Business Loan Application 042011 Form

What is the Business Loan Application 042011

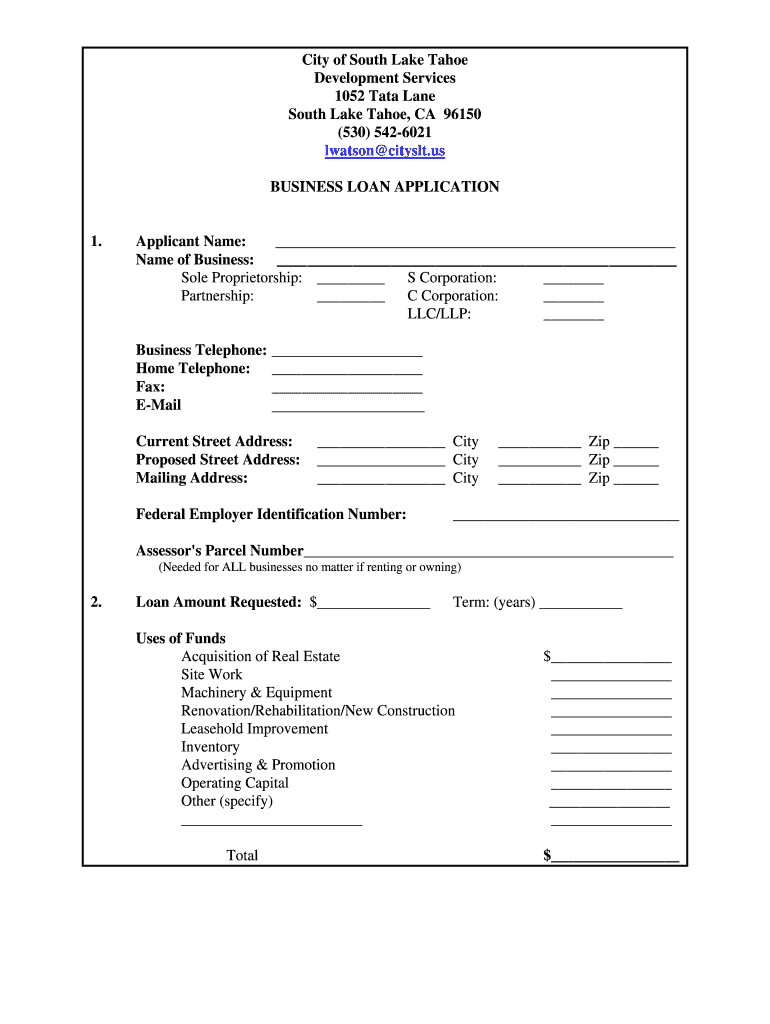

The Business Loan Application 042011 is a standardized form used by businesses in the United States to apply for financing. This application collects essential information about the business, including its financial status, ownership structure, and purpose for the loan. It is typically required by lenders to assess the creditworthiness of a business and determine the appropriate loan amount and terms. Understanding this form is crucial for any business seeking financial support to ensure that all necessary information is accurately provided.

Key Elements of the Business Loan Application 042011

Several critical components make up the Business Loan Application 042011. These include:

- Business Information: This section requires details such as the business name, address, and type of entity (e.g., LLC, corporation).

- Financial Statements: Applicants must provide recent financial statements, including balance sheets and income statements, to demonstrate the business's financial health.

- Loan Purpose: A clear explanation of how the loan funds will be used is necessary, whether for expansion, equipment purchase, or operational costs.

- Owner Information: Personal details about the business owners, including their credit history and financial background, are often required.

Steps to Complete the Business Loan Application 042011

Completing the Business Loan Application 042011 involves several important steps:

- Gather Required Documents: Collect all necessary financial documents, including tax returns, bank statements, and business licenses.

- Fill Out the Application: Carefully complete each section of the application, ensuring that all information is accurate and up-to-date.

- Review the Application: Double-check the application for any errors or omissions that could affect the approval process.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person, and send the application to the lender.

Required Documents for the Business Loan Application 042011

To successfully complete the Business Loan Application 042011, several documents are typically required:

- Business Financial Statements: Recent profit and loss statements, balance sheets, and cash flow statements.

- Tax Returns: Personal and business tax returns for the past two to three years.

- Business Plan: A detailed business plan outlining the business model, market analysis, and financial projections.

- Ownership Documentation: Information about the owners, including personal identification and ownership percentages.

Application Process & Approval Time

The application process for the Business Loan Application 042011 can vary depending on the lender, but generally follows these steps:

- Submission: After submitting the completed application and required documents, the lender will begin the review process.

- Underwriting: The lender assesses the application, evaluating the business's financial health and creditworthiness.

- Decision: The lender will make a decision regarding the loan approval, which can take anywhere from a few days to several weeks.

- Funding: If approved, the funds will be disbursed according to the agreed-upon terms.

Eligibility Criteria for the Business Loan Application 042011

Eligibility for the Business Loan Application 042011 typically depends on several factors, including:

- Business Type: Certain lenders may have specific requirements based on the type of business entity.

- Credit Score: A strong personal and business credit score is often necessary to qualify for favorable loan terms.

- Time in Business: Lenders may prefer businesses that have been operational for a minimum period, often two years or more.

- Revenue Levels: Consistent revenue generation is crucial, as lenders want to ensure the business can repay the loan.

Quick guide on how to complete business loan application 042011

Complete Business Loan Application 042011 effortlessly on any device

Online document handling has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Business Loan Application 042011 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Business Loan Application 042011 without any hassle

- Find Business Loan Application 042011 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Business Loan Application 042011 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business loan application 042011

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Business Loan Application 042011 process?

The Business Loan Application 042011 process is simple and streamlined. With airSlate SignNow, businesses can fill out and eSign their loan applications electronically, reducing processing time signNowly. This user-friendly platform ensures that all necessary documents are gathered efficiently and securely.

-

How much does it cost to use airSlate SignNow for my Business Loan Application 042011?

The pricing for using airSlate SignNow to manage your Business Loan Application 042011 is competitive and tailored to suit various business needs. We offer multiple subscription plans with flexible options, ensuring businesses can select a plan that aligns with their budget and usage requirements. Contact us for a customized quote.

-

What features does airSlate SignNow offer for the Business Loan Application 042011?

airSlate SignNow includes numerous features for the Business Loan Application 042011, such as customizable templates, real-time tracking, and secure electronic signatures. You can easily collaborate with team members and stakeholders to finalize your application. Our platform is designed to enhance productivity while ensuring compliance.

-

How can I integrate airSlate SignNow with other tools for my Business Loan Application 042011?

airSlate SignNow offers seamless integrations with a variety of tools and applications that can assist in managing your Business Loan Application 042011. Whether you're using CRM systems, accounting software, or cloud storage solutions, our platform is designed to work harmoniously with your existing workflow to improve efficiency.

-

What are the benefits of using airSlate SignNow for my Business Loan Application 042011?

Using airSlate SignNow for your Business Loan Application 042011 comes with numerous benefits, such as quicker turnaround times and enhanced security. The platform simplifies the paperwork involved in loan applications, allowing you to focus on your business operations. Additionally, eSigning eliminates the hassle of printing and scanning documents.

-

Is airSlate SignNow legally compliant for Business Loan Application 042011 signing?

Yes, airSlate SignNow is legally compliant and adheres to industry standards for electronic signatures, making it suitable for your Business Loan Application 042011. Our solution complies with the ESIGN Act and UETA regulations, ensuring that your signed documents are legally binding and secure.

-

How secure is my Business Loan Application 042011 data with airSlate SignNow?

Your data security is a top priority at airSlate SignNow. When processing your Business Loan Application 042011, we implement industry-leading encryption and security protocols to protect sensitive information. Additionally, we regularly conduct security audits to ensure data integrity and compliance with privacy regulations.

Get more for Business Loan Application 042011

- Roofing contract for contractor vermont form

- Electrical contract for contractor vermont form

- Sheetrock drywall contract for contractor vermont form

- Flooring contract for contractor vermont form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract vermont form

- Notice of intent to enforce forfeiture provisions of contact for deed vermont form

- Final notice of forfeiture and request to vacate property under contract for deed vermont form

- Buyers request for accounting from seller under contract for deed vermont form

Find out other Business Loan Application 042011

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document