St Louis Mo City Earnings Tax Form 2016

What is the St Louis Mo City Earnings Tax Form

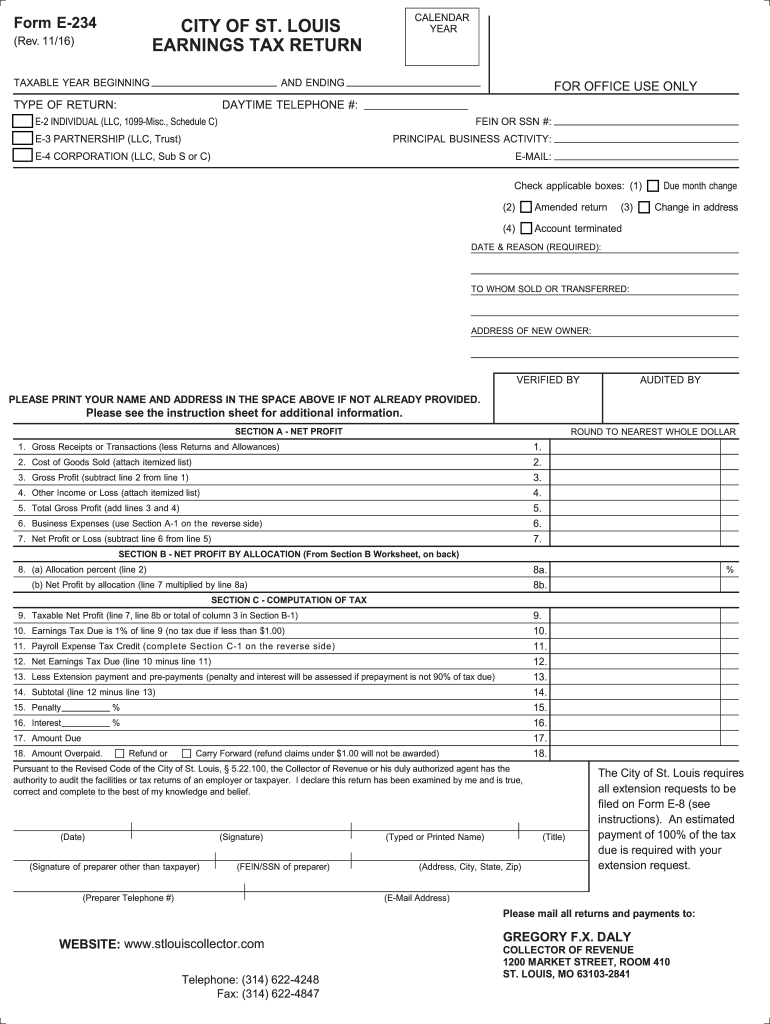

The St Louis Mo City Earnings Tax Form, commonly referred to as the e 234, is a crucial document for residents and businesses operating within the city limits of St. Louis. This form is used to report earnings and calculate the city earnings tax, which is applicable to individuals and entities earning income within the city. The earnings tax is a percentage of the gross income earned and is essential for funding local services and infrastructure.

Steps to complete the St Louis Mo City Earnings Tax Form

Completing the St Louis Mo City Earnings Tax Form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the e 234 form with the required information, ensuring all income sources are reported. After completing the form, review it for any errors. Finally, sign the form electronically or manually, depending on your submission method.

How to obtain the St Louis Mo City Earnings Tax Form

The e 234 form can be obtained online through the official St. Louis city government website or through the Department of Revenue. It is available as a fillable PDF, allowing users to complete the form digitally. Additionally, physical copies can be requested at local government offices for those who prefer to fill out a paper version.

Legal use of the St Louis Mo City Earnings Tax Form

The legal use of the St Louis Mo City Earnings Tax Form is governed by local tax laws and regulations. It is essential for taxpayers to ensure that they are using the most current version of the e 234 form, as outdated forms may not be accepted. Compliance with the legal requirements for filing this form is crucial to avoid penalties and ensure that the submitted information is valid for tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for the St Louis Mo City Earnings Tax Form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April 15 for individuals, while businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates, as late submissions can incur penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The e 234 form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using secure e-filing systems, which provide immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate city department or submitted in person at designated locations. Each method has its own advantages, such as convenience or direct interaction with city officials.

Quick guide on how to complete city of st louis earnings tax return stlouis mo

Your assistance manual on preparing your St Louis Mo City Earnings Tax Form

If you’re curious about how to finalize and dispatch your St Louis Mo City Earnings Tax Form, here are some simple guidelines to facilitate tax submission.

To get started, you simply need to set up your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to modify responses as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your St Louis Mo City Earnings Tax Form in a matter of minutes:

- Create your account and start processing PDFs within moments.

- Utilize our catalog to obtain any IRS tax form; navigate through versions and schedules.

- Click Obtain form to access your St Louis Mo City Earnings Tax Form in our editor.

- Input the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in physical form can cause mistakes on returns and delay reimbursements. Of course, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct city of st louis earnings tax return stlouis mo

FAQs

-

How can a person be able to earn the most out of their tax returns when forming a startup?

Save ALL receipts for items you purchased for the business as well as other expenses incurred. You won’t file them with your tax return but you will always be able to prove your deductions if audited.And you need to know that the IRS can audit a return many years later.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the city of st louis earnings tax return stlouis mo

How to generate an electronic signature for your City Of St Louis Earnings Tax Return Stlouis Mo in the online mode

How to create an electronic signature for the City Of St Louis Earnings Tax Return Stlouis Mo in Google Chrome

How to make an electronic signature for signing the City Of St Louis Earnings Tax Return Stlouis Mo in Gmail

How to generate an electronic signature for the City Of St Louis Earnings Tax Return Stlouis Mo right from your mobile device

How to generate an eSignature for the City Of St Louis Earnings Tax Return Stlouis Mo on iOS devices

How to create an eSignature for the City Of St Louis Earnings Tax Return Stlouis Mo on Android devices

People also ask

-

What is the e 234 feature in airSlate SignNow?

The e 234 feature in airSlate SignNow allows users to electronically sign and send documents seamlessly. This functionality simplifies the signing process, making it accessible for businesses of all sizes. By utilizing e 234, you can ensure faster transactions and improved document management.

-

How does airSlate SignNow's e 234 pricing compare to competitors?

airSlate SignNow offers competitive pricing for its e 234 services compared to other electronic signature solutions. Our cost-effective plans cater to small businesses and large enterprises alike, ensuring you get the best value. Explore various pricing tiers to find the right fit, tailored to your e 234 needs.

-

What are the key benefits of using e 234 with airSlate SignNow?

Using e 234 with airSlate SignNow streamlines your workflow, making document sending and signing efficient. The platform enhances collaboration by allowing multiple users to sign documents simultaneously. Additionally, e 234 ensures compliance with legal standards, giving you peace of mind.

-

Can I integrate e 234 with other software tools?

Yes, airSlate SignNow supports various integrations for its e 234 feature, including popular CRM and cloud storage systems. This flexibility allows you to connect your existing tools and streamline processes. Explore our integration options to enhance your business efficiency further.

-

Is the e 234 feature secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that the e 234 feature provides top-notch encryption and compliance with industry standards. Your sensitive documents are protected, minimizing the risk of data bsignNowes. Trust e 234 for secure electronic signing solutions.

-

How user-friendly is e 234 for new users?

The e 234 feature in airSlate SignNow is designed with user experience in mind, making it easy for new users to navigate. With intuitive controls and straightforward processes, even those unfamiliar with digital signatures can quickly adapt. Get started with e 234 effortlessly and enhance your document management.

-

What types of documents can I send using the e 234 feature?

With the e 234 feature in airSlate SignNow, you can send a wide variety of documents, including contracts, agreements, and forms. This versatility caters to diverse business needs, ensuring that you can manage all your document workflows efficiently. Leverage e 234 for your documentation requirements.

Get more for St Louis Mo City Earnings Tax Form

- Math lab graphing quadratic equations in standard form answer key

- Hoa acc application form

- Medicine inventory log form

- Gtcc jamestown phone number form

- Associated bank direct deposit form

- Nrc form 526

- Air force instruction 32 7070 form

- Tree proposal application including vegetation removal trimming tsra form

Find out other St Louis Mo City Earnings Tax Form

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free