36833 Form E 234 Nov 2020

What is the Form E 234?

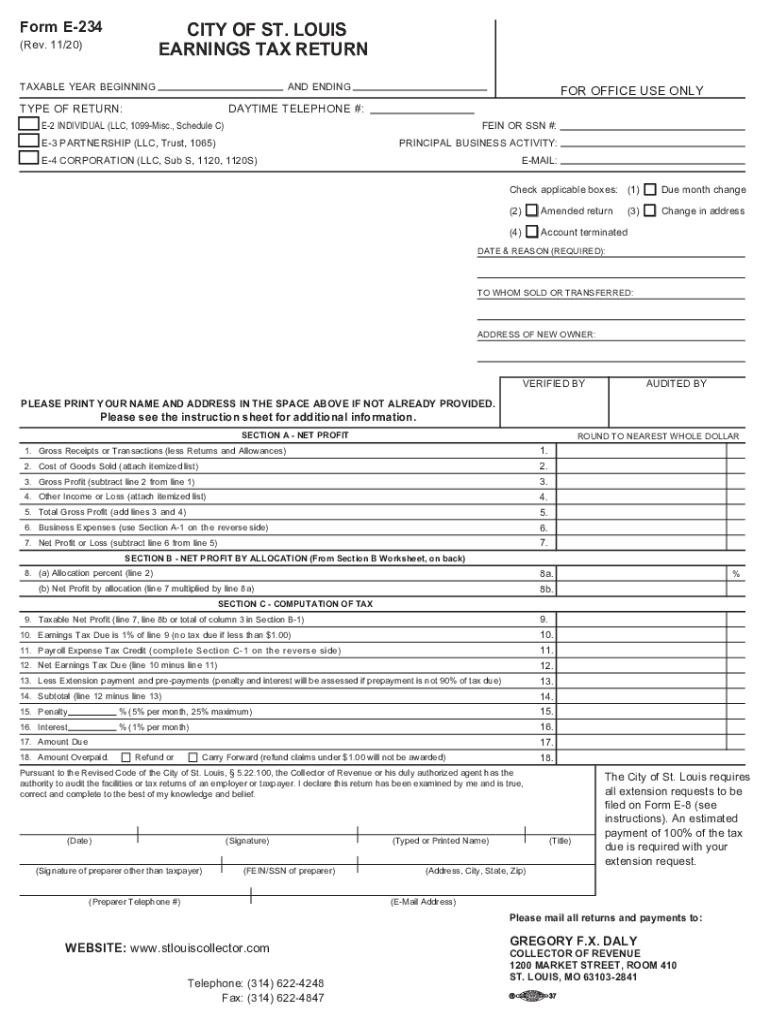

The Form E 234 is a tax document used by residents of the City of St. Louis to report their earnings and calculate their city income tax liability. This form is essential for individuals who earn income within the city limits and are subject to the local earnings tax. The form collects information about the taxpayer's income, deductions, and credits, which are crucial for determining the amount of tax owed to the city.

Steps to Complete the Form E 234

Completing the Form E 234 involves several key steps to ensure accuracy and compliance with city tax regulations. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income, followed by any applicable deductions. After calculating your tax liability, review the form for completeness and accuracy before submission.

Legal Use of the Form E 234

The Form E 234 is legally binding when completed accurately and submitted in accordance with local tax laws. It is important to ensure that all information provided is truthful and that the form is signed and dated. Electronic submission of the form is permitted, provided that it meets the requirements set forth by the city. Compliance with these regulations helps avoid penalties and ensures that your tax obligations are met.

Filing Deadlines / Important Dates

Filing deadlines for the Form E 234 are typically set by the City of St. Louis. Generally, the form must be submitted by April 15 of the year following the tax year being reported. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties and interest on unpaid taxes.

Form Submission Methods

The Form E 234 can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can use the official city tax portal to complete and file the form electronically. If submitting by mail, ensure that the form is sent to the appropriate city department and postmarked by the deadline. In-person submissions can be made at designated city offices during regular business hours.

Penalties for Non-Compliance

Failure to file the Form E 234 on time or providing inaccurate information can result in penalties imposed by the City of St. Louis. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete 36833 form e 234 nov 2020

Effortlessly prepare 36833 Form E 234 Nov on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage 36833 Form E 234 Nov on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign 36833 Form E 234 Nov without hassle

- Find 36833 Form E 234 Nov and click Get Form to commence.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as an ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device of your preference. Edit and electronically sign 36833 Form E 234 Nov and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 36833 form e 234 nov 2020

Create this form in 5 minutes!

How to create an eSignature for the 36833 form e 234 nov 2020

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is e 234 and how does it relate to airSlate SignNow?

The e 234 is a unique identifier associated with electronic signatures in the airSlate SignNow platform. This code helps streamline the signing process, allowing users to track and manage their documents efficiently. Understanding e 234 can enhance your experience when using airSlate SignNow.

-

How much does airSlate SignNow cost?

airSlate SignNow offers competitive pricing tailored to various business needs, starting with free trials for users to explore the service. Depending on the features required, plans are available at different tiers, making it easy to incorporate e 234 capabilities without breaking the budget. Visit our pricing page for detailed information.

-

What features does airSlate SignNow provide for managing e 234 signatures?

AirSlate SignNow boasts a range of features designed to enhance the e 234 signing process, including customizable templates, automated reminders, and document routing. These features enable seamless integration of e 234 signatures, ensuring that signing documents is as efficient and straightforward as possible.

-

Are there any benefits to using e 234 for my business?

Utilizing e 234 with airSlate SignNow can greatly improve document workflow efficiency and reduce the time spent on signatures. This cost-effective solution ensures that businesses can manage their contracts and agreements securely, enhancing accountability while promoting faster transaction times.

-

Can airSlate SignNow integrate with other software to utilize e 234?

Yes, airSlate SignNow provides robust integrations with various applications like Google Drive, Salesforce, and Microsoft Office. These integrations facilitate the use of e 234 seamlessly across platforms, enabling businesses to enhance their document management and signing processes.

-

Is airSlate SignNow secure for using e 234 signatures?

Absolutely! AirSlate SignNow employs advanced security protocols to protect your data and documents associated with e 234 signatures. With encryption and compliance with international regulations, businesses can trust that their signed documents are secure and legally binding.

-

What is the best way to get started with e 234 on airSlate SignNow?

To start using e 234 on airSlate SignNow, sign up for a free trial to familiarize yourself with the platform's features. After signing up, you can create templates and send documents for e 234 signatures, allowing you to experience the benefits of our user-friendly interface firsthand.

Get more for 36833 Form E 234 Nov

Find out other 36833 Form E 234 Nov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors