Form 4466 Rev November

What is the Form 4466 Rev November

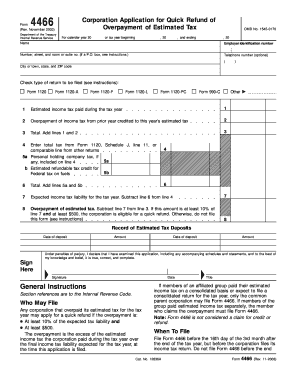

The Form 4466 Rev November is a tax form used by taxpayers in the United States to request a quick refund of an overpayment of income tax. This form is specifically designed for individuals and businesses that have overpaid their taxes and are seeking a prompt resolution. It is essential for those who expect a refund to complete this form accurately to ensure a smooth processing of their request.

How to use the Form 4466 Rev November

Using the Form 4466 Rev November involves several key steps. First, taxpayers must gather their tax information, including details of the overpayment. Next, they need to complete the form by providing necessary personal and financial details. After filling out the form, it should be submitted to the appropriate IRS office. It is important to follow the instructions carefully to avoid delays in processing the refund.

Steps to complete the Form 4466 Rev November

Completing the Form 4466 Rev November requires attention to detail. Start by entering your name, address, and Social Security number or Employer Identification Number. Then, indicate the tax year for which you are requesting a refund. Next, provide the amount of overpayment and any relevant calculations. Finally, review the form for accuracy before signing and dating it. Ensuring all information is correct will help expedite the refund process.

Filing Deadlines / Important Dates

Timely filing of the Form 4466 Rev November is crucial. Generally, the form must be submitted within a specific timeframe after the tax return is filed, typically within three years from the due date of the return. It is advisable to check the IRS guidelines for any changes to deadlines or specific dates relevant to your tax situation.

Eligibility Criteria

To be eligible to use the Form 4466 Rev November, taxpayers must have filed a tax return for the relevant year and must demonstrate that they have overpaid their taxes. This form is typically available for individuals and businesses that meet certain income thresholds and have no outstanding tax liabilities. Understanding these criteria is essential to ensure the form is applicable to your situation.

Key elements of the Form 4466 Rev November

The Form 4466 Rev November consists of several key elements that must be accurately completed. These include personal identification information, the tax year of the overpayment, the amount of the overpayment, and any relevant calculations. Additionally, the form requires the taxpayer's signature and date, confirming the accuracy of the information provided. Each section plays a vital role in processing the refund request.

Quick guide on how to complete form 4466 rev november

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] easily

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from a device of your choice. Edit and eSign [SKS] to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4466 Rev November

Create this form in 5 minutes!

How to create an eSignature for the form 4466 rev november

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4466 Rev November and why is it important?

Form 4466 Rev November is a tax form used by businesses to claim a refund of overpaid taxes. Understanding its purpose is crucial for organizations seeking to manage their tax liabilities effectively. Utilizing airSlate SignNow can streamline the eSigning process for Form 4466 Rev November, making it easier to submit electronically.

-

How can airSlate SignNow help with completing Form 4466 Rev November?

AirSlate SignNow offers an intuitive platform that allows users to fill out and sign Form 4466 Rev November quickly and securely. With its user-friendly interface, users can easily customize the form and add necessary signatures. This ensures that your submissions are timely and compliant with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for Form 4466 Rev November?

Yes, airSlate SignNow has a competitive pricing structure that suits different business needs. Users can benefit from affordable plans that enable unlimited document signing, including Form 4466 Rev November processing. The investment can lead to signNow time savings and improved workflow efficiency.

-

What features does airSlate SignNow offer for managing Form 4466 Rev November?

AirSlate SignNow provides features such as document templates, customizable workflows, and cloud storage which enhance the management of Form 4466 Rev November. Automated reminders and tracking functionalities ensure that all parties complete their tasks on time. This organized approach simplifies the eSigning process.

-

How does airSlate SignNow enhance security for Form 4466 Rev November submissions?

Security is a top priority at airSlate SignNow, especially for sensitive forms like Form 4466 Rev November. The platform employs advanced encryption protocols to protect your documents and data during transmission. Additionally, user authentication processes help maintain integrity and confidentiality.

-

Can I integrate airSlate SignNow with other software to manage Form 4466 Rev November?

Absolutely! airSlate SignNow seamlessly integrates with a variety of business applications, enhancing your ability to manage Form 4466 Rev November efficiently. Whether it’s CRM solutions, cloud storage, or other productivity tools, integrations can streamline your workflow and improve overall document management.

-

What are the benefits of using airSlate SignNow for Form 4466 Rev November?

Using airSlate SignNow for Form 4466 Rev November provides numerous benefits including reduced processing time, improved accuracy, and enhanced compliance with regulatory standards. The ability to eSign documents saves both time and resources for businesses. This efficient approach ultimately enhances the administrative experience.

Get more for Form 4466 Rev November

Find out other Form 4466 Rev November

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy