Michigan Department of Treasury 4640 Rev 12 10 Form 2015

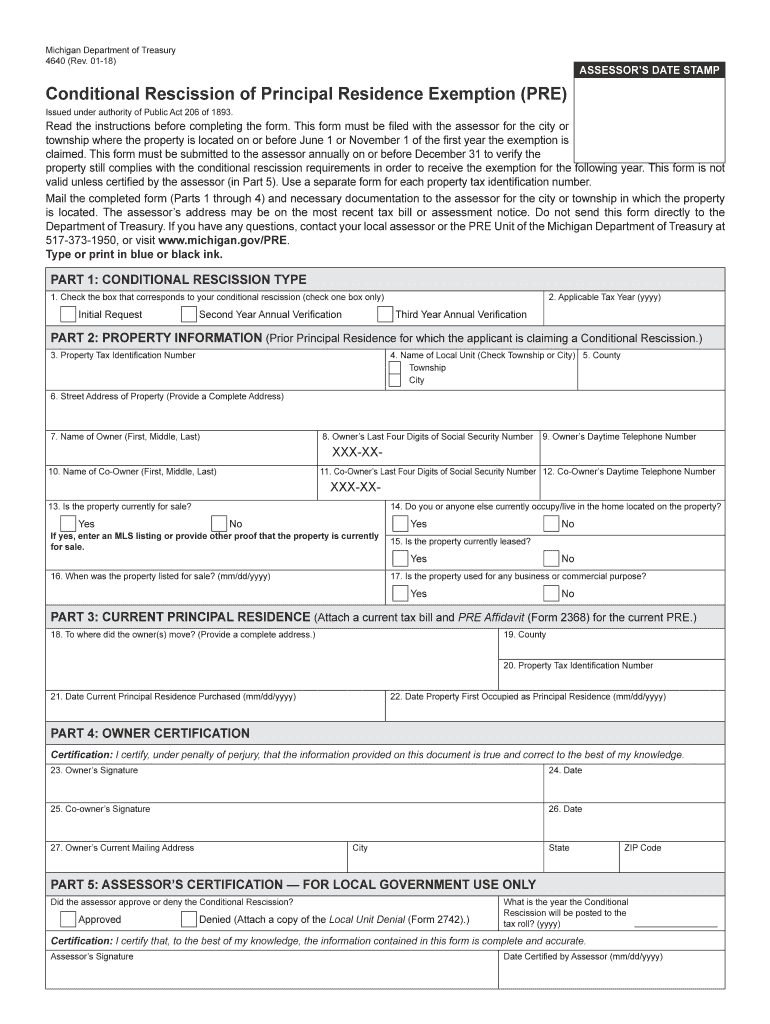

What is the Michigan Department Of Treasury 4640 Rev 12 10 Form

The Michigan Department Of Treasury 4640 Rev 12 10 Form is a specific tax document used for reporting various financial information to the state of Michigan. This form is primarily utilized by individuals and businesses to disclose income, deductions, and other relevant financial data. It is essential for ensuring compliance with state tax regulations and for accurate tax assessment. Understanding the purpose of this form is crucial for taxpayers to fulfill their legal obligations and avoid potential penalties.

Steps to complete the Michigan Department Of Treasury 4640 Rev 12 10 Form

Completing the Michigan Department Of Treasury 4640 Rev 12 10 Form involves several key steps. First, gather all necessary financial documents, including income statements, receipts, and previous tax returns. Next, carefully fill out the form, ensuring that all required fields are completed accurately. Pay special attention to any calculations to avoid errors. Once the form is filled out, review it thoroughly for accuracy before signing and dating it. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Legal use of the Michigan Department Of Treasury 4640 Rev 12 10 Form

The Michigan Department Of Treasury 4640 Rev 12 10 Form is legally binding when filled out and submitted according to state regulations. It is important for taxpayers to understand that this form must be completed truthfully and accurately, as providing false information can lead to severe penalties, including fines and legal consequences. The form's legal validity is supported by compliance with the Michigan tax code and federal regulations, ensuring that it meets all necessary requirements for electronic signatures and submissions.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Department Of Treasury 4640 Rev 12 10 Form can be submitted through various methods to accommodate taxpayer preferences. Online submission is available through the Michigan Department of Treasury's official website, allowing for quick processing and confirmation. Alternatively, taxpayers may choose to mail the completed form to the designated address provided in the instructions. For those who prefer face-to-face interaction, in-person submission at local treasury offices is also an option. Each method has its own guidelines and timelines that should be followed for successful submission.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Department Of Treasury 4640 Rev 12 10 Form are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by the state tax deadline, which aligns with federal tax filing dates. It is advisable for taxpayers to keep track of any specific deadlines announced by the Michigan Department of Treasury, as they may vary from year to year. Marking these important dates on a calendar can help ensure timely submission and prevent any last-minute issues.

Key elements of the Michigan Department Of Treasury 4640 Rev 12 10 Form

The Michigan Department Of Treasury 4640 Rev 12 10 Form includes several key elements that are essential for accurate reporting. These elements typically consist of personal identification information, income details, deductions, and credits. Additionally, the form may require specific calculations related to taxable income and tax owed. Understanding these key components is vital for taxpayers to complete the form correctly and ensure that all necessary information is provided for accurate tax assessment.

Quick guide on how to complete michigan department of treasury 4640 rev 12 10 2015 form

Your assistance manual on how to prepare your Michigan Department Of Treasury 4640 Rev 12 10 Form

If you’re curious about how to generate and dispatch your Michigan Department Of Treasury 4640 Rev 12 10 Form, here are some concise instructions on how to simplify tax declarations.

To begin, you simply need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an intuitive and powerful document solution that enables you to adjust, create, and complete your income tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures, and return to modify responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your Michigan Department Of Treasury 4640 Rev 12 10 Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Michigan Department Of Treasury 4640 Rev 12 10 Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and correct any inaccuracies.

- Finalize changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper may lead to more mistakes and longer wait times for refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct michigan department of treasury 4640 rev 12 10 2015 form

FAQs

-

How can I fill my JEE Advance 2019 form if my mark sheet of class 10 and class 12 are not available? I have given it for correction. How am I supposed to fill the form?

There is also the choice of uploading your Birth Certificate.On the first page it where your particulars are entered it asks for Class X marksheet only but when you submit that page, the next page (where you upload the photo) asks for Class X Marksheet or Birth Certificate.

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury 4640 rev 12 10 2015 form

How to generate an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2015 Form in the online mode

How to create an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2015 Form in Google Chrome

How to make an eSignature for putting it on the Michigan Department Of Treasury 4640 Rev 12 10 2015 Form in Gmail

How to generate an eSignature for the Michigan Department Of Treasury 4640 Rev 12 10 2015 Form from your smartphone

How to make an eSignature for the Michigan Department Of Treasury 4640 Rev 12 10 2015 Form on iOS devices

How to generate an electronic signature for the Michigan Department Of Treasury 4640 Rev 12 10 2015 Form on Android

People also ask

-

What is the Michigan Department Of Treasury 4640 Rev 12 10 Form?

The Michigan Department Of Treasury 4640 Rev 12 10 Form is a crucial document used by businesses in Michigan for compliance with state tax regulations. This form helps streamline the reporting of tax obligations and ensures that necessary information is submitted accurately and on time.

-

How can airSlate SignNow help with the Michigan Department Of Treasury 4640 Rev 12 10 Form?

airSlate SignNow offers an easy-to-use platform that enables users to eSign and send the Michigan Department Of Treasury 4640 Rev 12 10 Form quickly and securely. Our solution simplifies the signing process, ensuring that your documents meet compliance requirements while also enhancing overall productivity.

-

What are the pricing options for using airSlate SignNow for the Michigan Department Of Treasury 4640 Rev 12 10 Form?

airSlate SignNow provides flexible pricing plans tailored to various business needs. Customers can choose from different subscription options, ensuring they get the best value for managing documents like the Michigan Department Of Treasury 4640 Rev 12 10 Form without breaking the bank.

-

Are there any specific features in airSlate SignNow for managing the Michigan Department Of Treasury 4640 Rev 12 10 Form?

Yes, airSlate SignNow includes features such as document templates, automatic reminders, and secure cloud storage, which are particularly beneficial when handling the Michigan Department Of Treasury 4640 Rev 12 10 Form. These features enhance efficiency and reduce the likelihood of errors in document submission.

-

Can I integrate airSlate SignNow with other software when working on the Michigan Department Of Treasury 4640 Rev 12 10 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Microsoft Office. This allows you to efficiently manage the Michigan Department Of Treasury 4640 Rev 12 10 Form along with other business processes and applications already in use.

-

Is electronic signing of the Michigan Department Of Treasury 4640 Rev 12 10 Form legally binding?

Yes, electronic signing of the Michigan Department Of Treasury 4640 Rev 12 10 Form through airSlate SignNow is legally binding and compliant with federal and state e-signature laws. Our platform ensures that all signatures are secure and verifiable, helping you maintain the integrity of your documents.

-

What benefits does airSlate SignNow provide when dealing with the Michigan Department Of Treasury 4640 Rev 12 10 Form?

Using airSlate SignNow to manage the Michigan Department Of Treasury 4640 Rev 12 10 Form offers numerous benefits such as enhanced efficiency, reduced processing time, and improved collaboration. By digitizing document workflows, you can streamline operations and focus on growing your business.

Get more for Michigan Department Of Treasury 4640 Rev 12 10 Form

- Addendum to influenza vaccine 21502649 form

- Form no 14 child support amount calculation worksheet dshs wa

- Keno training form

- Guardian ad litem oklahoma form

- Wedding packet contract for non members bsmbcplanobborgb form

- 7 on 7 state qualifier registration form

- Applicant information first name last name email address

- Charms office assistant information sheet

Find out other Michigan Department Of Treasury 4640 Rev 12 10 Form

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later