should use it when you are offering work or services to a client who needs to report payments to the IRS. By providing a completed W-9 form, you ensure compliance and proper tax reporting.

-

How can airSlate SignNow help me manage W-9 forms?

airSlate SignNow allows you to easily create, send, and eSign W-9 forms securely online. With our platform, you can streamline the process of collecting necessary tax information, reducing manual errors and saving valuable time. This is particularly beneficial for businesses that regularly handle multiple W-9 forms.

-

Is airSlate SignNow cost-effective for handling W-9 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing W-9 forms. With transparent pricing plans, you can send and manage documents without incurring hidden fees. This allows businesses of all sizes to efficiently handle their documentation needs while staying within budget.

-

What features does airSlate SignNow offer for W-9 form management?

airSlate SignNow provides features such as customizable W-9 templates, easy eSignature capabilities, and real-time tracking of document status. You can also set reminders for pending forms, ensuring that no W-9 forms are left unprocessed. These features enhance efficiency and make W-9 management straightforward.

-

Can I integrate airSlate SignNow with my existing software for W-9 forms?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, including CRM and accounting tools, making it easier to manage W-9 forms as part of your workflow. This integration helps automate the data entry process and keeps your documents organized across platforms.

-

What are the benefits of using airSlate SignNow for W-9 forms?

Using airSlate SignNow for W-9 forms offers several benefits, including enhanced security, time savings, and improved accuracy. Our platform ensures all W-9 forms are securely stored and accessed when needed, while automated workflows minimize the risk of errors. This allows you to focus more on your core business operations.

-

Is my data safe when using airSlate SignNow for W-9 forms?

Yes, your data is safe with airSlate SignNow. We implement industry-standard security measures including encryption and secure data storage to protect your W-9 forms and personal information. Your peace of mind is our priority, allowing you to handle sensitive documents with confidence.

Get more for Complete This Form And Return It To Pursuppliestoledo

- Acknowledgment of satisfaction of lien individual montana form

- Quitclaim deed from husband and wife to llc montana form

- Warranty deed from husband and wife to llc montana form

- Montana satisfaction of judgment montana form

- Mt corporation form

- Conditional waiver and release of lien upon progress payment montana form

- Letter from landlord to tenant as notice to remove wild animals in premises montana form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises montana form

Find out other Complete This Form And Return It To Pursuppliestoledo

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors