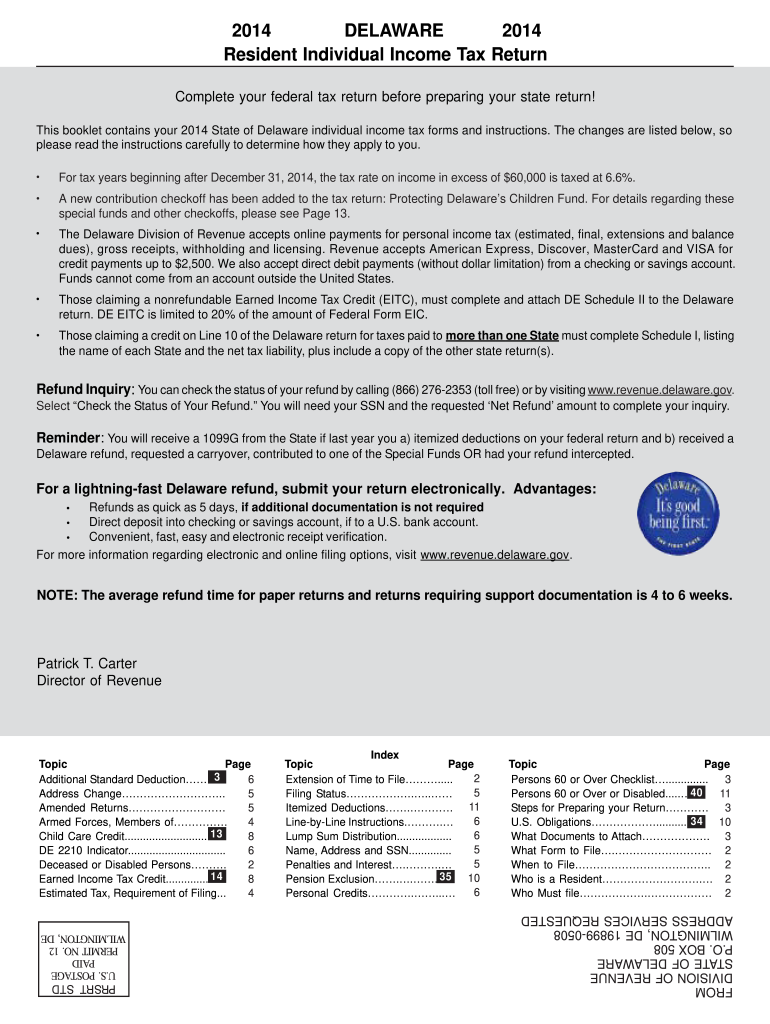

DELAWARE Resident Individual Income Tax Return Revenue Delaware 2014

What is the DELAWARE Resident Individual Income Tax Return Revenue Delaware

The DELAWARE Resident Individual Income Tax Return Revenue Delaware is a crucial document for individuals residing in Delaware to report their income and calculate their state tax obligations. This form is essential for ensuring compliance with state tax laws and is used to determine the amount of tax owed or any refund due. It encompasses various income sources, including wages, interest, dividends, and capital gains, allowing residents to accurately reflect their financial situation for the tax year.

Steps to complete the DELAWARE Resident Individual Income Tax Return Revenue Delaware

Completing the DELAWARE Resident Individual Income Tax Return involves several key steps:

- Gather all necessary documentation, such as W-2 forms, 1099s, and any other income statements.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring that you include all relevant details for each income type.

- Calculate your total income and determine any deductions or credits you may qualify for.

- Complete the tax calculation section to determine your total tax liability.

- Review the form for accuracy before signing and dating it.

- Submit the completed form by the appropriate deadline, either electronically or via mail.

How to obtain the DELAWARE Resident Individual Income Tax Return Revenue Delaware

The DELAWARE Resident Individual Income Tax Return can be obtained through various channels. Residents can download the form directly from the Delaware Division of Revenue's official website. Additionally, physical copies may be available at local tax offices or public libraries. For those who prefer digital solutions, using e-filing software can streamline the process, allowing for easy completion and submission of the form online.

Legal use of the DELAWARE Resident Individual Income Tax Return Revenue Delaware

The DELAWARE Resident Individual Income Tax Return is legally binding when filled out correctly and submitted according to state regulations. It serves as an official record of income and tax obligations, which can be reviewed by the Delaware Division of Revenue. To ensure its legal validity, it is important to provide accurate information and comply with all filing requirements, including deadlines and payment of any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Residents have multiple options for submitting the DELAWARE Resident Individual Income Tax Return. The form can be filed online through the Delaware Division of Revenue's e-filing system, which allows for immediate processing and confirmation. Alternatively, individuals may choose to print the completed form and mail it to the designated address provided by the state. In-person submission is also an option at local tax offices, where assistance may be available for those needing help with the process.

Required Documents

To successfully complete the DELAWARE Resident Individual Income Tax Return, several documents are necessary:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for any deductions or credits, such as mortgage interest statements

- Previous year’s tax return for reference

Quick guide on how to complete 2014 delaware 2014 resident individual income tax return revenue delaware

Effortlessly prepare DELAWARE Resident Individual Income Tax Return Revenue Delaware on any device

Internet-based document management has become favored among companies and individuals alike. It offers an excellent eco-conscious alternative to conventional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage DELAWARE Resident Individual Income Tax Return Revenue Delaware on any device using the airSlate SignNow Android or iOS applications and streamline your document-dependent processes today.

How to modify and electronically sign DELAWARE Resident Individual Income Tax Return Revenue Delaware with ease

- Locate DELAWARE Resident Individual Income Tax Return Revenue Delaware and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive details with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you would like to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign DELAWARE Resident Individual Income Tax Return Revenue Delaware and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 delaware 2014 resident individual income tax return revenue delaware

Create this form in 5 minutes!

How to create an eSignature for the 2014 delaware 2014 resident individual income tax return revenue delaware

How to generate an electronic signature for your 2014 Delaware 2014 Resident Individual Income Tax Return Revenue Delaware in the online mode

How to make an electronic signature for your 2014 Delaware 2014 Resident Individual Income Tax Return Revenue Delaware in Google Chrome

How to generate an eSignature for putting it on the 2014 Delaware 2014 Resident Individual Income Tax Return Revenue Delaware in Gmail

How to create an electronic signature for the 2014 Delaware 2014 Resident Individual Income Tax Return Revenue Delaware right from your smartphone

How to create an electronic signature for the 2014 Delaware 2014 Resident Individual Income Tax Return Revenue Delaware on iOS devices

How to generate an electronic signature for the 2014 Delaware 2014 Resident Individual Income Tax Return Revenue Delaware on Android

People also ask

-

What is the DELAWARE Resident Individual Income Tax Return Revenue Delaware?

The DELAWARE Resident Individual Income Tax Return Revenue Delaware is a document that individuals residing in Delaware must file to report their income and pay state taxes. This return helps ensure compliance with Delaware tax laws and contributes to funding state services. Understanding this form is crucial for managing your tax obligations accurately.

-

How does airSlate SignNow assist with the DELAWARE Resident Individual Income Tax Return Revenue Delaware?

airSlate SignNow streamlines the process of preparing and submitting your DELAWARE Resident Individual Income Tax Return Revenue Delaware by providing an easy-to-use eSignature platform. Our solution ensures that all your tax documents are securely signed and sent electronically. This saves time and reduces the risk of errors, making the filing process efficient.

-

What are the pricing options for airSlate SignNow regarding tax documentation?

airSlate SignNow offers a range of pricing plans tailored to fit different business needs, ensuring you can manage your DELAWARE Resident Individual Income Tax Return Revenue Delaware effectively. Our plans include various features such as unlimited eSignatures and document templates. We provide a cost-effective solution to handle your tax paperwork without breaking the bank.

-

Is airSlate SignNow secure for submitting tax documents?

Yes, airSlate SignNow employs advanced security measures to protect your data when submitting the DELAWARE Resident Individual Income Tax Return Revenue Delaware. We utilize encryption and secure storage to ensure that all personal and financial information is safe. Our commitment to security helps you confidently manage sensitive documents.

-

Can I integrate airSlate SignNow with other financial software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular accounting and financial software, making it easier to prepare and submit your DELAWARE Resident Individual Income Tax Return Revenue Delaware. These integrations help streamline workflows, allowing for seamless data transfer and reducing potential errors during tax preparation.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for filing your DELAWARE Resident Individual Income Tax Return Revenue Delaware offers numerous benefits, including increased efficiency, better document organization, and a user-friendly interface. You can track document status in real-time and receive notifications once your tax documents are signed, making the process hassle-free.

-

What types of documents can be managed with airSlate SignNow aside from tax returns?

In addition to managing your DELAWARE Resident Individual Income Tax Return Revenue Delaware, airSlate SignNow allows you to handle various documents such as contracts, agreements, and consent forms. Our platform is versatile and user-friendly, ensuring you can manage all your administrative paperwork effectively and efficiently.

Get more for DELAWARE Resident Individual Income Tax Return Revenue Delaware

Find out other DELAWARE Resident Individual Income Tax Return Revenue Delaware

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word