Form CT 3 AC Tax Ny 2014-2026

What is the Form CT 3 AC Tax NY

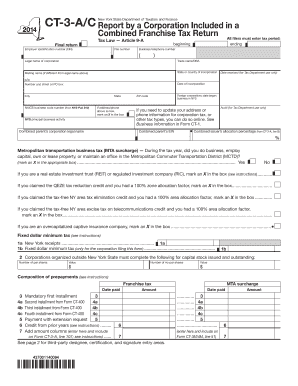

The Form CT 3 AC is a tax form used by corporations in New York State to report their franchise tax. This form is specifically designed for corporations that have a business presence in New York and are subject to the state's corporate tax laws. The CT 3 AC is part of the larger CT 3 series, which includes various forms for different types of corporate tax reporting. Understanding this form is essential for compliance with New York tax regulations.

How to Use the Form CT 3 AC Tax NY

To use the Form CT 3 AC effectively, corporations must gather all necessary financial information, including income, deductions, and credits. The form requires detailed reporting of the corporation's financial activities over the tax year. It is crucial to follow the instructions provided with the form carefully to ensure accurate reporting. Proper use of this form can help businesses avoid penalties and ensure compliance with state tax laws.

Steps to Complete the Form CT 3 AC Tax NY

Completing the Form CT 3 AC involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the identification section with the corporation's name, address, and employer identification number (EIN).

- Report total income, deductions, and any applicable credits in the designated sections.

- Calculate the franchise tax owed based on the information provided.

- Review the form for accuracy before submission.

Legal Use of the Form CT 3 AC Tax NY

The legal use of the Form CT 3 AC is essential for corporations operating in New York. Filing this form accurately and on time is a legal requirement for maintaining good standing with the New York State Department of Taxation and Finance. Failure to file or inaccuracies in the form can lead to penalties, interest on unpaid taxes, and potential legal issues. Corporations should ensure they understand their obligations under New York tax law.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form CT 3 AC to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is typically due by April 15. It's important for businesses to mark these dates on their calendars to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 3 AC can be submitted through various methods, providing flexibility for corporations. Businesses can file the form online through the New York State Department of Taxation and Finance website, which is often the quickest method. Alternatively, corporations may choose to mail a paper version of the form to the appropriate tax office. In-person submissions are also possible, though less common. Each method has its own guidelines and requirements, so it is important to follow the instructions carefully.

Quick guide on how to complete form ct 3 ac tax ny

Effortlessly prepare Form CT 3 AC Tax Ny on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Manage Form CT 3 AC Tax Ny on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form CT 3 AC Tax Ny without hassle

- Find Form CT 3 AC Tax Ny and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form CT 3 AC Tax Ny to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 ac tax ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 ac tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct3a c and how does it work with airSlate SignNow?

ct3a c is a powerful feature within airSlate SignNow that enables users to create and manage digital signatures efficiently. This tool streamlines the signing process, allowing businesses to send documents for eSignature in just a few clicks. With ct3a c, you can track document status and ensure timely completion without any hassle.

-

What pricing options are available for airSlate SignNow using ct3a c?

airSlate SignNow offers flexible pricing plans to suit different business needs, including those that utilize ct3a c. Pricing varies based on features and the number of users, allowing businesses to select a plan that fits their budget. Check our website for the most up-to-date pricing and special offers.

-

What features does ct3a c include to enhance document management?

The ct3a c feature in airSlate SignNow includes capabilities like customizable templates, automated workflows, and secure storage. These features enable users to manage their documents efficiently, ensuring that the process is seamless and organized. Additionally, ct3a c supports multiple file formats for convenience.

-

How does airSlate SignNow with ct3a c benefit businesses?

Businesses can benefit from airSlate SignNow's ct3a c by signNowly reducing the time spent on manual document handling. The ease of use and automation provided by ct3a c leads to faster turnaround times and improved customer satisfaction. Ultimately, this results in enhanced productivity and cost savings.

-

Can I integrate ct3a c with other tools and software?

Yes, airSlate SignNow offers integrations with a variety of third-party tools, including CRMs and productivity applications, to enhance the functionality of ct3a c. This ensures that your document signing and management processes are streamlined across platforms. Check our integrations page for a full list of compatible software.

-

Is ct3a c secure for handling sensitive documents?

Absolutely, ct3a c in airSlate SignNow prioritizes security by utilizing advanced encryption methods for data protection. This ensures that sensitive documents are securely transmitted and stored. Additionally, our compliance with industry standards gives users peace of mind when handling confidential information.

-

What kind of customer support is available for ct3a c users?

Users of ct3a c have access to dedicated customer support through various channels, including live chat, email, and phone support. Our team is trained to assist users with any questions or issues they may encounter. Comprehensive resources, such as guides and tutorials, are also available on our website.

Get more for Form CT 3 AC Tax Ny

- Discovery pretrial interrogatories to individual debtor minnesota form

- Power of attorney for bankruptcy proceedings minnesota form

- Interrogatories template form

- Discovery requests template form

- Original petition regarding open account minnesota form

- Motion summary judgment 497312653 form

- Minnesota interrogatories 497312654 form

- Mn subpoena form

Find out other Form CT 3 AC Tax Ny

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy