Michigan Department of Treasury 4640 Rev 12 10 Form 2013

What is the Michigan Department Of Treasury 4640 Rev 12 10 Form

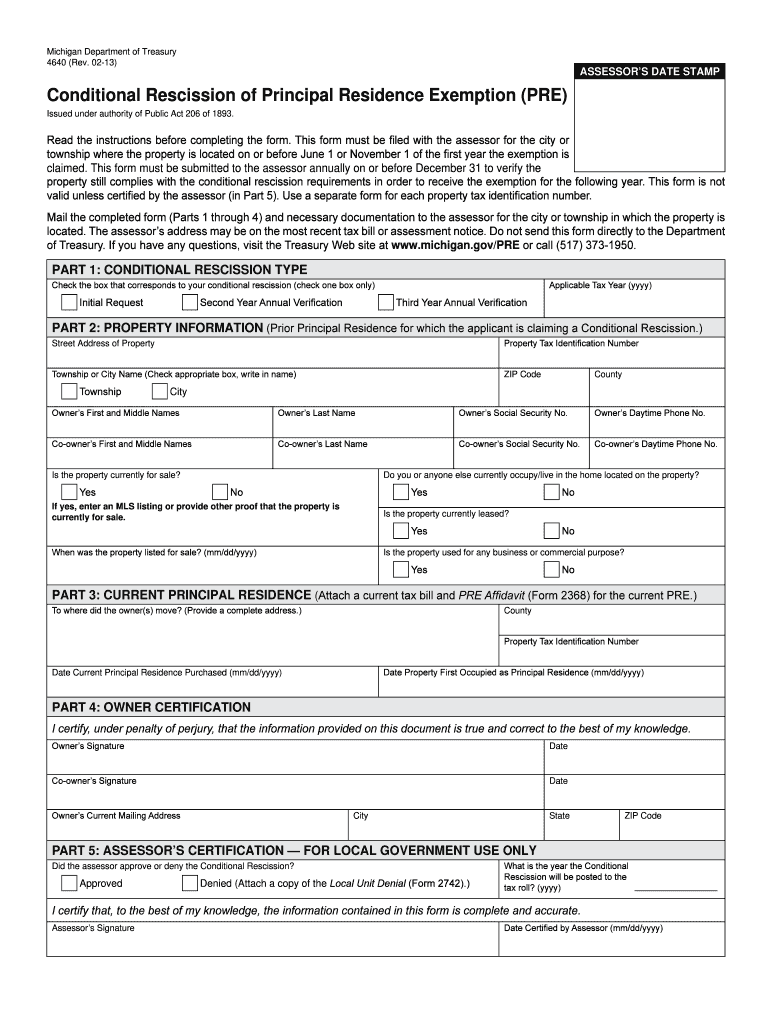

The Michigan Department Of Treasury 4640 Rev 12 10 Form is an official document used for tax purposes within the state of Michigan. This form is designed to assist individuals and businesses in reporting specific financial information to the state treasury. It is essential for ensuring compliance with state tax regulations and for accurately assessing tax obligations. The form includes various fields that require detailed information about income, deductions, and credits applicable to the taxpayer's situation.

How to use the Michigan Department Of Treasury 4640 Rev 12 10 Form

Using the Michigan Department Of Treasury 4640 Rev 12 10 Form involves several straightforward steps. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, access the form online or obtain a physical copy. Carefully fill out each section, ensuring accuracy in reporting income and deductions. Once completed, review the form for any errors before submitting it to the Michigan Department of Treasury. It is advisable to keep a copy for your records.

Steps to complete the Michigan Department Of Treasury 4640 Rev 12 10 Form

Completing the Michigan Department Of Treasury 4640 Rev 12 10 Form requires attention to detail. Follow these steps:

- Download or print the form from the Michigan Department of Treasury website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources as required on the form.

- List any applicable deductions and credits that you qualify for.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Michigan Department Of Treasury 4640 Rev 12 10 Form

The Michigan Department Of Treasury 4640 Rev 12 10 Form is legally recognized for tax filing purposes within the state. It must be completed accurately to comply with state tax laws. Submitting this form ensures that taxpayers fulfill their legal obligations and helps avoid potential penalties for non-compliance. It is important to understand that any misrepresentation or errors in the form can lead to legal repercussions, including audits or fines.

Form Submission Methods

The Michigan Department Of Treasury 4640 Rev 12 10 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Michigan Department of Treasury's secure portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local treasury offices, if preferred.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Department Of Treasury 4640 Rev 12 10 Form are crucial for compliance. Typically, taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, especially during tax season, to avoid late fees or penalties.

Quick guide on how to complete michigan department of treasury 4640 rev 12 10 2013 form

Your assistance manual on how to prepare your Michigan Department Of Treasury 4640 Rev 12 10 Form

If you’re eager to understand how to finalize and dispatch your Michigan Department Of Treasury 4640 Rev 12 10 Form, below are a few straightforward guidelines on how to simplify tax declaration.

To initiate, you just need to set up your airSlate SignNow account to revolutionize your approach to online paperwork. airSlate SignNow is an exceptionally user-friendly and robust document solution that permits you to alter, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify responses as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and simple sharing.

Adhere to the instructions below to finalize your Michigan Department Of Treasury 4640 Rev 12 10 Form in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; navigate through variations and schedules.

- Hit Get form to access your Michigan Department Of Treasury 4640 Rev 12 10 Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and correct any discrepancies.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please remember that filing in paper format can lead to return errors and delay reimbursements. Naturally, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct michigan department of treasury 4640 rev 12 10 2013 form

FAQs

-

How can I fill my JEE Advance 2019 form if my mark sheet of class 10 and class 12 are not available? I have given it for correction. How am I supposed to fill the form?

There is also the choice of uploading your Birth Certificate.On the first page it where your particulars are entered it asks for Class X marksheet only but when you submit that page, the next page (where you upload the photo) asks for Class X Marksheet or Birth Certificate.

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury 4640 rev 12 10 2013 form

How to create an eSignature for your Michigan Department Of Treasury 4640 Rev 12 10 2013 Form online

How to create an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2013 Form in Chrome

How to make an electronic signature for putting it on the Michigan Department Of Treasury 4640 Rev 12 10 2013 Form in Gmail

How to generate an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2013 Form from your smartphone

How to create an eSignature for the Michigan Department Of Treasury 4640 Rev 12 10 2013 Form on iOS

How to generate an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2013 Form on Android

People also ask

-

What is the Michigan Department Of Treasury 4640 Rev 12 10 Form?

The Michigan Department Of Treasury 4640 Rev 12 10 Form is a tax-related document used by individuals and businesses for state tax purposes. This form facilitates the accurate reporting of tax information to the Michigan Department of Treasury. Understanding this form is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with the Michigan Department Of Treasury 4640 Rev 12 10 Form?

AirSlate SignNow provides an efficient platform for businesses to complete and eSign the Michigan Department Of Treasury 4640 Rev 12 10 Form digitally. With its user-friendly interface, you can easily fill out and submit this form without the hassle of printing or mailing it. This streamlines the process, ensuring timely submission to meet tax deadlines.

-

Is there a cost associated with using airSlate SignNow for the Michigan Department Of Treasury 4640 Rev 12 10 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when managing documents like the Michigan Department Of Treasury 4640 Rev 12 10 Form. These plans are designed to be cost-effective, providing great value through features like unlimited eSignatures and secure cloud storage. You can select a plan that suits your volume and workflow requirements.

-

What features does airSlate SignNow offer for the Michigan Department Of Treasury 4640 Rev 12 10 Form?

AirSlate SignNow includes features like advanced eSignature capabilities, document templates, and customizable workflows specifically for the Michigan Department Of Treasury 4640 Rev 12 10 Form. These tools enhance efficiency and ensure that forms are filled out accurately, reducing errors and improving compliance with state regulations.

-

Can I track the status of my Michigan Department Of Treasury 4640 Rev 12 10 Form after sending it with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Michigan Department Of Treasury 4640 Rev 12 10 Form after it has been sent. You'll receive notifications when the document is opened and completed, giving you peace of mind throughout the submission process.

-

Does airSlate SignNow integrate with other software for handling the Michigan Department Of Treasury 4640 Rev 12 10 Form?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your workflow while dealing with the Michigan Department Of Treasury 4640 Rev 12 10 Form. This includes CRM systems, cloud storage providers, and productivity tools, making it easier to manage documents and streamline your operations.

-

What benefits does airSlate SignNow provide for businesses dealing with the Michigan Department Of Treasury 4640 Rev 12 10 Form?

Using airSlate SignNow for the Michigan Department Of Treasury 4640 Rev 12 10 Form offers multiple benefits, including increased efficiency, reduced paperwork, and secure document handling. The platform helps businesses save time and resources, allowing them to focus on other important tasks while ensuring compliance with Michigan's tax regulations.

Get more for Michigan Department Of Treasury 4640 Rev 12 10 Form

- Cross promotion agreement template el verano form

- 8 ways to maximize your youtube marketing results social form

- Recommendation against repair form

- Agreement this agreement is entered into thisday of form

- Negative space how should you use it in modern design form

- Research and development rampampdoverview ampamp process form

- Possible production ampamp operations management strategies form

- How to write a business plan business plan outline form

Find out other Michigan Department Of Treasury 4640 Rev 12 10 Form

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free