Mo Form E 1r 2014

What is the Mo Form E 1r

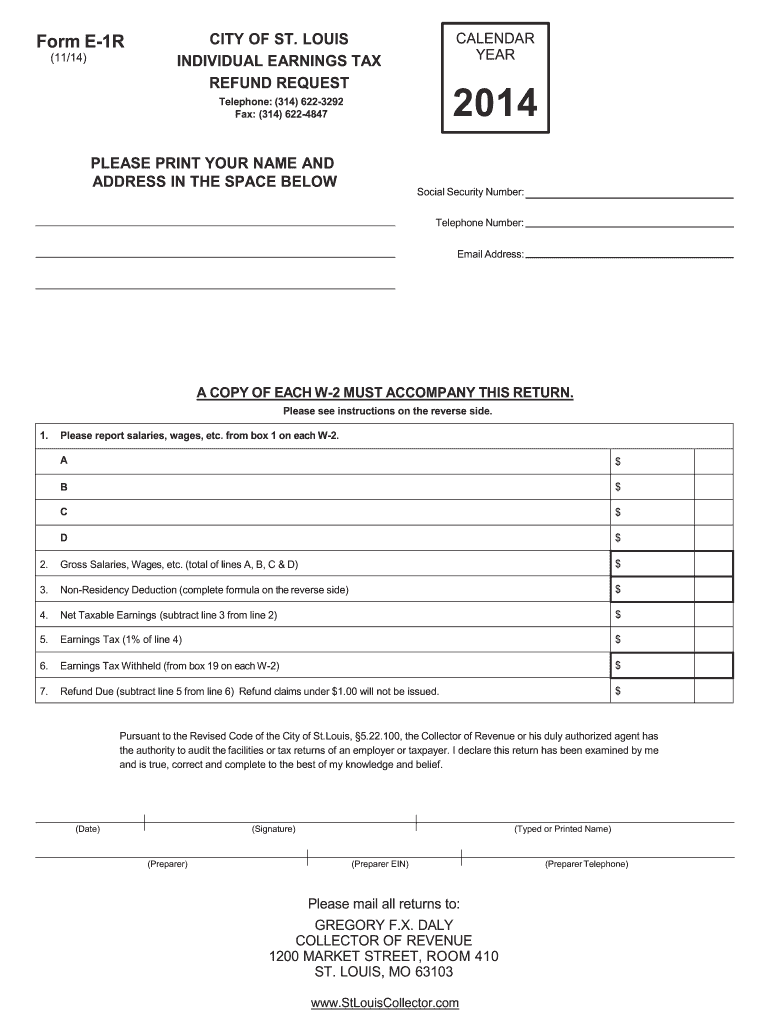

The Mo Form E 1r, also known as the St. Louis City Earnings Tax Refund Form E 1r, is a specific tax form used by residents of St. Louis, Missouri, to claim a refund for overpaid earnings taxes. This form is essential for individuals who have worked in St. Louis but may have had taxes withheld in excess of their actual tax liability. Understanding the purpose and requirements of the Mo Form E 1r is crucial for ensuring compliance and maximizing potential refunds.

How to use the Mo Form E 1r

Using the Mo Form E 1r involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including your W-2 forms and any relevant pay stubs. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Be sure to detail your earnings and the taxes withheld. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Mo Form E 1r

Completing the Mo Form E 1r requires careful attention to detail. Follow these steps:

- Gather your W-2 forms and any additional income documentation.

- Provide your personal information in the designated fields.

- Report your total earnings and the amount of earnings tax withheld.

- Calculate your refund amount based on the information provided.

- Sign and date the form to verify its accuracy.

Legal use of the Mo Form E 1r

The Mo Form E 1r is legally recognized for claiming refunds on earnings taxes in St. Louis. It is important to ensure that the form is filled out accurately and submitted within the designated deadlines to comply with local tax laws. Failure to adhere to these regulations may result in delays or denial of refund claims. Always keep a copy of the submitted form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Mo Form E 1r are critical to ensure timely processing of your refund. Typically, the deadline for submitting the form aligns with the annual tax return filing date, which is usually April fifteenth. It is advisable to check for any specific local extensions or changes in deadlines that may apply to your situation.

Form Submission Methods (Online / Mail / In-Person)

The Mo Form E 1r can be submitted through various methods to accommodate different preferences. You can file the form online through the St. Louis city tax portal, mail it to the designated tax office, or deliver it in person. Each method has its own processing times, so consider your urgency when choosing a submission method.

Quick guide on how to complete e 1r 2014 2019 form

Your assistance manual on preparing your Mo Form E 1r

If you're interested in learning how to generate and dispatch your Mo Form E 1r, here are some brief guidelines to facilitate tax processing.

To begin, all you need is to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and go back to adjust details as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and an intuitive sharing process.

Complete the following steps to finalize your Mo Form E 1r in just a few minutes:

- Create your profile and start editing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Mo Form E 1r in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting paper forms may increase errors on returns and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for submission guidelines pertinent to your state.

Create this form in 5 minutes or less

Find and fill out the correct e 1r 2014 2019 form

FAQs

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out the JEE Main 2019 exam application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application form.JEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

Create this form in 5 minutes!

How to create an eSignature for the e 1r 2014 2019 form

How to create an electronic signature for the E 1r 2014 2019 Form in the online mode

How to generate an eSignature for your E 1r 2014 2019 Form in Chrome

How to make an electronic signature for putting it on the E 1r 2014 2019 Form in Gmail

How to create an eSignature for the E 1r 2014 2019 Form straight from your mobile device

How to make an eSignature for the E 1r 2014 2019 Form on iOS devices

How to create an eSignature for the E 1r 2014 2019 Form on Android OS

People also ask

-

What is Mo Form E 1r and how does it work with airSlate SignNow?

Mo Form E 1r is a specific document format used for electronic signatures. With airSlate SignNow, you can easily create, send, and eSign Mo Form E 1r documents in a secure and efficient manner, streamlining your workflow and ensuring compliance.

-

How much does it cost to use airSlate SignNow for Mo Form E 1r documents?

airSlate SignNow offers competitive pricing plans tailored to suit different business needs. Whether you're an individual or part of a large organization, you can find an affordable option to electronically sign and manage your Mo Form E 1r documents.

-

What features does airSlate SignNow provide for Mo Form E 1r signing?

airSlate SignNow includes a variety of features for handling Mo Form E 1r documents, such as customizable templates, real-time tracking, and secure cloud storage. These features enhance your document management process and simplify the eSigning experience.

-

Can I integrate airSlate SignNow with other tools for managing Mo Form E 1r?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, making it easy to manage Mo Form E 1r documents alongside other tools you use. This integration enhances your workflow efficiency and centralizes your document handling.

-

What are the benefits of using airSlate SignNow for Mo Form E 1r documents?

Using airSlate SignNow for Mo Form E 1r documents offers numerous benefits, including time savings, improved accuracy, and better compliance. The platform's user-friendly interface ensures that anyone can eSign documents quickly and securely.

-

Is it safe to use airSlate SignNow for signing Mo Form E 1r?

Absolutely, airSlate SignNow prioritizes security and ensures that your Mo Form E 1r documents are protected with encryption and secure access controls. You can confidently manage sensitive information knowing that it is safeguarded.

-

How can I get started with airSlate SignNow for Mo Form E 1r?

Getting started with airSlate SignNow for Mo Form E 1r is simple. You can sign up for a free trial to explore the features, and once ready, choose a pricing plan that fits your needs to start sending and eSigning documents.

Get more for Mo Form E 1r

- On death tod deed saclaworg form

- The cannabis party membership application form 5 10 20

- Cdl temporary permit practice test 1x great lakes truck driving form

- Criminal history verification form portland public schools pps k12 or

- Driver education supply request form dl 396a

- Renaltab ii form

- Police department 880 tennent ave pinole ca financing form

- Form s 3 california department of industrial relations

Find out other Mo Form E 1r

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors