E FileE PayDelaware, OH 2020

What is the E-File/E-Pay Delaware Income Tax?

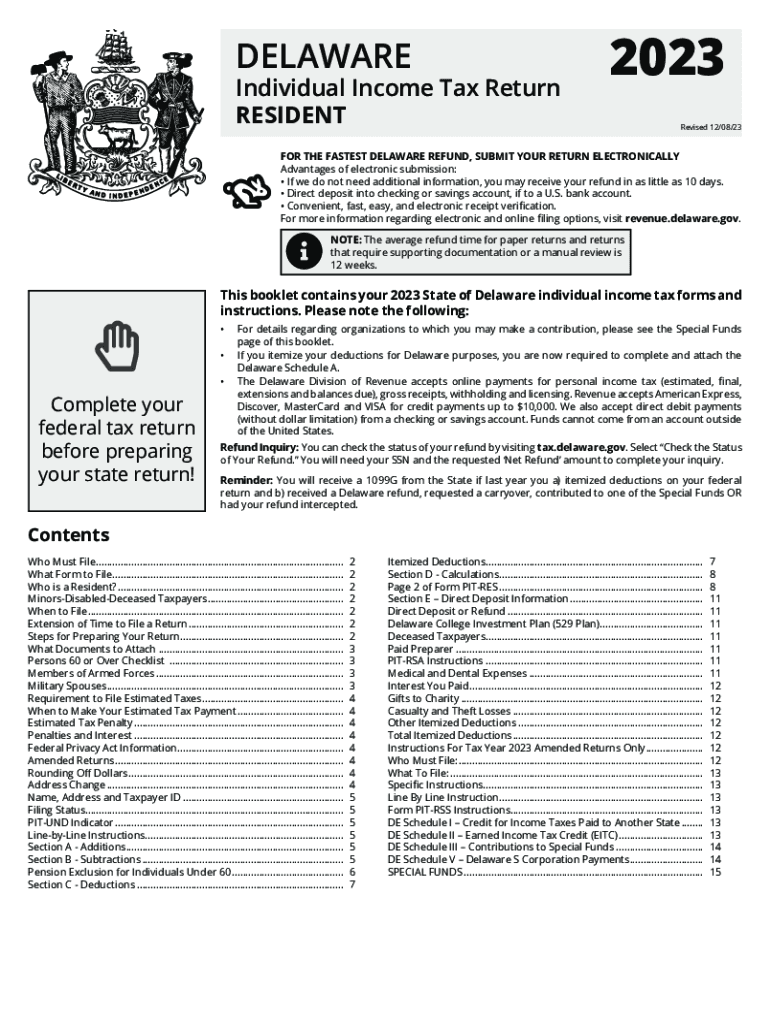

The E-File/E-Pay Delaware Income Tax system allows residents and businesses in Delaware to electronically file and pay their state income taxes. This system streamlines the tax filing process, making it more efficient and user-friendly. By using this digital platform, taxpayers can submit their forms securely and receive immediate confirmation of their submissions.

Steps to Complete the E-File/E-Pay Delaware Income Tax

To complete the E-File/E-Pay process, follow these steps:

- Gather all necessary documents, including your W-2 forms and any other income statements.

- Access the E-File/E-Pay portal on the Delaware Division of Revenue website.

- Complete the required forms, ensuring all information is accurate and up to date.

- Review your entries for any errors or omissions.

- Submit your forms electronically and make any necessary payments through the secure portal.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines to avoid penalties. For most individuals, the deadline to file Delaware income tax returns is April 30 of each year. If you are unable to meet this deadline, you may request an extension, but any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents for E-File/E-Pay

When preparing to file your Delaware income tax electronically, ensure you have the following documents:

- W-2 forms from all employers.

- 1099 forms for any additional income.

- Documentation for deductions and credits, such as mortgage interest statements or education expenses.

- Your previous year’s tax return for reference.

Who Issues the Form

The Delaware Division of Revenue is responsible for issuing the Delaware income tax forms, including the E-File/E-Pay system. This state agency oversees the collection of taxes and ensures compliance with state tax laws. They provide resources and assistance to help taxpayers navigate the filing process.

Penalties for Non-Compliance

Failing to file or pay your Delaware income tax on time can result in significant penalties. These may include:

- A late filing penalty, which is typically five percent of the unpaid tax for each month the return is late.

- Interest on any unpaid tax, accruing from the due date until the tax is paid in full.

- Potential legal action for severe cases of non-compliance.

Digital vs. Paper Version

The E-File/E-Pay system offers several advantages over traditional paper filing. Digital submissions are processed more quickly, reducing the time it takes to receive refunds. Additionally, electronic filing minimizes the risk of errors and provides instant confirmation of submission, enhancing overall efficiency for taxpayers.

Quick guide on how to complete e filee paydelaware oh

Complete E FileE PayDelaware, OH effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage E FileE PayDelaware, OH on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The most efficient way to edit and eSign E FileE PayDelaware, OH without hassle

- Obtain E FileE PayDelaware, OH and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign E FileE PayDelaware, OH and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct e filee paydelaware oh

Create this form in 5 minutes!

How to create an eSignature for the e filee paydelaware oh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware form income and why is it important?

The Delaware form income is a tax form required for reporting income generated by businesses operating in Delaware. It's crucial for compliance with state tax laws and ensures that businesses pay the appropriate taxes on their income. Accurate filing can help avoid penalties and streamline the tax process.

-

How can airSlate SignNow help me with the Delaware form income?

airSlate SignNow provides a streamlined approach to eSigning and sending documents, including tax-related forms like the Delaware form income. Our platform allows you to digitally sign and securely send your completed forms, reducing the hassle of paperwork and improving your filing efficiency.

-

What features does airSlate SignNow offer for managing the Delaware form income?

airSlate SignNow offers a variety of features that facilitate the management of the Delaware form income, such as document templates, advanced signing options, and secure storage. These tools enhance your ability to complete and store necessary tax documents efficiently, making sure that you have everything organized and compliant.

-

Are there any costs associated with using airSlate SignNow for Delaware form income?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers designed to suit different needs. While there is a cost, the investment provides signNow value by saving time and ensuring compliance with filing requirements such as the Delaware form income.

-

Can I integrate airSlate SignNow with my accounting software for Delaware form income?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to help streamline your workflows. This integration allows for efficient transfer of information necessary for the Delaware form income, ensuring you stay organized and compliant with tax regulations.

-

Is airSlate SignNow secure for handling sensitive documents like Delaware form income?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your sensitive documents, including the Delaware form income, are protected throughout the signing and sending process, giving you peace of mind about your data security.

-

How easy is it to eSign the Delaware form income using airSlate SignNow?

eSigning the Delaware form income with airSlate SignNow is incredibly user-friendly. The platform guides you through the process step-by-step, allowing you to sign documents quickly and efficiently without any technical complications.

Get more for E FileE PayDelaware, OH

- Buy sell agreement package maryland form

- Maryland option 497310559 form

- Amendment of lease package maryland form

- Annual financial checkup package maryland form

- Maryland bill sale form

- Living wills and health care package maryland form

- Last will and testament package maryland form

- Subcontractors package maryland form

Find out other E FileE PayDelaware, OH

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF