Michigan Department of Treasury 4640 Rev 12 10 Form 2018-2026

What is the Michigan Department of Treasury 4640 Rev 12 10 Form

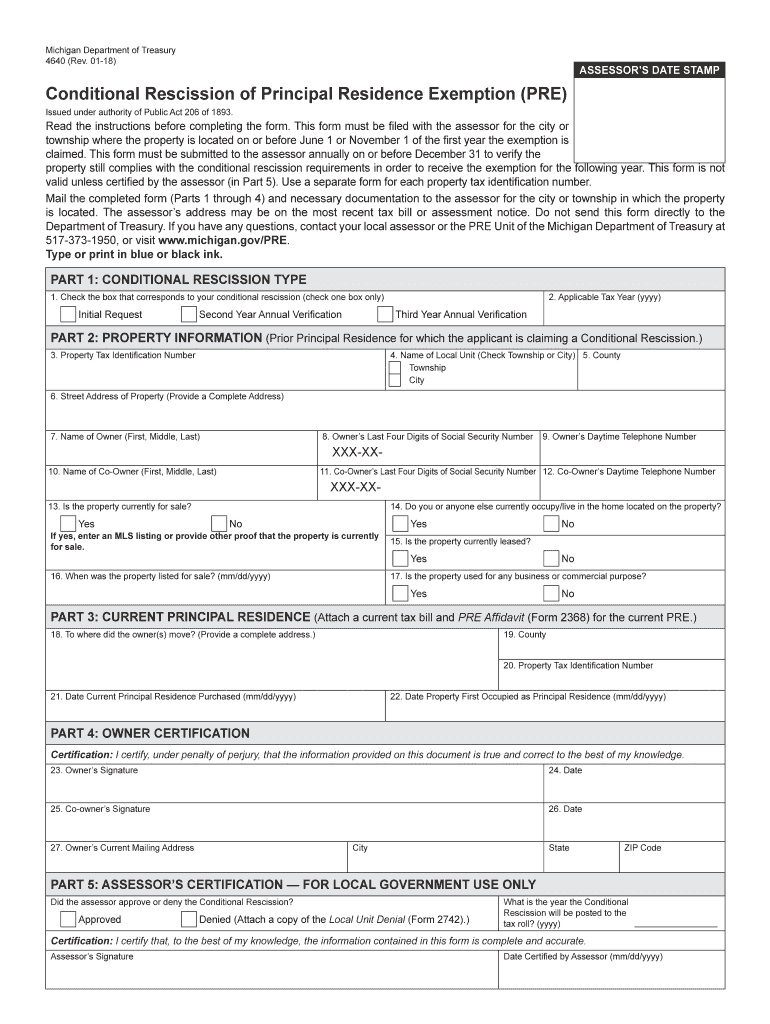

The Michigan Department of Treasury 4640 Rev 12 10 Form, commonly known as the rescission principal residence exemption form, is a crucial document for homeowners in Michigan. This form allows property owners to rescind their principal residence exemption, which can affect their property tax assessments. By submitting this form, taxpayers can ensure that their property tax classifications are accurate and reflect their current living situations.

How to Use the Michigan Department of Treasury 4640 Rev 12 10 Form

Using the Michigan Department of Treasury 4640 Rev 12 10 Form involves several straightforward steps. First, download the form from the Michigan Department of Treasury's official website or obtain a physical copy from your local assessor's office. Next, fill out the required fields, providing accurate information about your property and the reasons for rescission. Once completed, submit the form to your local tax authority to initiate the rescission process. It is important to keep a copy of the submitted form for your records.

Steps to Complete the Michigan Department of Treasury 4640 Rev 12 10 Form

Completing the Michigan Department of Treasury 4640 Rev 12 10 Form requires careful attention to detail. Follow these steps:

- Download the form from the Michigan Department of Treasury website.

- Enter your name, address, and property details accurately.

- Indicate the reason for rescinding the principal residence exemption.

- Sign and date the form to certify the information provided.

- Submit the completed form to your local tax authority by mail or in person.

Eligibility Criteria for Using the Michigan Department of Treasury 4640 Rev 12 10 Form

To use the Michigan Department of Treasury 4640 Rev 12 10 Form, property owners must meet specific eligibility criteria. The property must have previously qualified for a principal residence exemption. Additionally, the homeowner must be the owner of record and should provide valid reasons for rescinding the exemption, such as moving out of the property or converting it to a rental. It is essential to ensure that all information is accurate to avoid delays in processing.

Legal Use of the Michigan Department of Treasury 4640 Rev 12 10 Form

The Michigan Department of Treasury 4640 Rev 12 10 Form is legally recognized and must be used in accordance with state regulations. Submitting this form correctly ensures compliance with Michigan tax laws and helps maintain accurate property tax assessments. Failure to properly rescind the exemption can lead to incorrect tax calculations, which may result in penalties or increased tax liabilities.

Form Submission Methods

The Michigan Department of Treasury 4640 Rev 12 10 Form can be submitted through various methods. Homeowners can mail the completed form to their local tax authority or deliver it in person. It is advisable to check with the local office for any specific submission guidelines or requirements. Some jurisdictions may also offer online submission options, enhancing convenience for taxpayers.

Quick guide on how to complete michigan department of treasury 4640 rev 12 10 2018 2019 form

Your assistance manual on how to prepare your Michigan Department Of Treasury 4640 Rev 12 10 Form

If you’re interested in understanding how to complete and submit your Michigan Department Of Treasury 4640 Rev 12 10 Form, here are a few straightforward recommendations on how to simplify tax filing.

To begin, you just need to set up your airSlate SignNow account to transform your document management online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and make changes to answers whenever necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to accomplish your Michigan Department Of Treasury 4640 Rev 12 10 Form in a matter of minutes:

- Establish your account and start working on PDFs swiftly.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Michigan Department Of Treasury 4640 Rev 12 10 Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Make use of the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can increase return errors and delay refunds. Before e-filing your taxes, ensure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct michigan department of treasury 4640 rev 12 10 2018 2019 form

FAQs

-

How can I fill my JEE Advance 2019 form if my mark sheet of class 10 and class 12 are not available? I have given it for correction. How am I supposed to fill the form?

There is also the choice of uploading your Birth Certificate.On the first page it where your particulars are entered it asks for Class X marksheet only but when you submit that page, the next page (where you upload the photo) asks for Class X Marksheet or Birth Certificate.

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury 4640 rev 12 10 2018 2019 form

How to create an eSignature for the Michigan Department Of Treasury 4640 Rev 12 10 2018 2019 Form online

How to create an electronic signature for your Michigan Department Of Treasury 4640 Rev 12 10 2018 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the Michigan Department Of Treasury 4640 Rev 12 10 2018 2019 Form in Gmail

How to generate an eSignature for the Michigan Department Of Treasury 4640 Rev 12 10 2018 2019 Form straight from your mobile device

How to generate an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2018 2019 Form on iOS

How to make an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2018 2019 Form on Android

People also ask

-

What is the Michigan rescission principal and how does it relate to contract signing?

The Michigan rescission principal allows parties to cancel or rescind a contract under certain conditions. Understanding this principal is crucial when using airSlate SignNow to ensure that your electronic signatures comply with state laws. It provides legal protection in case one party wants to withdraw from the agreement, thus securing your transactions.

-

How does airSlate SignNow help comply with the Michigan rescission principal?

airSlate SignNow provides a transparent eSigning process that tracks all activities related to the document. This accountability helps parties understand their rights under the Michigan rescission principal and ensures that any necessary actions can be taken if a party decides to rescind a contract. Our platform includes features that provide clear timestamps and records for better compliance.

-

Is airSlate SignNow cost-effective for small businesses needing to understand the Michigan rescission principal?

Yes, airSlate SignNow offers competitive pricing plans that suit the budget of small businesses. For those learning about the Michigan rescission principal, our easy-to-use platform ensures that managing contracts and understanding their terms are straightforward and affordable. With our pricing structure, you can access vital tools without overspending.

-

What features does airSlate SignNow offer that relate to the Michigan rescission principal?

airSlate SignNow includes essential features such as document tracking, audit trails, and customizable templates. These tools help users navigate the complexities of the Michigan rescission principal by providing clarity and documentation in case a contract is rescinded. Our platform makes managing these cases efficient and straightforward.

-

Can airSlate SignNow integrate with other tools to enhance understanding of the Michigan rescission principal?

Absolutely! airSlate SignNow integrates with various software applications, which enhances the overall efficiency of contract management. By using these integrations, you can create workflows that help you comply with the Michigan rescission principal seamlessly, allowing for better organization and communication of your legal aspects.

-

What are the benefits of using airSlate SignNow for companies dealing with the Michigan rescission principal?

Using airSlate SignNow offers several benefits, especially for companies navigating the Michigan rescission principal. Our platform allows for quick eSigning processes, the ability to store documents securely, and immediate access to recorded agreements. This means businesses can swiftly respond to any contractual changes under the rescission principal.

-

How secure is airSlate SignNow in relation to the Michigan rescission principal?

Security is a top priority at airSlate SignNow, particularly for documents related to the Michigan rescission principal. Our platform employs bank-level encryption and multiple security features to ensure that your documents are safe from unauthorized access. This level of security gives users peace of mind when sealing agreements under the rescission principal.

Get more for Michigan Department Of Treasury 4640 Rev 12 10 Form

- The lazy editor answer key form

- Form 80 australia

- State of california w9 form

- Disclosure authorization form

- Request for cumulative records form

- Youth in media consent bform boy scoutb troop 574

- Texas hazardous materials endorsement applicationa form

- Medvet dallas 11333 north central expressway dallas tx form

Find out other Michigan Department Of Treasury 4640 Rev 12 10 Form

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter